Nebraska Form 21 2018

What is the Nebraska Form 21

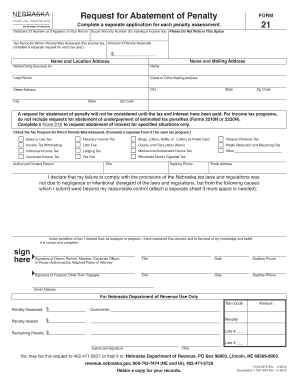

The Nebraska Form 21, also known as the Nebraska Department of Revenue Form 21, is a tax-related document used primarily for reporting and claiming various tax benefits in the state of Nebraska. This form is essential for taxpayers seeking to address issues related to tax liabilities, including penalties and abatements. It serves as a formal request to the Nebraska Department of Revenue for relief from certain tax obligations, making it a vital tool for both individuals and businesses navigating the state's tax regulations.

How to use the Nebraska Form 21

Using the Nebraska Form 21 involves several straightforward steps. First, gather all necessary financial documents and information related to your tax situation. Next, download the form from the Nebraska Department of Revenue's official website or access it through a reliable eSignature platform. Fill out the form accurately, ensuring that all required fields are completed. Once filled, you can eSign the document for a secure submission. It is crucial to keep a copy of the completed form for your records.

Steps to complete the Nebraska Form 21

Completing the Nebraska Form 21 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and tax identification number.

- Clearly indicate the reason for filing the form, such as requesting an abatement of penalties.

- Provide any supporting documentation that justifies your request, such as financial statements or correspondence with the Department of Revenue.

- Review the form for accuracy and completeness before signing.

- Submit the form electronically or via mail, depending on your preference and the submission options available.

Legal use of the Nebraska Form 21

The Nebraska Form 21 is legally recognized as a formal request for tax relief under Nebraska law. When properly completed and submitted, it can help taxpayers contest penalties or seek adjustments to their tax obligations. It is important to ensure compliance with all state regulations when using this form, as improper use may result in denial of the request or further penalties. Always consult with a tax professional if you have questions about the legal implications of using Form 21.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Form 21 can vary based on the specific circumstances of the taxpayer. Generally, it is advisable to file the form as soon as the need for an abatement arises, particularly if it relates to a tax penalty. For specific deadlines, refer to the Nebraska Department of Revenue’s guidelines or consult with a tax professional to ensure timely submission and compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Nebraska Form 21 can lead to significant penalties. Taxpayers may face additional fines or interest on unpaid taxes if the form is not submitted correctly or on time. It is essential to understand the potential consequences of non-compliance, including the possibility of losing the opportunity for an abatement. Engaging with a tax advisor can help mitigate these risks and ensure proper adherence to all filing requirements.

Quick guide on how to complete 21 request for abatement of penalty nebraska department of

Your assistance manual on how to prepare your Nebraska Form 21

If you’re unsure about how to complete and submit your Nebraska Form 21, here are a few straightforward instructions on how to simplify your tax filing process.

To begin, you simply need to sign up for your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an intuitive and robust document solution that allows you to edit, draft, and finalize your income tax forms with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify responses as needed. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the outlined steps below to complete your Nebraska Form 21 in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Access our catalog to find any IRS tax form; browse through various versions and schedules.

- Click Get form to launch your Nebraska Form 21 in our editor.

- Enter the necessary information in the fillable fields (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting in paper form can lead to increased return errors and delays in refunds. Of course, prior to e-filing your taxes, verify the IRS website for submission guidelines specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct 21 request for abatement of penalty nebraska department of

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the 21 request for abatement of penalty nebraska department of

How to create an electronic signature for your 21 Request For Abatement Of Penalty Nebraska Department Of online

How to make an electronic signature for your 21 Request For Abatement Of Penalty Nebraska Department Of in Google Chrome

How to generate an electronic signature for putting it on the 21 Request For Abatement Of Penalty Nebraska Department Of in Gmail

How to create an electronic signature for the 21 Request For Abatement Of Penalty Nebraska Department Of straight from your mobile device

How to make an eSignature for the 21 Request For Abatement Of Penalty Nebraska Department Of on iOS

How to create an eSignature for the 21 Request For Abatement Of Penalty Nebraska Department Of on Android devices

People also ask

-

What is the Nebraska statute 21 117 form?

The Nebraska statute 21 117 form is a legal document used for filing specific business-related information with the state. This form is crucial for ensuring compliance with Nebraska’s laws regulating business entities. Using airSlate SignNow makes it easy to securely eSign and submit this form online.

-

How can airSlate SignNow help with the Nebraska statute 21 117 form?

AirSlate SignNow streamlines the process of completing and signing the Nebraska statute 21 117 form. Our platform allows users to fill out the form electronically, ensuring all necessary signatures are collected quickly and efficiently. This saves businesses valuable time and ensures accuracy in their filings.

-

Is there a cost associated with using airSlate SignNow for the Nebraska statute 21 117 form?

Yes, there is a cost associated with using airSlate SignNow, but it offers a cost-effective solution for businesses. The pricing plans are designed to fit various budgets and include features that enhance the signing experience for forms like the Nebraska statute 21 117 form. You can choose a plan that best meets your needs.

-

What features does airSlate SignNow offer for eSigning the Nebraska statute 21 117 form?

AirSlate SignNow provides a variety of features for eSigning the Nebraska statute 21 117 form, including customizable signing workflows, document templates, and secure cloud storage. Users can also track the status of their documents and receive notifications upon completion. These features simplify the signing process signNowly.

-

Can I integrate airSlate SignNow with other software for the Nebraska statute 21 117 form?

Absolutely! AirSlate SignNow offers integration capabilities with various software tools, allowing you to connect with your existing systems seamlessly. This means you can easily create, manage, and sign the Nebraska statute 21 117 form within your preferred applications, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for legal forms like the Nebraska statute 21 117 form?

Using airSlate SignNow for legal forms like the Nebraska statute 21 117 form provides numerous benefits, including time savings, improved accuracy, and heightened security. Digital signatures are legally binding, ensuring your documents meet compliance regulations while reducing the risk of errors associated with paper forms.

-

How secure is airSlate SignNow when handling the Nebraska statute 21 117 form?

AirSlate SignNow prioritizes security, using advanced encryption methods to protect your documents, including the Nebraska statute 21 117 form. We also adhere to strict compliance standards, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for Nebraska Form 21

- Hunting lease license in texas form

- Critical data matrix form

- Form dtf 719 mn613renewal application for registration of retail dealers and vending machines for sales of cigarettes and

- Primary source activity networks answer key form

- Building permit application orlando gov form

- 1 new business small employer application rogers benefit group form

- Neptune beach permit search 621045856 form

- Inspection line 727 547 4575 ext form

Find out other Nebraska Form 21

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document