Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

What is the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

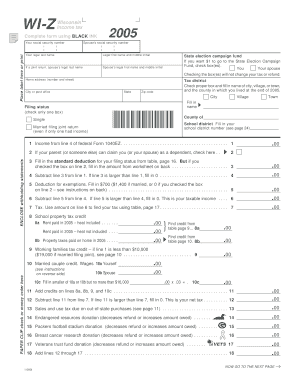

The Form WI Z is a specific income tax return utilized by residents of Wisconsin. This form is designed for individuals who have income that is not subject to withholding and need to report it for state tax purposes. It is essential for those who earn income from sources such as self-employment, rental properties, or other non-wage income. The form helps ensure that taxpayers comply with state tax regulations and accurately report their financial activities.

How to use the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

Using the Form WI Z involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary documentation, including income statements and any relevant deductions. After obtaining the form, individuals must fill it out with accurate information regarding their income, deductions, and any applicable credits. Once completed, the form can be submitted either electronically or by mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

Completing the Form WI Z requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including W-2s and 1099s.

- Obtain the latest version of the Form WI Z from the Wisconsin Department of Revenue website.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate any deductions or credits you may qualify for.

- Review the completed form for accuracy before submission.

- Submit the form electronically or mail it to the appropriate address.

Key elements of the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

The Form WI Z includes several critical components that taxpayers must understand. Key elements consist of:

- Personal Information: This section requires your name, address, and Social Security number.

- Income Reporting: Taxpayers must detail all income sources, including self-employment and other non-wage earnings.

- Deductions and Credits: This section allows for the reporting of eligible deductions and credits that can reduce taxable income.

- Signature: The form must be signed and dated to validate the submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form WI Z is crucial for compliance. Typically, the deadline to file is April 15 of the following year after the tax year ends. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available and the specific requirements for applying for such extensions.

Who Issues the Form

The Form WI Z is issued by the Wisconsin Department of Revenue. This state agency is responsible for the administration of tax laws and the collection of taxes within Wisconsin. Taxpayers can access the form directly from the Department of Revenue's official website, ensuring they have the most current version available for their filing needs.

Quick guide on how to complete form wi z wisconsin income tax return i 090 form wi z revenue wi

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary forms and securely archive them online. airSlate SignNow provides you with all the features needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and electronically sign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or conceal sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a physical signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form wi z wisconsin income tax return i 090 form wi z revenue wi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi?

The Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi is a tax document used by residents of Wisconsin to report their income and calculate their tax obligations. This form is specifically designed for individuals with simple tax situations, making it easier to file accurately and on time.

-

How can airSlate SignNow help me with the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi. Our user-friendly interface ensures that you can complete your tax documents quickly and securely, reducing the hassle of traditional paper filing.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different needs, including individual users and businesses. You can choose a plan that best fits your requirements for managing the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi, ensuring you get the best value for your investment.

-

Are there any features specifically for tax document management in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax document management, such as templates for the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi, automated reminders, and secure storage. These features help you stay organized and ensure that your tax documents are always accessible when needed.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your tax documents, including the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi. This integration simplifies your workflow and enhances productivity by connecting all your financial tools.

-

Is it safe to use airSlate SignNow for my tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your tax documents, including the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi, are protected. Our platform uses advanced encryption and secure storage solutions to keep your sensitive information safe.

-

What are the benefits of using airSlate SignNow for filing the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi?

Using airSlate SignNow for filing the Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, making it easier for you to meet tax deadlines without the stress of traditional filing methods.

Get more for Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

- Fillable online individual flexible purchase payment variable form

- Dmv use out of state change endorsement only new transfer form

- Read application in full form

- Form p11d for the period 1 jan 2020 to 31 dec 2020 return by employer for benefits non cash emoluments

- Calendar of key dates revenue form

- Ie nfs 1 2018 2021 fill and sign printable template form

- Claim by unregistered farmer for refund of value added tax form

- Asn4 asbestos waste shipment reporting form oregon

Find out other Form WI Z Wisconsin Income Tax Return I 090 Form WI Z Revenue Wi

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors