Business Tax Organizer the Goldwyn Group LLC Form

What is the Business Tax Organizer The Goldwyn Group LLC

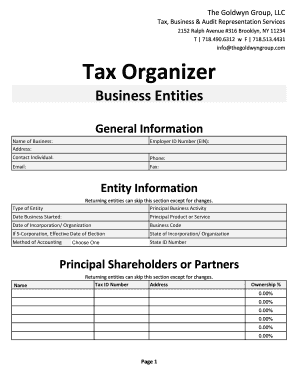

The Business Tax Organizer from The Goldwyn Group LLC is a comprehensive tool designed to assist businesses in gathering and organizing essential financial information for tax preparation. This organizer provides a structured format for documenting income, expenses, and deductions, ensuring that all necessary data is readily available for tax filing. By using this organizer, business owners can streamline their tax processes, minimize errors, and enhance compliance with IRS regulations.

How to use the Business Tax Organizer The Goldwyn Group LLC

Using the Business Tax Organizer is straightforward. Begin by downloading the form from The Goldwyn Group LLC's official website. Once you have the organizer, follow these steps:

- Gather your financial documents, including income statements, receipts, and previous tax returns.

- Fill in the sections of the organizer according to the categories provided, such as revenue, expenses, and deductions.

- Review the completed organizer to ensure all information is accurate and complete.

- Keep the organizer handy for reference when preparing your tax return or meeting with your tax advisor.

Key elements of the Business Tax Organizer The Goldwyn Group LLC

The Business Tax Organizer includes several key elements that are crucial for effective tax preparation:

- Income Reporting: Sections dedicated to documenting all sources of business income.

- Expense Tracking: Detailed categories for various business expenses, helping to maximize deductions.

- Asset Information: A section for listing business assets and their depreciation.

- Tax Credits: Information on potential tax credits applicable to your business.

Steps to complete the Business Tax Organizer The Goldwyn Group LLC

Completing the Business Tax Organizer involves several clear steps:

- Start with personal and business identification information at the top of the form.

- Document all income sources in the designated sections, ensuring accuracy.

- List all business expenses, categorizing them appropriately to facilitate deductions.

- Provide details about any assets owned by the business, including purchase dates and costs.

- Review and finalize the organizer before submission to ensure completeness.

Required Documents

To effectively complete the Business Tax Organizer, you will need several key documents:

- Profit and loss statements for the fiscal year.

- Receipts for all business-related expenses.

- Bank statements and financial records.

- Previous tax returns for reference.

IRS Guidelines

It is essential to follow IRS guidelines when using the Business Tax Organizer. Ensure that all reported income is accurately documented and that expenses are legitimate and properly categorized. Familiarize yourself with IRS regulations regarding deductions and credits to optimize your tax return and avoid potential penalties.

Quick guide on how to complete business tax organizer the goldwyn group llc

Effortlessly Prepare Business Tax Organizer The Goldwyn Group LLC on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Business Tax Organizer The Goldwyn Group LLC on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Business Tax Organizer The Goldwyn Group LLC with ease

- Find Business Tax Organizer The Goldwyn Group LLC and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form—through email, text message (SMS), or an invitation link—or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Business Tax Organizer The Goldwyn Group LLC to ensure excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business tax organizer the goldwyn group llc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Business Tax Organizer The Goldwyn Group LLC?

The Business Tax Organizer The Goldwyn Group LLC is a comprehensive tool designed to streamline the tax preparation process for businesses. It helps organize financial documents and essential information, making it easier for accountants to prepare accurate tax returns. This organizer is tailored to meet the specific needs of businesses, ensuring compliance and efficiency.

-

How does the Business Tax Organizer The Goldwyn Group LLC benefit my business?

Using the Business Tax Organizer The Goldwyn Group LLC can signNowly reduce the time and effort spent on tax preparation. It provides a structured format for gathering necessary documents, which minimizes errors and ensures that all relevant information is included. This ultimately leads to a smoother tax filing experience and potential savings on tax liabilities.

-

What features are included in the Business Tax Organizer The Goldwyn Group LLC?

The Business Tax Organizer The Goldwyn Group LLC includes features such as customizable templates, checklists for required documents, and easy-to-follow instructions. Additionally, it offers integration with popular accounting software, making it easier to import financial data. These features are designed to enhance the user experience and improve tax preparation efficiency.

-

Is the Business Tax Organizer The Goldwyn Group LLC suitable for all business sizes?

Yes, the Business Tax Organizer The Goldwyn Group LLC is designed to cater to businesses of all sizes, from sole proprietorships to larger corporations. Its flexible structure allows users to adapt the organizer to their specific needs, ensuring that every business can benefit from its features. This versatility makes it an ideal choice for any business looking to streamline their tax processes.

-

How much does the Business Tax Organizer The Goldwyn Group LLC cost?

The pricing for the Business Tax Organizer The Goldwyn Group LLC is competitive and designed to provide value for businesses. Various pricing tiers may be available depending on the features and level of support required. For specific pricing details, it is best to visit the official website or contact customer support for a personalized quote.

-

Can I integrate the Business Tax Organizer The Goldwyn Group LLC with my existing accounting software?

Absolutely! The Business Tax Organizer The Goldwyn Group LLC is designed to integrate seamlessly with popular accounting software. This integration allows for easy data transfer, reducing the need for manual entry and minimizing errors. It enhances the overall efficiency of your tax preparation process.

-

What support options are available for the Business Tax Organizer The Goldwyn Group LLC?

The Business Tax Organizer The Goldwyn Group LLC offers various support options, including online resources, FAQs, and customer service assistance. Users can access tutorials and guides to help them navigate the organizer effectively. Additionally, dedicated support teams are available to address any specific questions or concerns.

Get more for Business Tax Organizer The Goldwyn Group LLC

Find out other Business Tax Organizer The Goldwyn Group LLC

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast