4 Part Quarterly Schedule NJ 703 for Use by Vendors Located in New York State 07 Sales Tax Vendor Identification Number NJ Bu 2003

What is the 4 Part Quarterly Schedule NJ 703 for Use by Vendors Located in New York State 07 Sales Tax Vendor Identification Number NJ

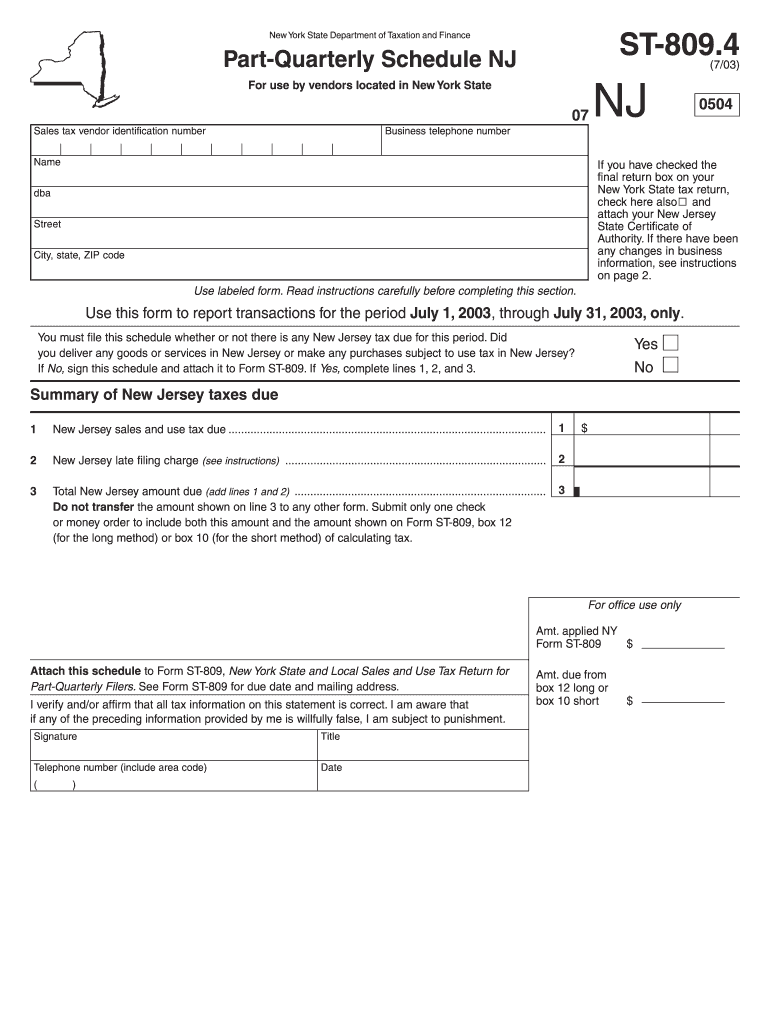

The 4 Part Quarterly Schedule NJ 703 is a tax form specifically designed for vendors operating in New York State who are required to report sales tax. This form serves as a tool for documenting sales tax collected and remitted to the state. It is essential for compliance with New Jersey tax regulations, allowing vendors to accurately report their tax obligations. The form consists of four parts, each serving a distinct purpose in the reporting process, ensuring that all necessary information is captured for state tax authorities.

How to Use the 4 Part Quarterly Schedule NJ 703

Using the 4 Part Quarterly Schedule NJ 703 involves several steps to ensure accurate completion. Vendors must first gather all relevant sales data for the reporting period. Once the data is compiled, the vendor fills out the form, entering details such as total sales, taxable sales, and the amount of sales tax collected. Each part of the form must be completed carefully, as errors can lead to compliance issues. After filling out the form, vendors can submit it electronically or via mail, depending on their preference and the guidelines provided by the New Jersey Division of Taxation.

Steps to Complete the 4 Part Quarterly Schedule NJ 703

Completing the 4 Part Quarterly Schedule NJ 703 requires attention to detail. Here are the steps to follow:

- Gather all sales records for the quarter, including receipts and invoices.

- Determine the total sales amount and the portion that is taxable.

- Fill out each section of the form, ensuring all figures are accurate.

- Review the completed form for any errors or omissions.

- Submit the form electronically through an approved platform or mail it to the designated address.

Legal Use of the 4 Part Quarterly Schedule NJ 703

The legal use of the 4 Part Quarterly Schedule NJ 703 is critical for vendors to meet their tax obligations. This form is recognized by the New Jersey Division of Taxation and must be used in accordance with state laws. Vendors are required to maintain accurate records and submit the form within the specified deadlines to avoid penalties. Understanding the legal requirements surrounding this form helps ensure compliance and protects vendors from potential audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the 4 Part Quarterly Schedule NJ 703 are crucial for vendors to adhere to. Typically, the form must be submitted quarterly, with specific due dates set by the New Jersey Division of Taxation. Vendors should mark their calendars for these deadlines to ensure timely submission. Missing a deadline can result in penalties and interest on unpaid taxes, making it essential to stay informed about the filing schedule.

Form Submission Methods

Vendors have multiple options for submitting the 4 Part Quarterly Schedule NJ 703. The form can be filed electronically through approved e-filing systems, which is often the preferred method due to its speed and efficiency. Alternatively, vendors may choose to print the form and mail it to the appropriate tax authority. Each method has its own set of guidelines, and vendors should select the one that best fits their operational needs.

Quick guide on how to complete 4 part quarterly schedule nj 703 for use by vendors located in new york state 07 sales tax vendor identification number nj

Your assistance manual on how to prepare your 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu

If you’re interested in understanding how to finalize and submit your 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu, here are some straightforward instructions on how to streamline the tax processing experience.

To begin, all you need is to create your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow offers a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures while being able to return and adjust information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and seamless sharing capabilities.

Follow the instructions below to complete your 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu in a matter of minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through different versions and schedules.

- Click Obtain form to access your 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to insert your legally-binding electronic signature (if needed).

- Examine your document and correct any errors.

- Save modifications, print your copy, submit it to your intended recipient, and download it to your device.

Make use of this guide to file your taxes electronically with airSlate SignNow. Kindly remember that submitting on paper can lead to errors in returns and delay refunds. Before e-filing your taxes, verify the IRS website for the filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct 4 part quarterly schedule nj 703 for use by vendors located in new york state 07 sales tax vendor identification number nj

Create this form in 5 minutes!

How to create an eSignature for the 4 part quarterly schedule nj 703 for use by vendors located in new york state 07 sales tax vendor identification number nj

How to generate an eSignature for the 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj in the online mode

How to make an eSignature for your 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj in Chrome

How to create an electronic signature for signing the 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj in Gmail

How to create an electronic signature for the 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj right from your mobile device

How to create an electronic signature for the 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj on iOS

How to create an electronic signature for the 4 Part Quarterly Schedule Nj 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number Nj on Android devices

People also ask

-

What is the 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu?

The 4 Part Quarterly Schedule NJ 703 is a specific form required for vendors located in New York State to document their sales tax activities. It helps businesses report their tax obligations accurately and ensures compliance with New Jersey tax regulations. Using this form aids in maintaining organized records, which is beneficial for audits and financial management.

-

How can airSlate SignNow assist with the 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu?

airSlate SignNow provides a user-friendly platform that allows businesses to eSign and send documents, including the 4 Part Quarterly Schedule NJ 703. This accelerates the process of preparing and submitting tax forms while ensuring that all signatures are legally binding. With real-time tracking and reminders, vendors can be confident that their documents are submitted on time.

-

What are the pricing options for using airSlate SignNow with the 4 Part Quarterly Schedule NJ 703?

airSlate SignNow offers various subscription plans, allowing businesses to choose one that fits their needs. The pricing is competitive and designed for all business sizes, providing cost-effective solutions for managing documents like the 4 Part Quarterly Schedule NJ 703. You can explore monthly and annual plans that include features tailored for efficient document handling.

-

What features does airSlate SignNow offer to simplify the eSigning of the 4 Part Quarterly Schedule NJ 703?

Features such as customizable templates, automated workflows, and secure cloud storage are available with airSlate SignNow. These tools streamline the process of completing the 4 Part Quarterly Schedule NJ 703, allowing you to quickly prepare, send, and receive signed documents. Enhanced security measures ensure that sensitive tax information is protected throughout the process.

-

Are there any integrations available with airSlate SignNow that benefit users of the 4 Part Quarterly Schedule NJ 703?

Yes, airSlate SignNow integrates with various third-party applications, enhancing its usability. By connecting to platforms such as Google Drive and Dropbox, businesses can easily access their documents when completing the 4 Part Quarterly Schedule NJ 703. This seamless integration improves workflow efficiency and ensures that all necessary information is readily available.

-

What are the benefits of using airSlate SignNow for the 4 Part Quarterly Schedule NJ 703?

Using airSlate SignNow for the 4 Part Quarterly Schedule NJ 703 offers numerous benefits, including time savings and improved accuracy. The platform minimizes the risk of errors commonly associated with manual paperwork, ensuring compliance with state tax requirements. Additionally, eSigning helps to expedite approvals, enabling vendors to focus on their core business operations.

-

Is it possible to track the status of my 4 Part Quarterly Schedule NJ 703 submissions with airSlate SignNow?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your 4 Part Quarterly Schedule NJ 703 submissions in real-time. You can receive notifications when documents are viewed and signed, providing transparency throughout the process. This feature enhances accountability and helps avoid delays in submission.

Get more for 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu

Find out other 4 Part Quarterly Schedule NJ 703 For Use By Vendors Located In New York State 07 Sales Tax Vendor Identification Number NJ Bu

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors