it Aff2 2023-2026

What is the It Aff2

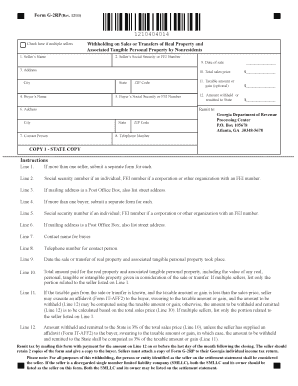

The It Aff2 is a specific form used in various tax and legal contexts. It serves to provide essential information required by the IRS or other regulatory bodies. This form is crucial for individuals and businesses to ensure compliance with federal and state regulations. Understanding its purpose and the information it collects is vital for accurate submissions and avoiding potential penalties.

How to use the It Aff2

Using the It Aff2 involves several straightforward steps. First, gather all necessary information, including personal details and any relevant financial data. Next, fill out the form accurately, ensuring all sections are completed as required. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, which may include online submission, mailing it to the designated office, or delivering it in person.

Steps to complete the It Aff2

Completing the It Aff2 requires careful attention to detail. Follow these steps for successful completion:

- Collect necessary documentation, such as identification and financial records.

- Fill in personal information, including name, address, and Social Security number.

- Provide any additional information as required by the form.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

Legal use of the It Aff2

The It Aff2 must be used in accordance with applicable laws and regulations. It is essential to understand the legal implications of the information provided on the form. Misrepresentation or failure to submit the form can lead to legal consequences, including fines or penalties. Therefore, using the It Aff2 correctly is crucial for maintaining compliance with tax and legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the It Aff2 can vary depending on the specific context in which it is used. It is important to be aware of these deadlines to avoid late fees or penalties. Generally, forms related to tax filings have specific due dates that coincide with the tax year. Keeping a calendar of important dates can help ensure timely submissions.

Required Documents

When preparing to complete the It Aff2, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or passport.

- Financial records, including income statements or tax returns.

- Any previous correspondence with tax authorities related to the form.

Having these documents ready can streamline the process of filling out the form and ensure all necessary information is included.

Quick guide on how to complete it aff2 5403684

Complete It Aff2 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage It Aff2 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign It Aff2 effortlessly

- Locate It Aff2 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you'd like to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign It Aff2 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it aff2 5403684

Create this form in 5 minutes!

How to create an eSignature for the it aff2 5403684

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it aff2?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents electronically. It aff2 is a key aspect of our service, ensuring that users can easily manage their document workflows while maintaining compliance and security.

-

How much does airSlate SignNow cost for users interested in it aff2?

The pricing for airSlate SignNow varies based on the plan you choose, with options suitable for individuals and businesses. For those interested in it aff2, we offer competitive pricing that provides excellent value for the features and benefits included.

-

What features does airSlate SignNow offer that support it aff2?

airSlate SignNow includes a variety of features that enhance document management, such as customizable templates, real-time tracking, and secure storage. These features are designed to support it aff2, making it easier for users to streamline their signing processes.

-

How can airSlate SignNow benefit my business in relation to it aff2?

By using airSlate SignNow, businesses can improve efficiency and reduce turnaround times for document signing. The benefits of it aff2 include enhanced collaboration, reduced paper usage, and increased security, all of which contribute to a more productive workflow.

-

Can airSlate SignNow integrate with other tools I use for it aff2?

Yes, airSlate SignNow offers integrations with various applications and platforms, making it easy to incorporate into your existing workflow. This flexibility is particularly beneficial for users focused on it aff2, as it allows for seamless document management across different systems.

-

Is airSlate SignNow secure for handling documents related to it aff2?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. For those dealing with it aff2, you can trust that your documents are protected and that your data privacy is maintained throughout the signing process.

-

What types of documents can I send using airSlate SignNow for it aff2?

airSlate SignNow supports a wide range of document types, including contracts, agreements, and forms. This versatility is essential for users interested in it aff2, as it allows for the efficient handling of various document needs within a single platform.

Get more for It Aff2

Find out other It Aff2

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy