Complete a Separate Application for Each Penalty Assessment 2020-2026

Understanding the Nebraska Form 21

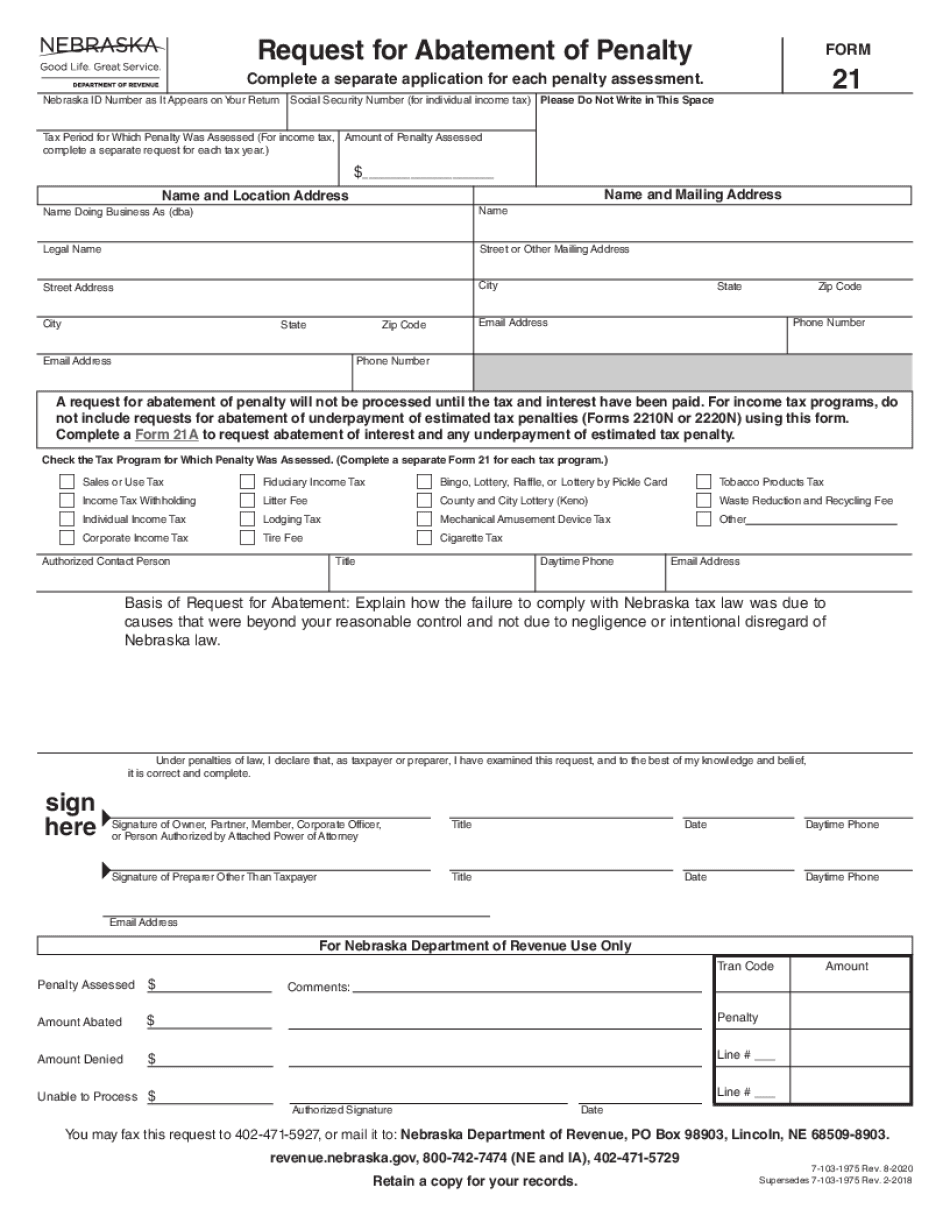

The Nebraska Form 21, also known as the Nebraska abatement penalty, is a crucial document for individuals and businesses seeking to address specific penalty assessments in the state. This form is primarily used to request the abatement of penalties imposed by the Nebraska Department of Revenue (DOR). It is essential to understand the purpose and implications of this form to ensure compliance and proper handling of your tax matters.

Steps to Complete the Nebraska Form 21

Completing the Nebraska Form 21 involves several important steps:

- Gather Required Information: Collect all necessary documentation related to the penalty assessment, including any previous correspondence with the Nebraska DOR.

- Fill Out the Form: Provide accurate details in each section of the form, ensuring that all information is complete and truthful.

- Attach Supporting Documents: Include any relevant documents that support your request for abatement, such as proof of compliance or mitigating circumstances.

- Review and Sign: Carefully review the completed form for accuracy before signing it. Ensure that all required signatures are included.

Eligibility Criteria for Nebraska Form 21

To qualify for the abatement of penalties using the Nebraska Form 21, applicants must meet specific eligibility criteria. These may include:

- Demonstrating reasonable cause for the failure to comply with tax obligations.

- Providing evidence of timely payment of taxes owed, if applicable.

- Submitting the form within the designated time frame following the penalty assessment.

Understanding these criteria is vital for a successful application process.

Form Submission Methods for Nebraska Form 21

The Nebraska Form 21 can be submitted through various methods, allowing for flexibility based on the applicant's preference:

- Online Submission: If available, submitting the form electronically through the Nebraska DOR website can expedite processing.

- Mail: Completed forms can be sent via postal service to the appropriate Nebraska DOR address. Ensure that you use the correct postage and address.

- In-Person Submission: Applicants may also choose to deliver the form in person at their local Nebraska DOR office for immediate assistance.

Penalties for Non-Compliance with Nebraska Form 21

Failure to comply with the requirements associated with the Nebraska Form 21 can lead to significant penalties. These may include:

- Denial of the abatement request, resulting in the continuation of the assessed penalties.

- Additional fines or interest accruing on the unpaid penalties.

- Potential legal action if the penalties remain unresolved.

Being aware of these consequences underscores the importance of accurately completing and submitting the form in a timely manner.

Key Elements of the Nebraska Form 21

Understanding the key elements of the Nebraska Form 21 is essential for effective completion. Important components include:

- Applicant Information: Details about the individual or business requesting the abatement.

- Penalty Assessment Details: Specifics about the penalties being contested, including dates and amounts.

- Reason for Abatement: A clear explanation of the circumstances justifying the request for penalty relief.

Each of these elements plays a critical role in the evaluation of the abatement request.

Quick guide on how to complete complete a separate application for each penalty assessment

Complete Complete A Separate Application For Each Penalty Assessment effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Complete A Separate Application For Each Penalty Assessment on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Complete A Separate Application For Each Penalty Assessment seamlessly

- Locate Complete A Separate Application For Each Penalty Assessment and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Complete A Separate Application For Each Penalty Assessment while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct complete a separate application for each penalty assessment

Create this form in 5 minutes!

How to create an eSignature for the complete a separate application for each penalty assessment

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is Nebraska Form 21 and how can airSlate SignNow assist with it?

Nebraska Form 21 is a crucial document often required for various administrative processes. airSlate SignNow provides an easy-to-use platform that allows users to upload, eSign, and send the Nebraska Form 21 seamlessly, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for handling Nebraska Form 21?

airSlate SignNow offers a variety of pricing plans tailored to your business needs, making it affordable to handle documents like Nebraska Form 21. You can choose between monthly or annual subscriptions, with options that scale as your document signing needs grow.

-

What features does airSlate SignNow provide for Nebraska Form 21?

airSlate SignNow offers numerous features for managing Nebraska Form 21, including customizable templates, notifications, and real-time tracking. These features streamline the eSigning process, ensuring documents are processed efficiently and securely.

-

Is airSlate SignNow compliant with Nebraska regulations for Form 21?

Yes, airSlate SignNow is compliant with Nebraska regulations for handling documents like Form 21. Our platform adheres to electronic signature laws, ensuring that all eSigned documents, including Nebraska Form 21, hold legal validity.

-

Can I integrate airSlate SignNow with other applications for managing Nebraska Form 21?

Absolutely! airSlate SignNow integrates with numerous applications, allowing you to manage Nebraska Form 21 alongside your favorite tools. This integration capability streamlines workflows and enhances productivity by connecting all your essential systems.

-

What are the benefits of using airSlate SignNow for Nebraska Form 21?

Using airSlate SignNow for Nebraska Form 21 offers several benefits, including time savings, reduced paperwork, and improved collaboration. Our platform simplifies the eSigning process, helping you close deals and manage documents faster and more efficiently.

-

Is there a mobile app for managing Nebraska Form 21 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage Nebraska Form 21 on the go. This mobile solution ensures that you can access, sign, and send your documents anytime, anywhere, boosting your productivity and flexibility.

Get more for Complete A Separate Application For Each Penalty Assessment

- Cafl frequencies form

- Oad clsu form

- Bescheinigung fr arbeitnehmerinnen ber die zahlung eines form

- Notice and consent for road test video audio recording form

- How to fill reference check form

- Poa 1 indiana form

- Assignment of policy as collateral penn mutual life form

- Som laboratory supplies application form new user application form for som laboratory supplies store nuhs edu

Find out other Complete A Separate Application For Each Penalty Assessment

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe