Form ST 809 41010 Part Quarterly Monthly Schedule NJ for Use by Vendors Located in New York State, St8094 2010-2026

Understanding the Form ST0 Part Quarterly Monthly Schedule NJ

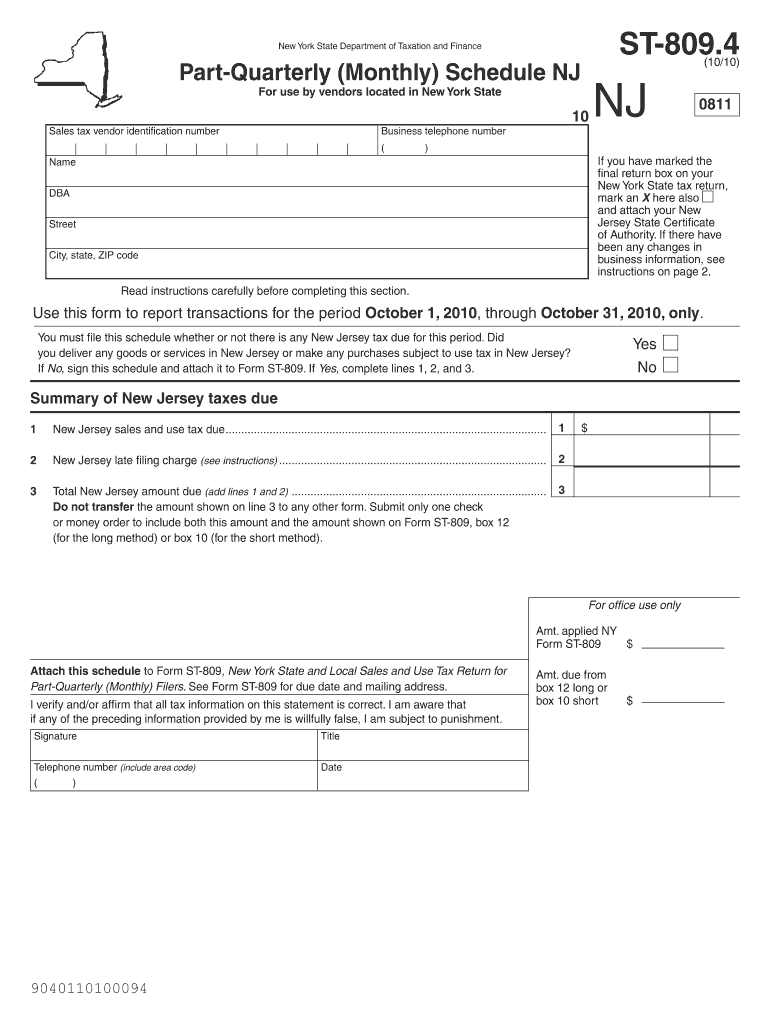

The Form ST 809, also known as the ST0 Part Quarterly Monthly Schedule, is specifically designed for vendors located in New York State. This form is essential for reporting sales tax collected and is used by businesses to comply with state tax regulations. It is crucial for vendors to accurately complete this form to ensure proper reporting and remittance of sales tax to the state authorities.

Steps to Complete the Form ST0 Part Quarterly Monthly Schedule NJ

Completing the Form ST 809 involves several key steps. First, gather all necessary sales records for the reporting period. This includes total sales, taxable sales, and any exemptions. Next, accurately fill in each section of the form, ensuring that all figures are correct and reflect your sales activities. After completing the form, review it for any errors before submitting it to the appropriate state agency. It is advisable to keep a copy for your records.

Filing Deadlines for the Form ST0 Part Quarterly Monthly Schedule NJ

Vendors must be aware of the filing deadlines for the Form ST 809 to avoid penalties. Generally, the form is due on a quarterly basis, with specific due dates set by the New York State Department of Taxation and Finance. It is important to stay informed about these deadlines to ensure timely submission and compliance with state tax laws.

Legal Use of the Form ST0 Part Quarterly Monthly Schedule NJ

The legal use of the Form ST 809 is governed by New York State tax laws. Vendors are required to use this form to report sales tax collected on taxable sales. Failure to use the correct form or to report accurately can lead to penalties and interest charges. Understanding the legal requirements surrounding this form is essential for maintaining compliance and avoiding potential legal issues.

Key Elements of the Form ST0 Part Quarterly Monthly Schedule NJ

The Form ST 809 contains several key elements that vendors must complete. These include sections for reporting total sales, taxable sales, and any applicable exemptions. Additionally, the form requires vendors to calculate the total sales tax due based on the reported figures. Each section must be filled out accurately to ensure proper processing by the state.

Examples of Using the Form ST0 Part Quarterly Monthly Schedule NJ

Understanding how to use the Form ST 809 can be enhanced through practical examples. For instance, a vendor selling clothing must report the total sales from the previous quarter, indicating which items were taxable and which were exempt. By following the guidelines and examples provided with the form, vendors can ensure accurate reporting and compliance with state tax regulations.

Quick guide on how to complete form st 80941010 part quarterly monthly schedule nj for use by vendors located in new york state st8094

Your assistance manual on how to prepare your Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094

If you’re curious about how to generate and submit your Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094, here are a few concise instructions on how to make tax submission less challenging.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a user-friendly and robust document solution that allows you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures and return to revise details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094 within moments:

- Create your account and start working on PDFs shortly.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Get form to access your Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094 in our editor.

- Populate the required fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to incorporate your legally-binding eSignature (if necessary).

- Review your document and remedy any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please note that submitting via paper can increase return inaccuracies and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form st 80941010 part quarterly monthly schedule nj for use by vendors located in new york state st8094

Create this form in 5 minutes!

How to create an eSignature for the form st 80941010 part quarterly monthly schedule nj for use by vendors located in new york state st8094

How to make an eSignature for the Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 online

How to generate an eSignature for your Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 in Google Chrome

How to make an eSignature for putting it on the Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 in Gmail

How to make an electronic signature for the Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 from your smart phone

How to create an electronic signature for the Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 on iOS

How to generate an electronic signature for the Form St 80941010 Part Quarterly Monthly Schedule Nj For Use By Vendors Located In New York State St8094 on Android OS

People also ask

-

What is the sales tax rate in NJ for 2024?

The sales tax rate in NJ for 2024 is set at 6.625%. This applies to most goods and services sold in the state. It's important to stay updated with regulations, as they can change, impacting business operations.

-

How can airSlate SignNow help in managing sales tax in NJ for 2024?

airSlate SignNow streamlines the process of collecting sales tax in NJ for 2024 by allowing businesses to eSign and send documents quickly. It provides templates and compliance tools that ensure tax documents are accurate and up to date, reducing the chances of errors.

-

Are there any pricing plans for airSlate SignNow that include sales tax management features?

Yes, airSlate SignNow offers various pricing plans that include features for managing sales tax in NJ for 2024. These plans are designed to accommodate businesses of all sizes, providing essential tools for efficient tax management.

-

What integrations are available with airSlate SignNow for handling sales tax in NJ in 2024?

airSlate SignNow integrates seamlessly with various accounting and finance software, which aids in calculating and tracking sales tax in NJ for 2024. These integrations help ensure that all taxation records are kept accurate and easily accessible.

-

How does airSlate SignNow ensure compliance with sales tax regulations in NJ for 2024?

airSlate SignNow is built to assist users in maintaining compliance with sales tax regulations in NJ for 2024 through automated updates and document templates. This feature helps businesses keep up with any changes in legislation, ensuring they meet all necessary requirements.

-

Can airSlate SignNow help with tax filing associated with sales tax in NJ for 2024?

Yes, airSlate SignNow can assist in preparing documents necessary for tax filing related to sales tax in NJ for 2024. By providing a secure platform for document management, businesses can ensure that they have all their tax documents and eSigned agreements organized.

-

Is airSlate SignNow user-friendly for small businesses managing sales tax in NJ for 2024?

Absolutely! airSlate SignNow is designed to be user-friendly, making it particularly suitable for small businesses managing sales tax in NJ for 2024. Its intuitive interface allows users to quickly learn how to eSign and send required documents without technical expertise.

Get more for Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094

- Limited special occasion permit form

- Dd form 1494 fillable

- To whom it may concern medical certificate form

- Footankle disability index form

- Agriculture az govdownload formsdownload formsarizona department of agriculture

- Equine registration application form

- Lake havasu city development services department 2330 form

Find out other Form ST 809 41010 Part Quarterly Monthly Schedule NJ For Use By Vendors Located In New York State, St8094

- Create Sign Document Secure

- Create Sign Form iPad

- Create Sign Document Simple

- Create Sign PPT Myself

- How To Create Sign Form

- Create Sign Presentation Online

- Create Sign Document Mac

- Create Sign PPT Android

- Create Sign Presentation Free

- How To Erase Sign PDF

- Erase Sign Form Online

- Erase Sign Word Myself

- How To Erase Sign Word

- Redact Sign Word Online

- Redact Sign PDF Online

- Redact Sign Word iPad

- How To Redact Sign PDF

- Redact Sign PDF Free

- How Can I Redact Sign PDF

- Redact Sign Form Online