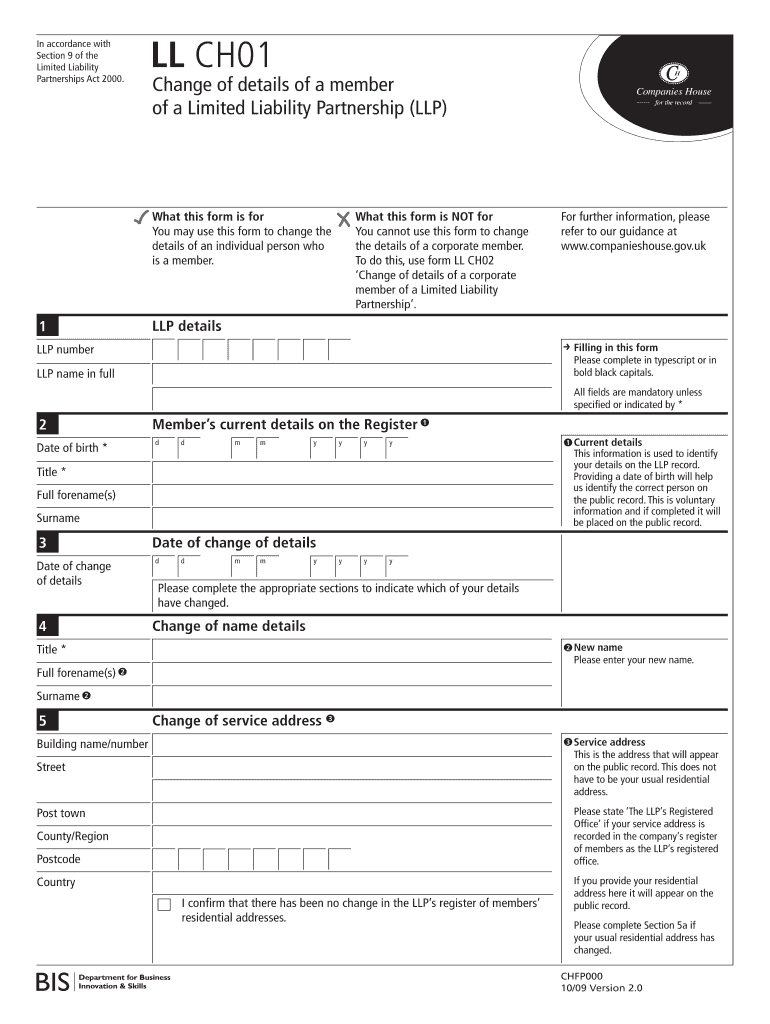

In Accordance with Section 9 of the Limited Liability Partnerships Act Form

Understanding the In Accordance With Section 9 Of The Limited Liability Partnerships Act

The phrase "In Accordance With Section 9 Of The Limited Liability Partnerships Act" refers to a specific legal framework governing limited liability partnerships (LLPs) in the United States. This section outlines the requirements and regulations that LLPs must adhere to for proper formation and operation. It is essential for businesses to understand these provisions to ensure compliance and protect their interests.

Steps to Complete the In Accordance With Section 9 Of The Limited Liability Partnerships Act

Completing the requirements outlined in Section 9 involves several key steps. First, businesses must gather necessary documentation, including partnership agreements and identification of partners. Next, they should ensure that all provisions of the partnership agreement align with state laws. After preparing the documents, the business must file the appropriate forms with the state authorities, typically the Secretary of State. Finally, it is important to maintain accurate records and comply with ongoing reporting requirements to uphold the LLP's legal status.

Legal Use of the In Accordance With Section 9 Of The Limited Liability Partnerships Act

The legal use of this section is crucial for establishing the legitimacy of an LLP. By adhering to the guidelines set forth, businesses can benefit from limited liability protections, which shield personal assets from business debts. This section also provides clarity on the roles and responsibilities of partners, ensuring that all parties understand their obligations within the partnership. Understanding these legal parameters helps avoid disputes and fosters a cooperative business environment.

Key Elements of the In Accordance With Section 9 Of The Limited Liability Partnerships Act

Key elements of this section include the definition of a limited liability partnership, the process for registration, and the rights and duties of partners. It typically stipulates the need for a written partnership agreement, outlines the liability protections offered, and specifies the requirements for maintaining the LLP status. Additionally, it may address how profits and losses are distributed among partners, which is vital for financial planning and management.

Required Documents for the In Accordance With Section 9 Of The Limited Liability Partnerships Act

To comply with Section 9, several documents are typically required. These may include a partnership agreement, which outlines the terms of the partnership, and registration forms that provide details about the business and its partners. Identification documents for each partner, such as driver's licenses or Social Security numbers, may also be necessary. Ensuring that all documents are accurate and complete is essential for a smooth registration process.

State-Specific Rules for the In Accordance With Section 9 Of The Limited Liability Partnerships Act

Each state may have specific rules and regulations that govern the formation and operation of limited liability partnerships. It is important for businesses to research their state's requirements, as these can vary significantly. Some states may have additional filing fees, specific forms, or unique compliance obligations that must be met. Understanding these state-specific rules is vital for ensuring compliance and maintaining the LLP's legal standing.

Examples of Using the In Accordance With Section 9 Of The Limited Liability Partnerships Act

Examples of how Section 9 is applied can provide valuable insights for businesses. For instance, a group of professionals, such as lawyers or accountants, may choose to form an LLP to benefit from limited liability while collaborating on projects. Another example could involve a group of entrepreneurs pooling resources to launch a startup, using the protections offered by this section to safeguard their personal assets. These scenarios illustrate the practical applications of the regulations and highlight the advantages of compliance.

Quick guide on how to complete in accordance with section 9 of the limited liability partnerships act

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious document searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to In Accordance With Section 9 Of The Limited Liability Partnerships Act

Create this form in 5 minutes!

How to create an eSignature for the in accordance with section 9 of the limited liability partnerships act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Limited Liability Partnerships Act?

airSlate SignNow is a digital solution that empowers businesses to send and eSign documents efficiently. In accordance with Section 9 of the Limited Liability Partnerships Act, it ensures that electronic signatures are legally binding, making it a reliable choice for LLPs.

-

How does airSlate SignNow ensure compliance with Section 9 of the Limited Liability Partnerships Act?

airSlate SignNow complies with Section 9 of the Limited Liability Partnerships Act by providing secure and legally recognized electronic signatures. Our platform adheres to the necessary regulations, ensuring that all signed documents are valid and enforceable.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to meet the needs of various businesses. In accordance with Section 9 of the Limited Liability Partnerships Act, our cost-effective solutions provide excellent value for LLPs looking to streamline their document signing processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage. These features help businesses manage their documents efficiently while ensuring compliance with Section 9 of the Limited Liability Partnerships Act.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers seamless integrations with various software tools, enhancing your workflow. This capability is particularly beneficial for businesses operating in accordance with Section 9 of the Limited Liability Partnerships Act, as it allows for streamlined document management.

-

What are the benefits of using airSlate SignNow for LLPs?

Using airSlate SignNow provides numerous benefits for LLPs, including increased efficiency and reduced turnaround times for document signing. In accordance with Section 9 of the Limited Liability Partnerships Act, our platform ensures that all electronic signatures are secure and legally binding.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses. In accordance with Section 9 of the Limited Liability Partnerships Act, our affordable pricing and user-friendly interface make it an ideal choice for small LLPs.

Get more for In Accordance With Section 9 Of The Limited Liability Partnerships Act

- Civil forms gun restraining orders california courts cagov

- I50 insurance claim form income

- Gv 109 notice of court hearing california courts cagov form

- Request for hearing denied application for counsel or waiver of fees juvenile form

- Guardian ad litem gal or attorney for a minor child amc form

- Fl 303 declaration regarding notice and service of request for temporary emergency ex parte orders judicial council forms

- Uncontested divorce forms new york state unified court

- Fillable online statement of information for a consent

Find out other In Accordance With Section 9 Of The Limited Liability Partnerships Act

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF