FailSafe Refund Request Form Complete and Return by January 15

What is the FailSafe Refund Request Form Complete And Return By January 15

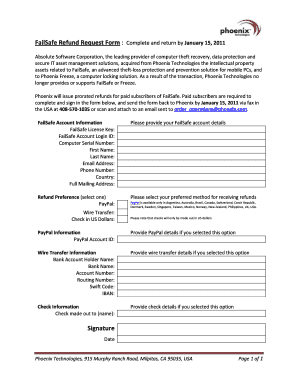

The FailSafe Refund Request Form is a critical document designed for individuals and businesses seeking to request a refund. This form must be completed accurately and returned by January 15 to ensure timely processing. It serves as an official request for the return of funds, whether due to overpayment, errors, or other qualifying reasons. Understanding the purpose of this form is essential for ensuring compliance and maximizing the chances of a successful refund.

Steps to complete the FailSafe Refund Request Form Complete And Return By January 15

Completing the FailSafe Refund Request Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and any relevant financial records. Next, fill out the form carefully, ensuring that all sections are completed. Double-check your entries for accuracy before signing the document. Finally, submit the form by the specified deadline of January 15, either electronically or by mail, depending on the submission guidelines provided.

Required Documents

To successfully complete the FailSafe Refund Request Form, certain documents are typically required. These may include:

- Proof of identity, such as a government-issued ID or Social Security number.

- Financial statements or receipts that support the refund request.

- Any previous correspondence related to the refund, if applicable.

Having these documents ready will streamline the process and enhance the likelihood of approval.

Form Submission Methods

The FailSafe Refund Request Form can be submitted through various methods, providing flexibility for users. Common submission methods include:

- Online Submission: Many organizations offer a digital platform for submitting forms, which can expedite processing.

- Mail: If preferred, users can print the completed form and send it via postal service to the designated address.

- In-Person: Some may choose to deliver the form directly to the relevant office, ensuring immediate receipt.

Choosing the right submission method can significantly impact the speed and efficiency of the refund process.

Eligibility Criteria

Understanding the eligibility criteria for the FailSafe Refund Request Form is crucial for applicants. Generally, individuals and businesses may qualify if they have experienced overpayments, billing errors, or other valid reasons for requesting a refund. Specific eligibility requirements can vary by organization or jurisdiction, so it is important to review the guidelines associated with the form to determine if you meet the necessary conditions.

Filing Deadlines / Important Dates

Adhering to filing deadlines is essential when submitting the FailSafe Refund Request Form. The primary deadline for submission is January 15, which ensures that requests are processed in a timely manner. It is advisable to be aware of any other relevant dates, such as the beginning of the refund processing period or any updates that may affect submission timelines. Staying informed about these dates can help prevent delays in receiving your refund.

Quick guide on how to complete failsafe refund request form complete and return by january 15

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the relevant form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents quickly without interruptions. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from a device of your selection. Alter and eSign [SKS] and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FailSafe Refund Request Form Complete And Return By January 15

Create this form in 5 minutes!

How to create an eSignature for the failsafe refund request form complete and return by january 15

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FailSafe Refund Request Form Complete And Return By January 15?

The FailSafe Refund Request Form Complete And Return By January 15 is a specific document designed to streamline the refund process for customers. By completing and returning this form by the specified date, you ensure that your request is processed efficiently. This form is essential for maintaining compliance and ensuring timely refunds.

-

How do I access the FailSafe Refund Request Form Complete And Return By January 15?

You can easily access the FailSafe Refund Request Form Complete And Return By January 15 through our website. Simply navigate to the refund section, and you will find the form available for download. Make sure to fill it out completely before returning it by the deadline.

-

What are the benefits of using the FailSafe Refund Request Form Complete And Return By January 15?

Using the FailSafe Refund Request Form Complete And Return By January 15 simplifies the refund process, ensuring that your request is handled promptly. This form helps prevent delays and miscommunication, allowing for a smoother experience. Additionally, it provides a clear record of your request for future reference.

-

Is there a fee associated with submitting the FailSafe Refund Request Form Complete And Return By January 15?

No, there is no fee for submitting the FailSafe Refund Request Form Complete And Return By January 15. This service is provided to enhance customer satisfaction and streamline the refund process. We believe in making the refund experience as hassle-free as possible for our users.

-

What happens if I miss the January 15 deadline for the FailSafe Refund Request Form?

If you miss the January 15 deadline for the FailSafe Refund Request Form Complete And Return By January 15, your refund request may be delayed or not processed at all. It is crucial to submit the form on time to ensure your request is handled efficiently. We recommend setting reminders to avoid missing this important date.

-

Can I submit the FailSafe Refund Request Form Complete And Return By January 15 electronically?

Yes, you can submit the FailSafe Refund Request Form Complete And Return By January 15 electronically through our platform. This feature allows for a quicker and more convenient submission process. Ensure that all required fields are filled out accurately before sending your form.

-

What information do I need to provide on the FailSafe Refund Request Form Complete And Return By January 15?

The FailSafe Refund Request Form Complete And Return By January 15 requires basic information such as your name, contact details, and the reason for the refund. Additionally, you may need to provide transaction details to help us process your request efficiently. Make sure all information is accurate to avoid delays.

Get more for FailSafe Refund Request Form Complete And Return By January 15

- How long after a car accident can you file a claim form

- Classified staff verification of classifiednon teaching work experience clear form

- Click here to email form when complete

- Tenants rights when lease falls through before signing form

- Physical damage incident report form

- What is ithttpswwwbricksmortarcannabis form

- Contact the division of fire standards and training nhgov form

- An important safety city of concord new hampshire form

Find out other FailSafe Refund Request Form Complete And Return By January 15

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors