Tax Administration Jamaica Forms 2002

What is the Tax Administration Jamaica Forms

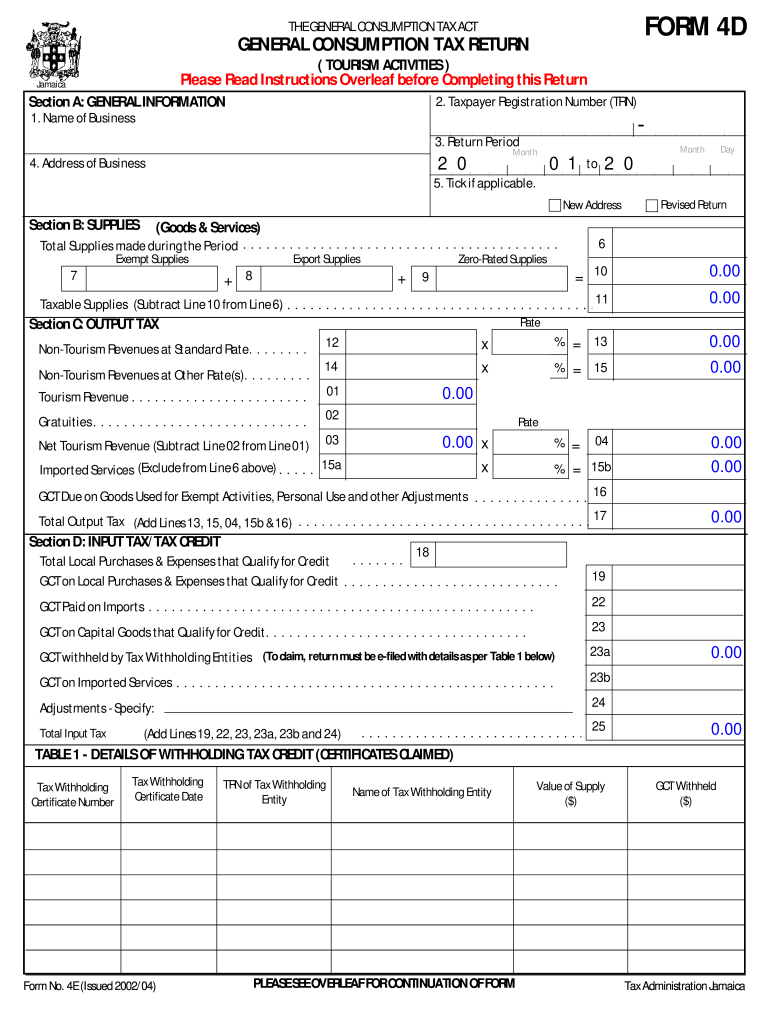

The Tax Administration Jamaica (TAJ) forms are official documents used for various tax-related purposes in Jamaica. These forms facilitate the reporting of income, deductions, and tax liabilities to the Jamaican government. Among these forms, the P24 form is specifically designed for employers to report payroll information, including employee earnings and tax deductions. Understanding the purpose of these forms is crucial for compliance with Jamaican tax laws and regulations.

How to use the Tax Administration Jamaica Forms

Using the Tax Administration Jamaica forms involves several steps to ensure accurate completion and submission. First, identify the specific form required for your situation, such as the P24 form for payroll reporting. Next, gather all necessary information, including employee details, earnings, and deductions. Fill out the form carefully, ensuring all information is accurate and complete. Once completed, the form can be submitted either online through the TAJ portal or in person at designated offices, depending on the specific requirements for each form.

Steps to complete the Tax Administration Jamaica Forms

Completing the Tax Administration Jamaica forms requires careful attention to detail. Here are the general steps to follow:

- Identify the correct form needed for your tax situation.

- Gather all relevant information, such as personal identification numbers and financial data.

- Fill in the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified method, whether online or in person.

Legal use of the Tax Administration Jamaica Forms

The legal use of Tax Administration Jamaica forms, including the P24 form, is governed by Jamaican tax laws. These forms must be completed accurately and submitted within specified deadlines to avoid penalties. The information provided on these forms is used by the Jamaican government to assess tax obligations and ensure compliance with tax regulations. Failure to use these forms correctly can result in legal consequences, including fines or other penalties.

Key elements of the Tax Administration Jamaica Forms

Key elements of the Tax Administration Jamaica forms include essential information that must be provided for the form to be valid. For the P24 form, this includes:

- Employer details, including name and tax registration number.

- Employee details, such as name, tax identification number, and earnings.

- Details of deductions made from employee earnings, including income tax and National Insurance contributions.

- Signature of the employer or authorized representative, confirming the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

Tax Administration Jamaica forms can be submitted through various methods, depending on the specific requirements of each form. The P24 form, for instance, can be submitted online via the TAJ's digital portal, which allows for quick processing. Alternatively, forms can be mailed to the appropriate tax office or submitted in person at designated TAJ locations. Each submission method has its own guidelines and deadlines that must be adhered to for compliance.

Penalties for Non-Compliance

Non-compliance with the requirements of the Tax Administration Jamaica forms can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for individuals and businesses to understand the implications of failing to submit forms accurately and on time to avoid these consequences. Regular audits and checks can help ensure compliance with tax obligations.

Quick guide on how to complete tax administration jamaica forms

Complete Tax Administration Jamaica Forms effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly without interruptions. Handle Tax Administration Jamaica Forms on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The most efficient way to modify and eSign Tax Administration Jamaica Forms effortlessly

- Locate Tax Administration Jamaica Forms and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Tax Administration Jamaica Forms and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax administration jamaica forms

Create this form in 5 minutes!

How to create an eSignature for the tax administration jamaica forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a P24 form in Jamaica?

The P24 form in Jamaica is a document used for reporting employee earnings and deductions to the National Insurance Scheme. It provides essential information about payroll that helps ensure compliance with Jamaican labor regulations. Understanding the P24 form Jamaica is crucial for businesses to avoid potential penalties and maintain accurate records.

-

How can airSlate SignNow help with the P24 form Jamaica?

airSlate SignNow facilitates the electronic signing and management of the P24 form Jamaica, allowing businesses to streamline their document workflow. With its user-friendly interface, users can easily send, sign, and store important payroll documents securely. This can signNowly reduce time spent on paperwork and improve operational efficiency.

-

Is there a cost associated with using airSlate SignNow for the P24 form Jamaica?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, ensuring access to features necessary for managing the P24 form Jamaica efficiently. You can choose a plan based on your document volume and required functionalities. Starting with a cost-effective solution can help businesses save on administrative costs while staying compliant.

-

Are there any specific features for managing P24 forms in Jamaica?

airSlate SignNow includes features specifically designed for managing the P24 form Jamaica, such as customizable templates, automated reminders, and secure storage. Users can create standard templates for repeated use, ensuring consistency and compliance. The platform also allows for easy tracking of document status for enhanced visibility.

-

What benefits does airSlate SignNow provide when handling the P24 form Jamaica?

Using airSlate SignNow for the P24 form Jamaica ensures faster processing times, reduced paperwork, and improved accuracy in payroll reporting. Its digital solution minimizes risks associated with manual errors, streamlining the submission process to regulatory bodies. This ultimately leads to more efficient business operations and enhanced employee satisfaction.

-

Can airSlate SignNow integrate with existing payroll systems for P24 form Jamaica?

Absolutely! airSlate SignNow can seamlessly integrate with various payroll systems to enhance the management of the P24 form Jamaica. By connecting with your existing tools, you can automate data transfer and ensure that your documents are always up-to-date without manual intervention. This integration supports overall efficiency in payroll management.

-

How secure is airSlate SignNow for handling the P24 form Jamaica?

airSlate SignNow prioritizes security, implementing advanced encryption protocols to protect the P24 form Jamaica and other sensitive documents. User access levels can be customized to ensure that only authorized personnel can view or edit critical files. This robust security framework helps businesses maintain compliance and safeguard their data.

Get more for Tax Administration Jamaica Forms

- Paving contract for contractor new hampshire form

- Site work contract for contractor new hampshire form

- Siding contract for contractor new hampshire form

- New hampshire contract 497318487 form

- New hampshire contract 497318488 form

- New hampshire contract 497318489 form

- Plumbing contract for contractor new hampshire form

- Brick mason contract for contractor new hampshire form

Find out other Tax Administration Jamaica Forms

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free