Auburn University Alien Tax Information Form Auburn

What is the Auburn University Alien Tax Information Form?

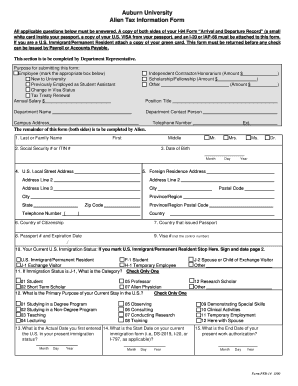

The Auburn University Alien Tax Information Form is a document designed for international students and scholars at Auburn University. This form collects necessary tax information to ensure compliance with U.S. tax laws. It is essential for non-resident aliens who receive income from the university, as it helps determine the appropriate tax withholding and reporting requirements. Understanding this form is crucial for maintaining legal status and ensuring that tax obligations are met accurately.

How to use the Auburn University Alien Tax Information Form

Using the Auburn University Alien Tax Information Form involves several steps to ensure that all required information is accurately provided. First, gather personal identification details, including your visa status and Social Security number, if applicable. Next, complete the form by filling in the necessary sections regarding your income and residency status. Once completed, submit the form to the appropriate department at Auburn University for processing. This ensures that your tax withholding is correctly calculated based on your individual circumstances.

Steps to complete the Auburn University Alien Tax Information Form

Completing the Auburn University Alien Tax Information Form requires careful attention to detail. Follow these steps:

- Gather all relevant documents, such as your passport, visa, and any previous tax forms.

- Fill out your personal information, including your name, address, and contact details.

- Provide information about your immigration status and the type of income you receive.

- Review the form for accuracy and completeness.

- Submit the form to the designated office at Auburn University, either electronically or via mail, as specified in the instructions.

Required Documents

When filling out the Auburn University Alien Tax Information Form, certain documents are required to verify your identity and tax status. These documents typically include:

- Passport and visa information

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Any prior tax documents, if applicable

- Proof of enrollment or employment at Auburn University

Having these documents ready will facilitate a smoother completion of the form.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Auburn University Alien Tax Information Form. Generally, the form should be submitted before you receive any income from the university to ensure proper tax withholding. Specific deadlines may vary based on your employment or scholarship status, so it is advisable to consult the university's financial services for the most accurate dates. Missing these deadlines can lead to complications with tax compliance.

Form Submission Methods

The Auburn University Alien Tax Information Form can be submitted through various methods to accommodate different preferences. You may choose to:

- Submit the form electronically via the university's designated online portal.

- Mail the completed form to the appropriate office at Auburn University.

- Deliver the form in person to ensure it is received promptly.

Each submission method has its own processing times, so consider your circumstances when choosing how to submit.

Quick guide on how to complete auburn university alien tax information form auburn

Complete [SKS] effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused operation today.

The most efficient way to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to commence.

- Utilize the tools we offer to submit your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Auburn University Alien Tax Information Form Auburn

Create this form in 5 minutes!

How to create an eSignature for the auburn university alien tax information form auburn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Auburn University Alien Tax Information Form Auburn?

The Auburn University Alien Tax Information Form Auburn is a document required for international students and scholars to report their tax information accurately. This form helps ensure compliance with U.S. tax regulations and is essential for maintaining your visa status while studying or working at Auburn University.

-

How can airSlate SignNow help with the Auburn University Alien Tax Information Form Auburn?

airSlate SignNow provides a seamless platform for electronically signing and sending the Auburn University Alien Tax Information Form Auburn. With its user-friendly interface, you can easily complete and submit your tax forms without the hassle of printing or mailing.

-

Is there a cost associated with using airSlate SignNow for the Auburn University Alien Tax Information Form Auburn?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While there may be a nominal fee for premium features, the platform remains a cost-effective solution for managing the Auburn University Alien Tax Information Form Auburn and other documents.

-

What features does airSlate SignNow offer for the Auburn University Alien Tax Information Form Auburn?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Auburn University Alien Tax Information Form Auburn. These features enhance the document management process, making it easier to stay organized and compliant.

-

Can I integrate airSlate SignNow with other applications for the Auburn University Alien Tax Information Form Auburn?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the Auburn University Alien Tax Information Form Auburn. This includes popular tools like Google Drive, Dropbox, and more, ensuring you can manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for the Auburn University Alien Tax Information Form Auburn?

Using airSlate SignNow for the Auburn University Alien Tax Information Form Auburn provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform simplifies the signing process, ensuring that you can focus on your studies or work without worrying about paperwork.

-

Is airSlate SignNow secure for submitting the Auburn University Alien Tax Information Form Auburn?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for submitting the Auburn University Alien Tax Information Form Auburn. The platform employs advanced encryption and security measures to protect your sensitive information throughout the signing process.

Get more for Auburn University Alien Tax Information Form Auburn

- Please mail to anglican financial care po box 12 287 thorndon wellington 6144 or email officeangfincare form

- Health fund anglican financial careanglican financial form

- Fillable online goods and services tax gst calculator form

- Highway safety works at km 495504 north amp south bound on motorway m 1 form

- Fatherhusband name form

- Account updation form

- Wms form a

- Office of the accountant general pakistan revenues form

Find out other Auburn University Alien Tax Information Form Auburn

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document