Form 8453N Nebraska Department of Revenue

What is the Form 8453N Nebraska Department Of Revenue

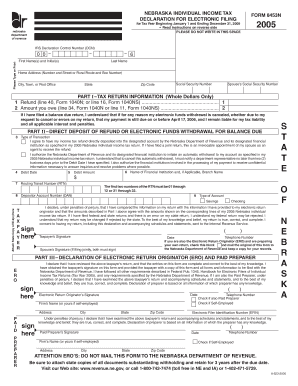

The Form 8453N is a document used by taxpayers in Nebraska to authorize the electronic filing of their state income tax returns. This form serves as a declaration that the taxpayer has reviewed their return and agrees to the information provided. It is crucial for ensuring that all electronic submissions are legitimate and compliant with state regulations.

How to use the Form 8453N Nebraska Department Of Revenue

To use the Form 8453N, taxpayers must first complete their Nebraska income tax return electronically. After reviewing the return for accuracy, they will fill out the Form 8453N to confirm their consent for electronic submission. The completed form must then be signed and submitted along with the electronic filing of the tax return.

Steps to complete the Form 8453N Nebraska Department Of Revenue

Completing the Form 8453N involves several straightforward steps:

- Access the form through the Nebraska Department of Revenue website or a tax preparation software.

- Fill in personal information, including name, address, and Social Security number.

- Indicate the type of return being filed and the tax year.

- Review the completed tax return for accuracy.

- Sign the form electronically or print it for a handwritten signature.

- Submit the signed form with the electronic tax return.

Key elements of the Form 8453N Nebraska Department Of Revenue

The Form 8453N includes several key elements that are essential for proper submission. These elements include:

- Taxpayer identification information, such as name and Social Security number.

- Details about the electronic return being filed, including the type and year of the return.

- Signature section for the taxpayer to confirm their consent for electronic filing.

- Instructions for submitting the form alongside the electronic return.

Legal use of the Form 8453N Nebraska Department Of Revenue

The legal use of the Form 8453N is governed by Nebraska state tax laws. It is essential for taxpayers to use this form correctly to ensure compliance with state regulations. Failure to properly authorize the electronic filing through this form may result in the rejection of the tax return or other legal implications.

Form Submission Methods

The Form 8453N can be submitted in conjunction with the electronic filing of the Nebraska income tax return. Taxpayers typically submit the form online through tax preparation software. Alternatively, if filing by mail, the signed form must accompany the paper tax return. It is important to follow the submission guidelines provided by the Nebraska Department of Revenue to ensure proper processing.

Quick guide on how to complete form 8453n nebraska department of revenue

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight relevant parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8453n nebraska department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453N for the Nebraska Department of Revenue?

Form 8453N is a declaration form used by taxpayers in Nebraska to authorize the electronic filing of their income tax returns. This form is essential for ensuring that your tax return is submitted accurately and securely to the Nebraska Department of Revenue.

-

How can airSlate SignNow help with Form 8453N for the Nebraska Department of Revenue?

airSlate SignNow provides a streamlined solution for electronically signing and sending Form 8453N to the Nebraska Department of Revenue. Our platform simplifies the eSignature process, ensuring that your documents are signed quickly and securely.

-

What are the pricing options for using airSlate SignNow for Form 8453N?

airSlate SignNow offers flexible pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, allowing you to select the best option for managing your Form 8453N submissions efficiently.

-

Are there any features specifically designed for Form 8453N in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for handling Form 8453N, such as customizable templates, automated reminders, and secure storage. These features enhance the efficiency of your document management process with the Nebraska Department of Revenue.

-

What benefits does airSlate SignNow offer for filing Form 8453N?

Using airSlate SignNow for filing Form 8453N provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform ensures that your documents are processed quickly and reduces the risk of errors during submission to the Nebraska Department of Revenue.

-

Can I integrate airSlate SignNow with other software for Form 8453N?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Form 8453N alongside your existing tools. This seamless integration helps streamline your workflow and improve overall efficiency.

-

Is airSlate SignNow compliant with the Nebraska Department of Revenue regulations for Form 8453N?

Yes, airSlate SignNow is fully compliant with the regulations set forth by the Nebraska Department of Revenue for Form 8453N. Our platform adheres to industry standards for security and data protection, ensuring that your submissions are handled appropriately.

Get more for Form 8453N Nebraska Department Of Revenue

- Sacssp application form

- Kanisa sacco form

- 2019 form 8453 llc california e file return authorization for limited liability companies 2019 form 8453 llc california e file

- Power of attorney poa form and instructions

- Select oneri am updating my business tax account ri am updating my sales and use exemption account form

- Visit httpsmydmv form

- Government chudachudi form

- Tn application registration form

Find out other Form 8453N Nebraska Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors