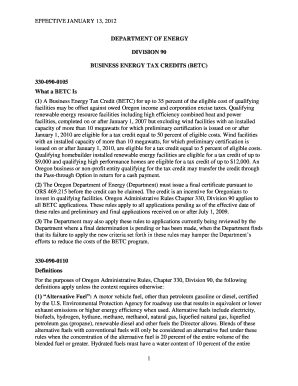

Business Energy Tax Credit State of Oregon Form

What is the Business Energy Tax Credit in the State of Oregon

The Business Energy Tax Credit (BETC) in Oregon is a financial incentive designed to encourage businesses to invest in renewable energy and energy efficiency projects. This credit allows eligible businesses to receive a tax credit based on the amount invested in qualified energy projects. The program aims to promote sustainable practices and reduce energy consumption within the state, contributing to Oregon's environmental goals.

Eligibility Criteria for the Business Energy Tax Credit in Oregon

To qualify for the Business Energy Tax Credit, businesses must meet specific criteria. Eligible projects typically include renewable energy installations, such as solar, wind, and biomass, as well as energy efficiency upgrades. Businesses must demonstrate that the project will significantly reduce energy consumption or generate renewable energy. Additionally, the project must comply with state regulations and guidelines to qualify for the credit.

Steps to Complete the Business Energy Tax Credit Application

Completing the application for the Business Energy Tax Credit involves several key steps. First, businesses should identify eligible projects and ensure they meet the necessary criteria. Next, they must gather required documentation, including project plans and cost estimates. Once the documentation is prepared, businesses can fill out the appropriate forms and submit them to the Oregon Department of Energy. It is essential to follow all guidelines and ensure accuracy to avoid delays in processing.

Required Documents for the Business Energy Tax Credit Application

When applying for the Business Energy Tax Credit, businesses need to provide various documents to support their application. Required documents typically include:

- Detailed project description and specifications

- Cost estimates and invoices for project expenses

- Proof of project completion, such as photographs or inspection reports

- Any relevant permits or approvals required by local authorities

Having these documents ready can streamline the application process and facilitate a smoother review by the Oregon Department of Energy.

Filing Deadlines for the Business Energy Tax Credit

It is crucial for businesses to be aware of filing deadlines associated with the Business Energy Tax Credit. Applications must be submitted within a specific timeframe following project completion. Generally, businesses should file their applications by the end of the tax year in which the project was completed. Staying informed about these deadlines can help ensure that businesses do not miss out on available tax credits.

Key Elements of the Business Energy Tax Credit Program

The Business Energy Tax Credit program includes several key elements that businesses should understand. These elements encompass the types of projects eligible for the credit, the percentage of the investment that can be claimed, and any limitations on the total credit amount. Additionally, businesses should be aware of the potential for credits to be transferred or sold, providing further financial flexibility. Understanding these elements can help businesses maximize their benefits from the program.

Quick guide on how to complete business energy tax credit state of oregon

Complete [SKS] effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and electronically sign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Energy Tax Credit State Of Oregon

Create this form in 5 minutes!

How to create an eSignature for the business energy tax credit state of oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Energy Tax Credit State Of Oregon?

The Business Energy Tax Credit State Of Oregon is a program designed to incentivize businesses to invest in energy-efficient technologies. By utilizing this credit, businesses can signNowly reduce their tax liabilities while contributing to a more sustainable environment. This program is particularly beneficial for companies looking to upgrade their energy systems.

-

How can airSlate SignNow help with the Business Energy Tax Credit State Of Oregon application process?

airSlate SignNow streamlines the application process for the Business Energy Tax Credit State Of Oregon by allowing businesses to easily send and eSign necessary documents. Our platform ensures that all paperwork is completed efficiently and securely, reducing the time spent on administrative tasks. This means you can focus more on your energy projects and less on paperwork.

-

What are the eligibility requirements for the Business Energy Tax Credit State Of Oregon?

To qualify for the Business Energy Tax Credit State Of Oregon, businesses must meet specific criteria related to energy efficiency improvements. This includes using qualified equipment and ensuring that the upgrades meet state standards. It's essential to review the guidelines to ensure your project aligns with the requirements for the tax credit.

-

What types of projects are eligible for the Business Energy Tax Credit State Of Oregon?

Eligible projects for the Business Energy Tax Credit State Of Oregon include upgrades to lighting, HVAC systems, and renewable energy installations. Businesses can also receive credits for energy-efficient appliances and building improvements. Each project must meet the state's energy efficiency criteria to qualify for the tax credit.

-

How does the Business Energy Tax Credit State Of Oregon benefit my business financially?

The Business Energy Tax Credit State Of Oregon can provide substantial financial benefits by reducing your overall tax burden. By investing in energy-efficient technologies, your business can save on energy costs while receiving tax credits that offset expenses. This dual benefit can enhance your bottom line and promote long-term sustainability.

-

Are there any deadlines for applying for the Business Energy Tax Credit State Of Oregon?

Yes, there are specific deadlines for applying for the Business Energy Tax Credit State Of Oregon, which can vary based on the type of project and fiscal year. It's crucial to stay informed about these deadlines to ensure your application is submitted on time. Missing a deadline could result in losing out on valuable tax credits.

-

Can I use airSlate SignNow to track my Business Energy Tax Credit State Of Oregon application?

Absolutely! airSlate SignNow offers features that allow you to track the status of your Business Energy Tax Credit State Of Oregon application. You can monitor document progress, receive notifications, and ensure that all necessary paperwork is completed and submitted promptly, making the process more transparent and manageable.

Get more for Business Energy Tax Credit State Of Oregon

- Scca732 form

- Application for homestead classification ramsey county co ramsey mn form

- You must own and occupy the property on either january 2 or december 1 and the application must be returned to your assessors form

- Form lic9151 ampquotproperty ownerlandlord notification family

- Lic 9151 form

- Lic 700 form

- Accident and illness report form ct

- Provider information page in

Find out other Business Energy Tax Credit State Of Oregon

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself