What You Need to Know About Overdrafts and Overdra 2021-2026

Understanding Bank OZK Overdraft Fees

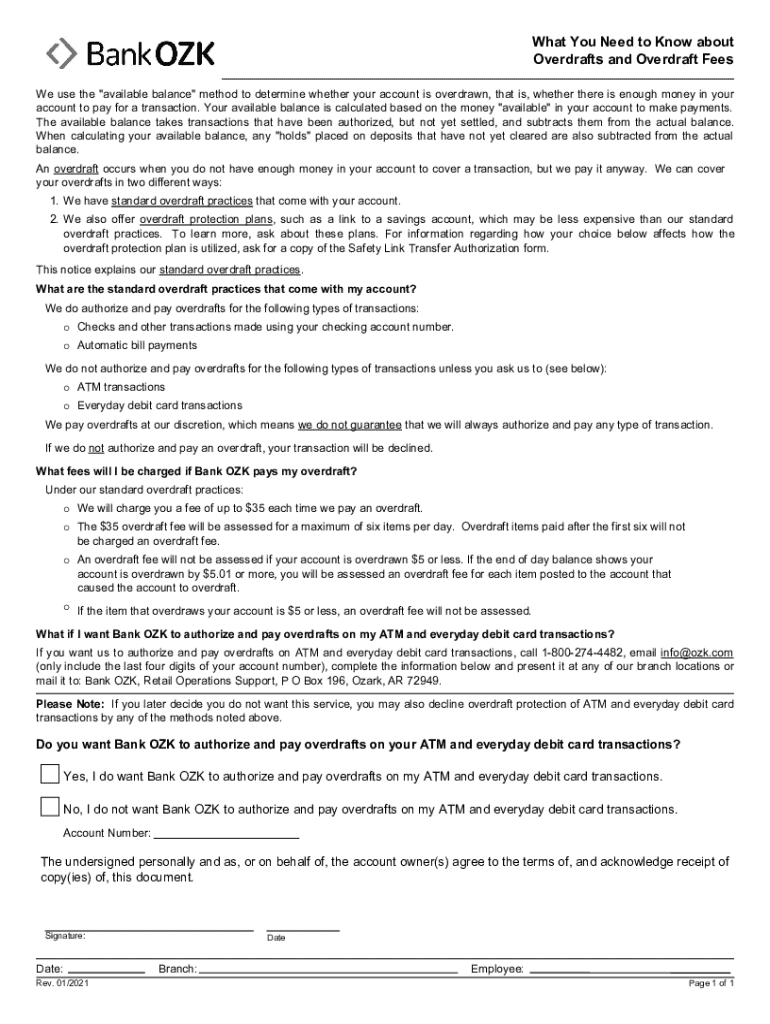

Bank OZK charges an overdraft fee when a customer spends more than their available account balance. This fee typically applies to transactions such as checks, debit card purchases, and electronic payments that exceed the funds in the account. It is important for customers to be aware of these fees to manage their finances effectively.

The standard overdraft fee at Bank OZK may vary, but it is essential to check the latest fee schedule for the most accurate information. Customers should also be informed about how frequently these fees can be charged, as multiple overdrafts in a single day can lead to multiple fees.

Bank OZK Overdraft Protection Options

Bank OZK offers overdraft protection services to help customers avoid fees. This service links a checking account to a savings account or a line of credit, allowing funds to be transferred automatically when the checking account balance is insufficient. Customers can opt into this service to provide a safety net against unexpected expenses.

Understanding the overdraft protection policy is crucial for customers, as it can help prevent the inconvenience of declined transactions and associated fees. Customers should review the terms and conditions of the overdraft protection service to ensure it meets their needs.

Key Elements of Bank OZK's Overdraft Policy

The overdraft policy at Bank OZK includes several key elements that customers should understand. First, the policy outlines the criteria for overdraft approval, which may include account history and balance. Second, it specifies the fees associated with overdrafts, including the amount charged per transaction and any daily limits on fees.

Additionally, the policy may detail how customers can opt out of overdraft services and the process for managing overdraft situations. Being familiar with these elements can empower customers to make informed decisions regarding their banking practices.

Examples of Overdraft Situations

Consider a scenario where a customer has a checking account balance of $100 and makes a purchase of $120. In this case, the transaction would typically result in an overdraft, triggering a fee. If the customer has overdraft protection, the bank may cover the difference, preventing the fee from being charged.

Another example could involve a recurring payment, such as a subscription service, that attempts to withdraw funds when the account balance is insufficient. Understanding these examples helps customers anticipate potential overdrafts and manage their accounts more effectively.

Eligibility Criteria for Overdraft Protection

To qualify for overdraft protection at Bank OZK, customers generally need to meet specific eligibility criteria. This may include maintaining a checking account in good standing, having a consistent deposit history, and meeting any minimum balance requirements set by the bank.

Customers should inquire directly with Bank OZK to understand the exact criteria and ensure they are eligible for this service. Meeting these requirements can provide peace of mind and financial security when managing their accounts.

Steps to Manage Overdraft Situations

In the event of an overdraft, customers can take several steps to manage the situation effectively. First, they should review their account balance and transaction history to understand the cause of the overdraft. Next, customers can transfer funds from a linked account or deposit cash to cover the overdraft amount.

Additionally, contacting Bank OZK's customer service can provide guidance on resolving the overdraft and discussing options for avoiding future occurrences. Proactive management of overdraft situations can help maintain financial stability.

Quick guide on how to complete what you need to know about overdrafts and overdra

Complete What You Need To Know About Overdrafts And Overdra effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle What You Need To Know About Overdrafts And Overdra on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and electronically sign What You Need To Know About Overdrafts And Overdra without hassle

- Locate What You Need To Know About Overdrafts And Overdra and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require creating new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign What You Need To Know About Overdrafts And Overdra and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what you need to know about overdrafts and overdra

Create this form in 5 minutes!

How to create an eSignature for the what you need to know about overdrafts and overdra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bank ozk overdraft fee?

The bank ozk overdraft fee is a charge applied when an account holder spends more than their available balance. This fee can vary based on the bank's policies and the specific account type. Understanding this fee is crucial for managing your finances effectively.

-

How can I avoid the bank ozk overdraft fee?

To avoid the bank ozk overdraft fee, ensure that you maintain a sufficient balance in your account. Setting up alerts for low balances and linking your checking account to a savings account can also help prevent overdrafts. Additionally, consider opting for overdraft protection services offered by the bank.

-

What are the benefits of using airSlate SignNow for banking documents?

Using airSlate SignNow for banking documents allows you to streamline the signing process, making it faster and more efficient. You can easily send and eSign documents related to your bank ozk overdraft fee inquiries, ensuring that all paperwork is handled promptly. This can save you time and reduce the risk of errors.

-

Are there any fees associated with airSlate SignNow?

airSlate SignNow offers a cost-effective solution with transparent pricing. While there are subscription fees, there are no hidden charges related to the service. This makes it easier for businesses to manage their expenses, including those related to bank ozk overdraft fees.

-

Can I integrate airSlate SignNow with my banking software?

Yes, airSlate SignNow can be integrated with various banking software and applications. This integration allows for seamless document management and eSigning, which can help you address issues like the bank ozk overdraft fee more efficiently. Check our integration options to find the best fit for your needs.

-

How does airSlate SignNow enhance document security?

airSlate SignNow prioritizes document security by employing advanced encryption and authentication measures. This ensures that sensitive information, such as details related to your bank ozk overdraft fee, is protected. You can confidently send and sign documents knowing that your data is secure.

-

Is airSlate SignNow user-friendly for non-technical users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for non-technical users. The intuitive interface allows anyone to easily navigate the platform and manage documents related to their bank ozk overdraft fee without any technical expertise.

Get more for What You Need To Know About Overdrafts And Overdra

- Form 0098 new amp young worker orientation by emp employers report of injury or occupational disease

- State of tennessee davidson county chancery court plaintiff subpoena to testify duces tecum to take deposition medical records form

- Annual evaluation form for graduate students department of anthropology tamu

- Letter of medical necessity south coast dme form

- Course 2 chapter 7 form

- Bc change name 2016 2019 form

- Nsaa explosives use guidelines and avalanche blasting resource guide form

- Admission amp discharge referral and decision tracking summary pdf adat clinical tool for admission and discharge tracking for form

Find out other What You Need To Know About Overdrafts And Overdra

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy