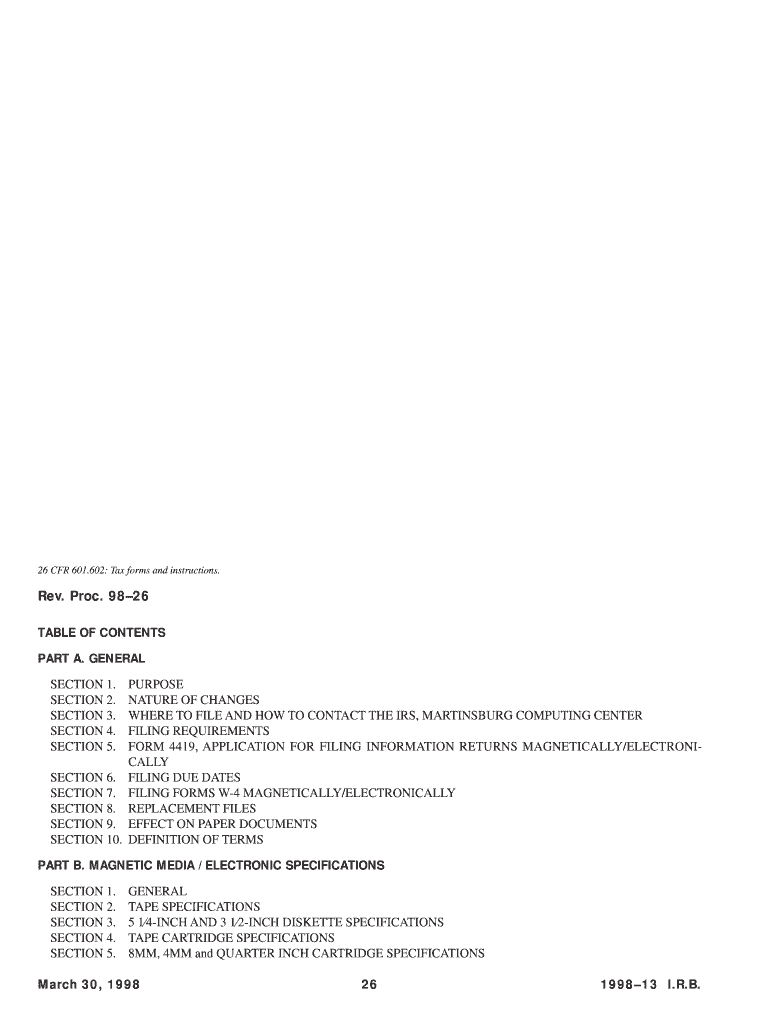

Revenue Procedure 26 Electronic Filing; Magnetic Media; Form W 4 Specifications Specifications for Filing Form W 4, Employee

Understanding Revenue Procedure 26 for Electronic Filing

Revenue Procedure 26 outlines the specifications for electronically filing the W-4 form, known as the Employee's Withholding Allowance Certificate. This procedure is essential for employers and payroll processors who wish to submit W-4 forms using magnetic media or electronic means. It provides detailed instructions on the format, data requirements, and submission methods necessary to comply with IRS regulations.

Steps for Using Revenue Procedure 26

To utilize Revenue Procedure 26 effectively, follow these steps:

- Review the specifications outlined in the procedure to ensure compliance.

- Prepare the W-4 forms according to the required format, including all necessary data fields.

- Choose the appropriate electronic filing method, whether through magnetic media or online submission.

- Submit the completed forms to the IRS by the specified deadlines.

Key Elements of Revenue Procedure 26

Several key elements are crucial when working with Revenue Procedure 26:

- Data formatting requirements for electronic submissions.

- Identification of the employer and employee information needed on the W-4 form.

- Submission deadlines to avoid penalties.

- Guidelines for maintaining confidentiality and data security during the filing process.

Legal Use of Revenue Procedure 26

Employers must adhere to the legal requirements set forth in Revenue Procedure 26 to ensure that their electronic filings are valid. This includes understanding the legal implications of submitting W-4 forms electronically, such as maintaining accurate records and ensuring compliance with IRS regulations. Non-compliance can result in penalties or issues with employee withholding allowances.

Filing Deadlines for Revenue Procedure 26

It is important to be aware of the filing deadlines associated with Revenue Procedure 26. Employers must submit W-4 forms electronically by specific dates to comply with IRS regulations. Missing these deadlines can lead to penalties and complications in employee tax withholding. Regularly check the IRS website for updates on filing deadlines to ensure timely submissions.

Examples of Using Revenue Procedure 26

Employers can benefit from understanding practical examples of using Revenue Procedure 26. For instance, a company transitioning to electronic filing can refer to the specifications to set up their payroll system accordingly. Additionally, examples of common errors and how to avoid them can help streamline the filing process and ensure compliance with IRS guidelines.

Quick guide on how to complete revenue procedure 26 electronic filing magnetic media form w 4 specifications specifications for filing form w 4 employees

Effortlessly prepare [SKS] on any device

Digital document management has gained increased popularity among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without hassles. Handle [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee exceptional communication at all stages of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the revenue procedure 26 electronic filing magnetic media form w 4 specifications specifications for filing form w 4 employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Revenue Procedure 26 Electronic Filing?

Revenue Procedure 26 Electronic Filing outlines the specifications for filing Form W-4, Employee's Withholding Allowance Certificate, magnetically or electronically. This procedure ensures that businesses comply with IRS requirements while streamlining the filing process. By following these specifications, companies can avoid penalties and ensure accurate withholding for employees.

-

How does airSlate SignNow support Revenue Procedure 26 Electronic Filing?

airSlate SignNow provides a user-friendly platform that simplifies the electronic filing of Form W-4 in accordance with Revenue Procedure 26 Electronic Filing. Our solution allows businesses to easily prepare, send, and eSign documents while ensuring compliance with IRS specifications. This not only saves time but also enhances accuracy in employee withholding.

-

What are the benefits of using airSlate SignNow for Form W-4 filing?

Using airSlate SignNow for Form W-4 filing offers numerous benefits, including compliance with Revenue Procedure 26 Electronic Filing and enhanced efficiency. Our platform reduces paperwork, minimizes errors, and accelerates the filing process. Additionally, businesses can track document status in real-time, ensuring timely submissions.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, ensuring that you can access the tools necessary for compliance with Revenue Procedure 26 Electronic Filing without breaking the bank. This affordability makes it easier for small businesses to manage their employee withholding efficiently.

-

What features does airSlate SignNow offer for electronic filing?

airSlate SignNow offers a range of features that facilitate electronic filing, including customizable templates for Form W-4, secure eSigning, and automated workflows. These features are designed to comply with Revenue Procedure 26 Electronic Filing, ensuring that your submissions meet IRS standards. Additionally, our platform provides integration with various applications to streamline your processes further.

-

Can airSlate SignNow integrate with other software for payroll processing?

Absolutely! airSlate SignNow seamlessly integrates with various payroll and HR software, enhancing your ability to manage employee documents and comply with Revenue Procedure 26 Electronic Filing. This integration allows for automatic updates and ensures that your Form W-4 filings are processed efficiently. By connecting with your existing systems, we help you maintain a smooth workflow.

-

How secure is the data when using airSlate SignNow for electronic filing?

Data security is a top priority at airSlate SignNow. We implement robust security measures, including encryption and secure access controls, to protect your information during the electronic filing process. By adhering to the guidelines set forth in Revenue Procedure 26 Electronic Filing, we ensure that your sensitive data remains confidential and secure.

Get more for Revenue Procedure 26 Electronic Filing; Magnetic Media; Form W 4 Specifications Specifications For Filing Form W 4, Employee

Find out other Revenue Procedure 26 Electronic Filing; Magnetic Media; Form W 4 Specifications Specifications For Filing Form W 4, Employee

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document