Detroit Dw 4 Form 2018-2026

What is the Detroit DW-4 Form

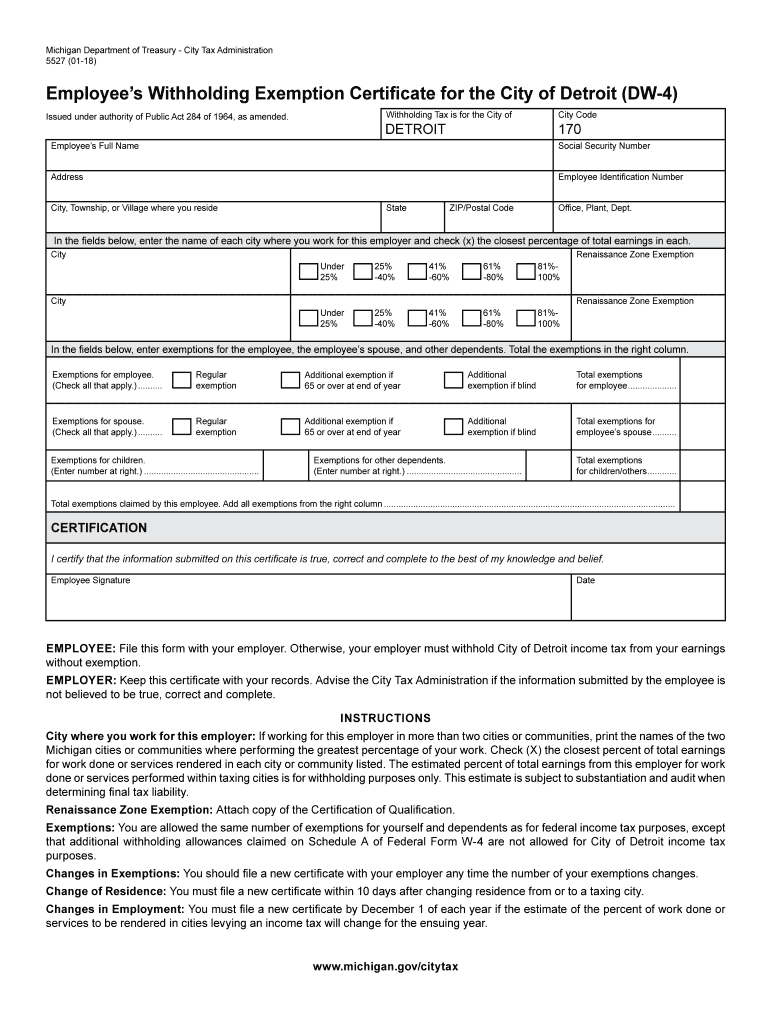

The Detroit DW-4 form is a local tax withholding form used by employees working in the city of Detroit. It allows individuals to specify their withholding allowances for city income tax purposes. This form is essential for ensuring that the correct amount of taxes is withheld from an employee's paycheck, reflecting their personal financial situation. By accurately completing the DW-4 form, employees can manage their tax liabilities effectively and avoid over-withholding or under-withholding throughout the year.

Steps to Complete the Detroit DW-4 Form

Completing the Detroit DW-4 form involves several straightforward steps:

- Obtain a copy of the DW-4 form, which can be accessed online or through your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status and the number of allowances you are claiming based on your financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer's payroll department for processing.

It is advisable to review the form for accuracy before submission to prevent any issues with tax withholding.

Legal Use of the Detroit DW-4 Form

The Detroit DW-4 form is legally recognized as a valid document for local tax withholding purposes in Detroit. It complies with the regulations set forth by the City of Detroit and the Michigan Department of Treasury. Employees must ensure that the information provided on the form is truthful and accurate, as any discrepancies could lead to penalties or issues with tax compliance. Understanding the legal implications of the DW-4 form helps employees fulfill their tax obligations responsibly.

How to Obtain the Detroit DW-4 Form

Employees can obtain the Detroit DW-4 form through various methods:

- Download a printable version from the official City of Detroit website.

- Request a copy from your employer's human resources or payroll department.

- Visit local government offices or tax assistance centers that provide tax forms.

Ensuring you have the latest version of the DW-4 form is crucial, as tax regulations may change over time.

Form Submission Methods

Once the Detroit DW-4 form is completed, it can be submitted through the following methods:

- Directly to your employer's payroll department, either in person or via email.

- By mailing a physical copy to your employer if required.

Employers typically have their own procedures for processing tax forms, so it is important to follow their specific instructions for submission.

Key Elements of the Detroit DW-4 Form

The Detroit DW-4 form contains several key elements that are crucial for accurate completion:

- Personal Information: Name, address, and Social Security number.

- Filing Status: Options for single, married, or head of household.

- Withholding Allowances: Number of allowances claimed based on personal and financial circumstances.

- Signature: Required to validate the information provided on the form.

Understanding these elements helps ensure that the form is filled out correctly and complies with local tax regulations.

Quick guide on how to complete dw 4 formpdffillercom 2018 2019

Your assistance manual on how to prepare your Detroit Dw 4 Form

If you’re curious about how to finalize and submit your Detroit Dw 4 Form, here are some brief guidelines to make tax handling considerably simpler.

To begin, you just need to set up your airSlate SignNow profile to change how you manage documentation online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, create, and complete your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures, and return to adjust responses as needed. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Adhere to the steps below to complete your Detroit Dw 4 Form in a few minutes:

- Create your account and start managing PDFs in no time.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Click Get form to access your Detroit Dw 4 Form in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-valid eSignature (if necessary).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please keep in mind that submitting on paper may lead to increased errors and delays in refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct dw 4 formpdffillercom 2018 2019

FAQs

-

Can we file an ITR for the financial year 2017-2018 in April 2019?

No

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

What should I do if I filled out the FAFSA application for 2018-2019 instead of 2017-2018?

Speak with the financial aid office at the college if your choice to make sure that this is actually a problem.

Create this form in 5 minutes!

How to create an eSignature for the dw 4 formpdffillercom 2018 2019

How to generate an eSignature for your Dw 4 Formpdffillercom 2018 2019 in the online mode

How to create an electronic signature for the Dw 4 Formpdffillercom 2018 2019 in Google Chrome

How to create an electronic signature for putting it on the Dw 4 Formpdffillercom 2018 2019 in Gmail

How to create an eSignature for the Dw 4 Formpdffillercom 2018 2019 from your mobile device

How to generate an eSignature for the Dw 4 Formpdffillercom 2018 2019 on iOS devices

How to create an eSignature for the Dw 4 Formpdffillercom 2018 2019 on Android

People also ask

-

What is the Detroit Dw 4 Form and why is it important?

The Detroit Dw 4 Form is a crucial document for individuals working in Detroit, as it allows employees to claim exemptions from local income tax withholding. This form ensures that your payroll deductions are accurate and compliant with local regulations. By properly submitting the Detroit Dw 4 Form, you can avoid over-withholding and manage your finances more effectively.

-

How can I easily eSign the Detroit Dw 4 Form using airSlate SignNow?

With airSlate SignNow, you can effortlessly eSign the Detroit Dw 4 Form online. Simply upload your document, add the necessary fields for signatures, and send it for signing. Our platform streamlines the signing process, allowing you to complete your paperwork quickly and securely.

-

What features does airSlate SignNow offer for managing the Detroit Dw 4 Form?

airSlate SignNow provides a range of features specifically designed to manage the Detroit Dw 4 Form efficiently. You can create templates, automate workflows, and track the signing process in real-time. These features help ensure that your documents are handled with accuracy and speed.

-

Is airSlate SignNow a cost-effective solution for handling the Detroit Dw 4 Form?

Yes, airSlate SignNow is a cost-effective solution for managing the Detroit Dw 4 Form and other documents. Our pricing plans are competitive, allowing businesses of all sizes to access professional eSigning capabilities without breaking the bank. This affordability makes it an ideal choice for managing essential paperwork.

-

Can I integrate airSlate SignNow with other software for the Detroit Dw 4 Form?

Absolutely! airSlate SignNow can be seamlessly integrated with various applications, enhancing your ability to manage the Detroit Dw 4 Form. Whether you use CRM systems, document storage solutions, or project management tools, our integrations streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the Detroit Dw 4 Form?

Using airSlate SignNow for the Detroit Dw 4 Form offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are stored safely and that you can access them anytime. Additionally, the ease of eSigning helps speed up your processes.

-

How does airSlate SignNow ensure the security of the Detroit Dw 4 Form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your Detroit Dw 4 Form and other documents. We adhere to industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Detroit Dw 4 Form

- Sandf online application form

- Speed problems form

- Silverscript appeal form

- Nha georgia form

- Florida supreme court approved family law form florida courts flcourts 100291557

- Florida supreme court approved family law form 12 930c

- Transcript of records 672471306 form

- Sevis i 20 form application fill online printable

Find out other Detroit Dw 4 Form

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement