Form 21, Request for Abatement of Penalty Nebraska Department 2013

What is the Form 21, Request For Abatement Of Penalty Nebraska Department

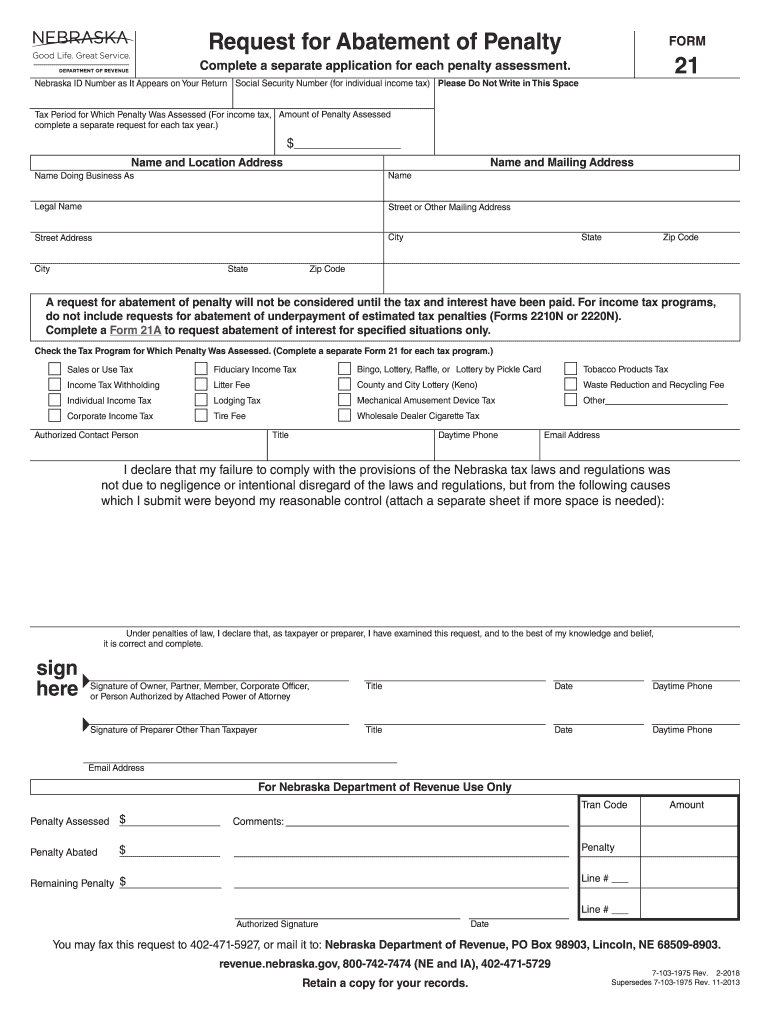

The Form 21, Request For Abatement Of Penalty, is a document used by taxpayers in Nebraska to formally request the reduction or elimination of penalties imposed by the Nebraska Department of Revenue. This form is particularly relevant for individuals or businesses that have incurred penalties due to late payments or filing issues. The abatement process allows taxpayers to present their case, often citing reasonable cause for their non-compliance, and seek relief from financial penalties that may have been assessed.

How to use the Form 21, Request For Abatement Of Penalty Nebraska Department

To effectively use the Form 21, taxpayers should first ensure they meet the eligibility criteria for requesting an abatement. The form should be filled out completely, providing accurate information about the taxpayer's situation and the reasons for the penalty. After completing the form, it must be submitted to the Nebraska Department of Revenue, either electronically or via mail, depending on the submission method chosen. It is essential to retain a copy of the submitted form for personal records and follow up on the status of the request.

Steps to complete the Form 21, Request For Abatement Of Penalty Nebraska Department

Completing the Form 21 involves several key steps:

- Gather necessary documentation that supports your request for abatement, such as payment records or correspondence with the Department of Revenue.

- Fill out the form accurately, ensuring all required fields are completed, including taxpayer identification details and specifics regarding the penalties incurred.

- Clearly articulate the reasons for the abatement request in the designated section, providing any relevant evidence that supports your case.

- Review the completed form for accuracy and completeness before submission.

- Submit the form according to the guidelines provided by the Nebraska Department of Revenue, either online or by mailing it to the appropriate address.

Key elements of the Form 21, Request For Abatement Of Penalty Nebraska Department

The Form 21 includes several critical elements that must be addressed for a successful submission. These elements typically encompass:

- Taxpayer identification information, including name, address, and identification number.

- A detailed explanation of the penalties being contested and the specific reasons for the abatement request.

- Supporting documentation that validates the claims made in the request.

- Signature of the taxpayer or authorized representative, affirming the accuracy of the information provided.

Eligibility Criteria

To qualify for submitting the Form 21, taxpayers must meet specific eligibility criteria set forth by the Nebraska Department of Revenue. Generally, this includes having incurred penalties due to circumstances beyond the taxpayer's control, such as natural disasters, serious illness, or other reasonable causes. Taxpayers should also ensure that they have filed all required tax returns and paid any outstanding taxes to be considered for penalty abatement.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 21 through various methods, depending on their preference and the guidelines established by the Nebraska Department of Revenue. The available submission methods include:

- Online submission through the Nebraska Department of Revenue's official website, which may offer a streamlined process for electronic filing.

- Mailing the completed form to the designated address provided by the Department of Revenue for processing.

- In-person submission at local Department of Revenue offices, where taxpayers may also seek assistance if needed.

Quick guide on how to complete form 21 request for abatement of penalty nebraska department

Your assistance manual on how to prepare your Form 21, Request For Abatement Of Penalty Nebraska Department

If you’re interested in understanding how to create and submit your Form 21, Request For Abatement Of Penalty Nebraska Department, here are a few brief instructions to make tax submission simpler.

First, you'll need to set up your airSlate SignNow profile to change the way you manage documents online. airSlate SignNow is a highly user-friendly and powerful document management solution that enables you to edit, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to modify responses as necessary. Streamline your tax management using advanced PDF editing, eSigning, and easy sharing capabilities.

Follow the instructions below to complete your Form 21, Request For Abatement Of Penalty Nebraska Department in just a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our library to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form 21, Request For Abatement Of Penalty Nebraska Department in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting paper forms may increase errors and delay refunds. It’s important to check the IRS website for filing regulations in your state prior to e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct form 21 request for abatement of penalty nebraska department

FAQs

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How can I get a lot of people to fill out my Google form survey for a research paper?

First of all, to get a lot of responses for your survey don't forget to follow main rules of creating a survey. Here are some of them:Create and design an invitation page, sett the information about why it is so important for you to get the answers there; also write the purpose of your survey.Make your survey short. Remember that people spend their time answering questions.Preset your goal, decide what information you want to get in the end. Prepare list of questions, which would be the most important for you.Give your respondents enough time to answer a survey.Don't forget to say "Thank you!", be polite.Besides, if you want to get more responses, you can use these tips:1.The first one is to purchase responses from survey panel. You can use MySurveyLab’s survey panel for it. In this case you will get reliable and useful results. You can read more about it here.2.If you don’t want to spent money for responses, you can use the second solution. The mentioned tool enables sharing the survey via different channels: email (invitations and e-mail embedded surveys, SMS, QR codes, as a link.You can share the link on different social media, like Twitter, Facebook, Facebook groups, different forums could be also useful, Pinterest, LinkedIn, VKontakte and so on… I think that if you use all these channels, you could get planned number of responses.Hope to be helpful! Good luck!

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the form 21 request for abatement of penalty nebraska department

How to create an electronic signature for your Form 21 Request For Abatement Of Penalty Nebraska Department online

How to generate an eSignature for the Form 21 Request For Abatement Of Penalty Nebraska Department in Google Chrome

How to make an eSignature for putting it on the Form 21 Request For Abatement Of Penalty Nebraska Department in Gmail

How to make an eSignature for the Form 21 Request For Abatement Of Penalty Nebraska Department straight from your mobile device

How to make an eSignature for the Form 21 Request For Abatement Of Penalty Nebraska Department on iOS

How to create an eSignature for the Form 21 Request For Abatement Of Penalty Nebraska Department on Android

People also ask

-

What is the Form 21, Request For Abatement Of Penalty Nebraska Department?

The Form 21, Request For Abatement Of Penalty Nebraska Department is an official document used to request the abatement of penalties assessed by the Nebraska Department of Revenue. This form is essential for taxpayers who believe they have valid reasons for penalty relief. Using this form can help simplify the process of managing tax penalties efficiently.

-

How can airSlate SignNow help with the Form 21, Request For Abatement Of Penalty Nebraska Department?

airSlate SignNow offers a user-friendly platform that allows you to easily prepare, sign, and send the Form 21, Request For Abatement Of Penalty Nebraska Department. Our solution streamlines the eSigning process, ensuring that your form is securely submitted and tracked. You can rest assured your abatement request is handled with efficiency and professionalism.

-

What are the costs associated with using airSlate SignNow for Form 21 submissions?

airSlate SignNow provides a cost-effective solution for sending documents like the Form 21, Request For Abatement Of Penalty Nebraska Department. Our pricing plans are designed to fit various business needs and budgets, offering great value for the features we provide. Contact us for details on our subscription options and enjoy the benefits of eSigning at competitive rates.

-

Is the Form 21, Request For Abatement Of Penalty Nebraska Department easy to fill out using airSlate SignNow?

Yes, airSlate SignNow simplifies the process of filling out the Form 21, Request For Abatement Of Penalty Nebraska Department. With our intuitive interface, you can quickly input necessary information without the hassle of manual paperwork. You'll find features like template creation that allows for easier form completion in the future.

-

Are there any integrations available for airSlate SignNow when submitting Form 21?

airSlate SignNow integrates seamlessly with various tools, allowing you to submit the Form 21, Request For Abatement Of Penalty Nebraska Department directly from platforms you already use. This includes document management systems and cloud storage solutions. Our integrations enhance your workflow and ensure convenient access to your documents.

-

What are the main benefits of using airSlate SignNow for tax forms like Form 21?

Using airSlate SignNow for tax forms like the Form 21, Request For Abatement Of Penalty Nebraska Department offers numerous benefits, including time efficiency, enhanced security, and cost savings. You can manage all your eSigning needs in one place while ensuring compliance and tracking your submissions easily. Take advantage of our robust features tailored for tax professionals.

-

Can I track the status of my Form 21 submission with airSlate SignNow?

Yes, airSlate SignNow provides a tracking feature that enables you to monitor the status of your Form 21, Request For Abatement Of Penalty Nebraska Department submission. You will receive notifications and updates on the document's progress, ensuring that you're always informed. This enhances communication and reduces uncertainty during the submission process.

Get more for Form 21, Request For Abatement Of Penalty Nebraska Department

Find out other Form 21, Request For Abatement Of Penalty Nebraska Department

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors