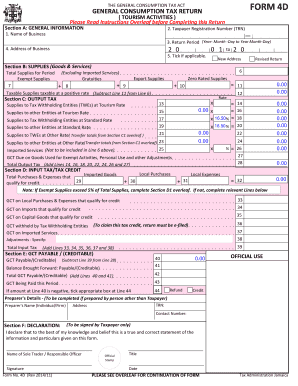

FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl 2014-2026

Understanding the Tax Return Form in Jamaica

The tax return form in Jamaica is an essential document for individuals and businesses to report their income and calculate their tax liabilities. This form is crucial for compliance with Jamaican tax laws and is used by the Tax Administration Jamaica (TAJ) to assess tax obligations. The primary tax return form is designed to capture various income sources, deductions, and credits that may apply to taxpayers.

Steps to Complete the Tax Return Form

Filling out the tax return form requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary financial documents, including income statements, receipts for deductions, and prior tax returns.

- Obtain the correct version of the tax return form from the Tax Administration Jamaica website or authorized offices.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Report all income sources accurately, ensuring that all figures are supported by documentation.

- Calculate deductions and credits to determine your taxable income.

- Review the completed form for accuracy before submission.

Required Documents for Filing

To complete the tax return form, certain documents are typically required. These include:

- Income statements such as the P24 form, which details employment income.

- Receipts for deductible expenses, including medical expenses and charitable contributions.

- Previous year’s tax return for reference.

- Any additional forms relevant to specific deductions or credits.

Submission Methods for the Tax Return Form

The tax return form can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission through the Tax Administration Jamaica’s e-filing system.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices across Jamaica.

Penalties for Non-Compliance

Failure to file the tax return form on time can result in penalties. Taxpayers may face:

- Late filing penalties, which increase the longer the form is overdue.

- Interest on unpaid taxes, accruing from the original due date.

- Potential legal action for continued non-compliance.

Eligibility Criteria for Filing

Eligibility to file a tax return in Jamaica is generally based on income levels and sources. Individuals who earn above a certain threshold must file a return. Additionally, businesses must file returns if they are engaged in taxable activities. Special considerations may apply to non-residents and specific industries.

Quick guide on how to complete form4d thegeneralconsumptiontaxact generalconsumptiontaxreturn print tourismactivities

Complete FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl on any device using airSlate SignNow Android or iOS apps and streamline any document-related tasks today.

The easiest way to modify and eSign FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl without hassle

- Obtain FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl and then click Get Form to initiate.

- Employ the tools we offer to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your edits.

- Decide how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, frustrating form hunts, or errors that require new printed document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you choose. Modify and eSign FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form4d thegeneralconsumptiontaxact generalconsumptiontaxreturn print tourismactivities

Create this form in 5 minutes!

How to create an eSignature for the form4d thegeneralconsumptiontaxact generalconsumptiontaxreturn print tourismactivities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax return form Jamaica and why is it important?

The tax return form Jamaica is a document that individuals and businesses must complete to report their income and calculate their tax obligations. It is crucial for compliance with Jamaican tax laws and helps ensure that taxpayers fulfill their responsibilities accurately and on time.

-

How can airSlate SignNow help with the tax return form Jamaica?

airSlate SignNow simplifies the process of completing and submitting the tax return form Jamaica by allowing users to eSign documents securely and efficiently. With our platform, you can easily manage your tax documents, ensuring they are filled out correctly and submitted on time.

-

What features does airSlate SignNow offer for managing tax return forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the tax return form Jamaica. These tools help streamline the process, reduce errors, and enhance overall efficiency in handling tax documents.

-

Is airSlate SignNow cost-effective for small businesses handling tax return forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the tax return form Jamaica. Our pricing plans are designed to accommodate various budgets, ensuring that even small enterprises can access the tools they need to handle their tax documentation efficiently.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various accounting and tax preparation software, making it easier to manage the tax return form Jamaica alongside your other financial documents. This integration helps streamline workflows and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for tax return forms?

Using airSlate SignNow for the tax return form Jamaica offers numerous benefits, including enhanced security, reduced processing time, and improved accuracy. Our platform allows you to eSign documents from anywhere, making it convenient to manage your tax obligations on the go.

-

How secure is airSlate SignNow when handling sensitive tax return forms?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information, including the tax return form Jamaica. You can trust that your documents are safe and secure while using our platform.

Get more for FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl

- Va form 21 4142 vba va

- Va form 10 2850a online application for nursespdf

- Application to copy or transfer from one medicare form

- Approved inspection station scheme changes to ais approval form

- 23 pdf print form vehicle registration transfer

- Form 58s version 5 3 notice of objection site la

- Steps in the application for a booked hire service licence form

- 21p 534a application for dependency and indemnity compensation by a surviving spouse or child in service death only form

Find out other FORM4D THEGENERALCONSUMPTIONTAXACT GENERALCONSUMPTIONTAXRETURN PRINT TOURISMACTIVITIES PleaseReadInstructionsOverleafbeforeCompl

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple