TRAVEL EXPENSE Claiming Footnote This Form is to 2019-2026

Understanding the Canada Travel Expense Claim

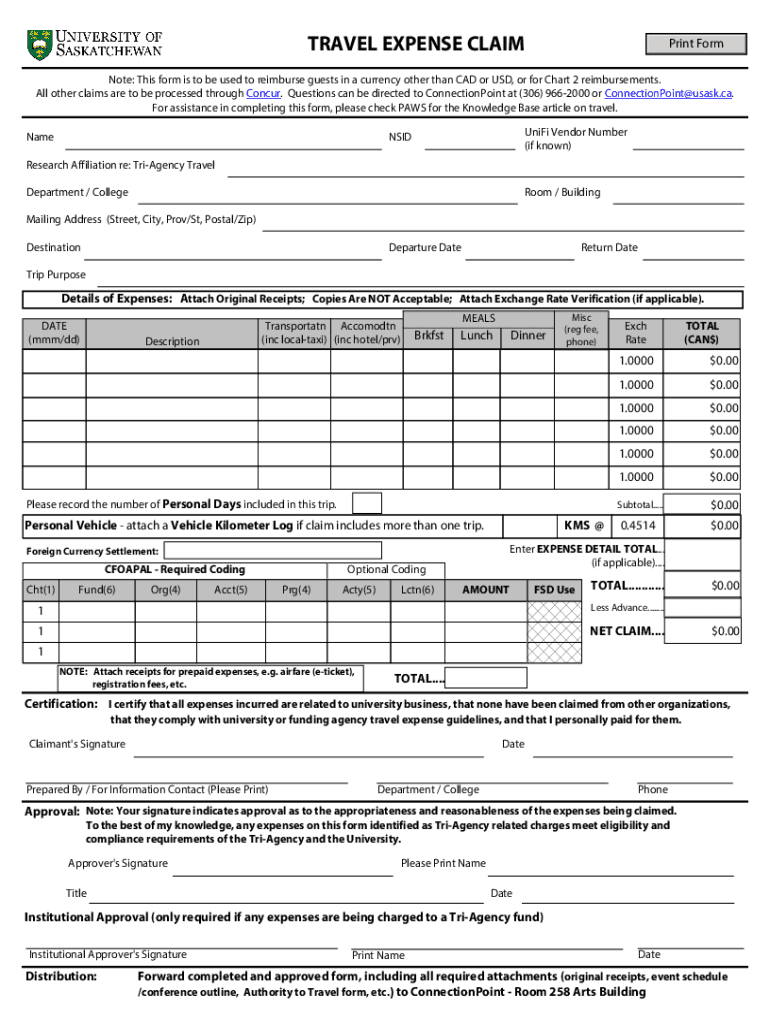

The Canada travel expense claim is a formal document used by employees or individuals to request reimbursement for travel-related expenses incurred while conducting business activities. This form is essential for ensuring that all eligible expenses are accounted for and reimbursed accurately. It typically includes costs such as transportation, lodging, meals, and other incidentals directly related to business travel.

Steps to Complete the Canada Travel Expense Claim Form

Filling out the Canada travel expense claim form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant receipts and documentation that support your expenses. Next, fill in your personal and business information, including your name, position, and the purpose of your travel. Then, itemize each expense, providing details such as the date, amount, and nature of the expense. Finally, review the form for completeness and accuracy before submitting it for approval.

Required Documents for Submission

To successfully submit a Canada travel expense claim, certain documents are typically required. These may include:

- Original receipts for all expenses claimed.

- A copy of your travel itinerary or agenda.

- Any pre-approval documentation, if applicable.

- Proof of payment, such as credit card statements or bank statements.

Ensuring that all required documents are included can expedite the reimbursement process.

Form Submission Methods

The Canada travel expense claim can be submitted through various methods, depending on your organization's policies. Common submission methods include:

- Online submission through a designated expense management system.

- Mailing a physical copy of the completed form to the finance department.

- In-person submission to your supervisor or finance team.

Choosing the appropriate method can help streamline the approval process.

Eligibility Criteria for Claiming Expenses

To be eligible for reimbursement through the Canada travel expense claim, certain criteria must be met. Generally, expenses must be:

- Directly related to business activities.

- Reasonable and necessary for the travel undertaken.

- Supported by valid receipts and documentation.

Understanding these criteria ensures that claims are valid and increases the likelihood of approval.

IRS Guidelines for Travel Expenses

While the Canada travel expense claim is specific to Canadian regulations, it is important for U.S. travelers to be aware of IRS guidelines regarding travel expenses. The IRS allows deductions for business travel expenses that are ordinary and necessary. This includes transportation, lodging, and meals, provided they are substantiated with adequate records. Familiarizing yourself with these guidelines can help ensure compliance and maximize potential deductions.

Quick guide on how to complete travel expense claiming footnote this form is to

Effortlessly Prepare TRAVEL EXPENSE Claiming Footnote This Form Is To on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without unnecessary delays. Handle TRAVEL EXPENSE Claiming Footnote This Form Is To on any platform using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign TRAVEL EXPENSE Claiming Footnote This Form Is To

- Find TRAVEL EXPENSE Claiming Footnote This Form Is To and click on Get Form to commence.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form – via email, SMS, invite link, or download it to your computer.

No more worries about lost or misplaced files, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign TRAVEL EXPENSE Claiming Footnote This Form Is To to ensure outstanding communication throughout any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct travel expense claiming footnote this form is to

Create this form in 5 minutes!

How to create an eSignature for the travel expense claiming footnote this form is to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Canada travel expense claim?

A Canada travel expense claim is a formal request for reimbursement of travel-related expenses incurred while conducting business in Canada. This can include costs for transportation, lodging, meals, and other travel-related expenses. Understanding how to properly file a Canada travel expense claim is essential for ensuring you receive the funds you are entitled to.

-

How can airSlate SignNow help with Canada travel expense claims?

airSlate SignNow streamlines the process of submitting Canada travel expense claims by allowing users to easily create, send, and eSign expense reports. With its user-friendly interface, you can quickly compile all necessary documentation and submit your claims efficiently. This not only saves time but also reduces the likelihood of errors in your claims.

-

What features does airSlate SignNow offer for managing Canada travel expense claims?

airSlate SignNow offers features such as customizable templates for expense reports, electronic signatures, and secure document storage. These features make it easier to manage your Canada travel expense claims from start to finish. Additionally, the platform allows for real-time tracking of your claims, ensuring you stay informed throughout the process.

-

Is airSlate SignNow cost-effective for small businesses handling Canada travel expense claims?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing Canada travel expense claims. With flexible pricing plans, you can choose the option that best fits your budget while still accessing powerful tools to streamline your expense management. This helps small businesses save money and time.

-

Can I integrate airSlate SignNow with other software for Canada travel expense claims?

Absolutely! airSlate SignNow offers integrations with various accounting and expense management software, making it easier to manage your Canada travel expense claims. This seamless integration allows you to sync data across platforms, ensuring that all your financial records are up-to-date and accurate.

-

What are the benefits of using airSlate SignNow for Canada travel expense claims?

Using airSlate SignNow for Canada travel expense claims provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced accuracy. The platform's electronic signature feature speeds up the approval process, while its document management capabilities help keep everything organized. This ultimately leads to faster reimbursements and improved cash flow.

-

How secure is airSlate SignNow for handling Canada travel expense claims?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling Canada travel expense claims. You can trust that your sensitive information is safe and secure throughout the entire process. This commitment to security ensures peace of mind for businesses and their employees.

Get more for TRAVEL EXPENSE Claiming Footnote This Form Is To

Find out other TRAVEL EXPENSE Claiming Footnote This Form Is To

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer