Pa 40 2008-2026

What is the PA 40?

The PA 40 is the Pennsylvania Personal Income Tax Return form. It is used by individuals to report their income, calculate their Pennsylvania state tax liability, and claim any applicable credits. This form is essential for residents and non-residents who earn income in Pennsylvania, including wages, business income, and investment earnings. Understanding the PA 40 is crucial for accurate tax reporting and compliance with state tax laws.

Steps to Complete the PA 40

Completing the PA 40 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of any other income sources.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: Detail all sources of income, including wages, self-employment income, and any other earnings.

- Calculate deductions: Identify and apply any eligible deductions to reduce your taxable income.

- Determine tax liability: Use the provided tax tables to calculate your total tax owed based on your taxable income.

- Claim credits: If applicable, claim any tax credits that can further reduce your tax liability.

- Sign and date the form: Ensure that you sign and date the PA 40 before submission.

Required Documents

When preparing to file the PA 40, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms: For reporting wages and salaries from employers.

- 1099 forms: For reporting income from freelance work, interest, dividends, and other sources.

- Business income records: If self-employed, maintain detailed records of income and expenses.

- Proof of deductions: Gather receipts or documentation for any deductions you plan to claim.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the PA 40 to avoid penalties. The standard deadline for filing the PA 40 is April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

IRS Guidelines

While the PA 40 is specific to Pennsylvania, it is important to also consider IRS guidelines when filing. The IRS provides regulations on income reporting, deductions, and credits that may affect your Pennsylvania tax return. Ensure that your income reported on the PA 40 aligns with your federal tax filings to maintain compliance with both state and federal tax laws.

Digital vs. Paper Version

Taxpayers have the option to file the PA 40 either digitally or using a paper form. Filing electronically can streamline the process, reduce errors, and provide immediate confirmation of receipt. Conversely, some individuals may prefer to complete a paper version for various reasons, including familiarity or lack of access to digital tools. Regardless of the method chosen, it is essential to ensure that all information is accurate and submitted on time.

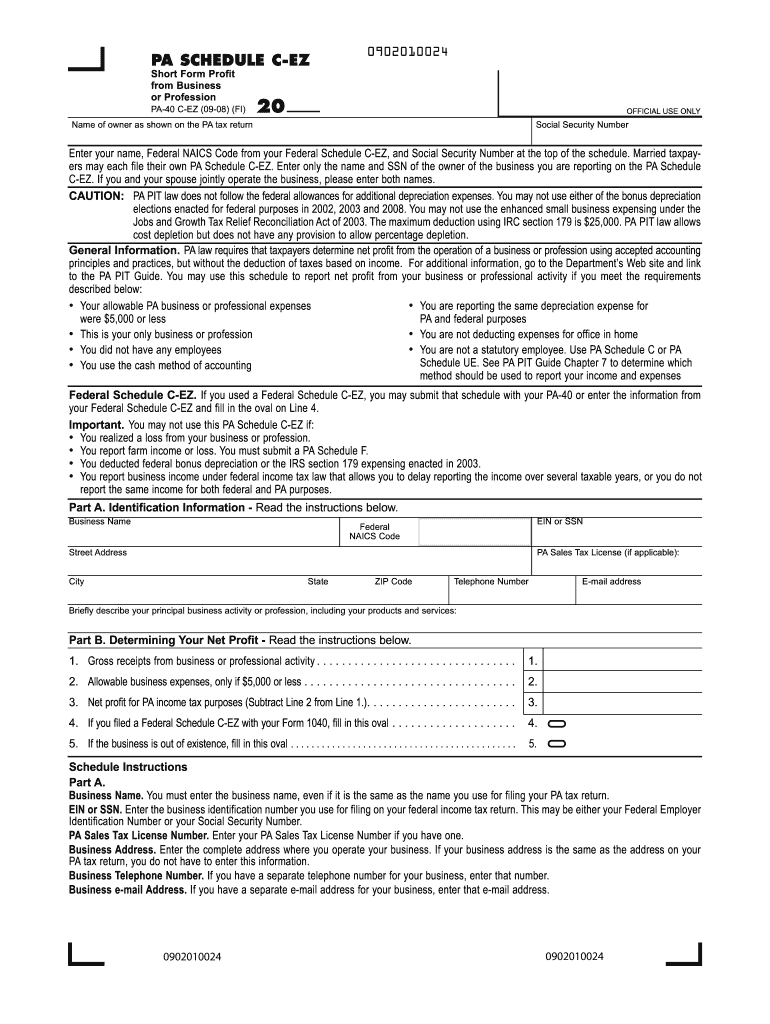

Quick guide on how to complete pa schedule c ez 2008 2019 form

Your assistance manual on how to prepare your Pa 40

If you’re interested in learning how to create and submit your Pa 40, here are some straightforward instructions on how to simplify the tax declaration process.

To begin, all you need to do is register your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax documents effortlessly. With its editing features, you can alternate between text, check boxes, and eSignatures, and revisit to amend information as required. Enhance your tax administration with sophisticated PDF editing, electronic signing, and easy sharing.

Follow the steps below to complete your Pa 40 in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Pa 40 in our editor.

- Populate the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and correct any discrepancies.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that filing on paper may increase errors and postpone refunds. Make sure to review the IRS website for filing regulations applicable in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct pa schedule c ez 2008 2019 form

FAQs

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

Create this form in 5 minutes!

How to create an eSignature for the pa schedule c ez 2008 2019 form

How to generate an eSignature for the Pa Schedule C Ez 2008 2019 Form in the online mode

How to make an eSignature for the Pa Schedule C Ez 2008 2019 Form in Google Chrome

How to make an electronic signature for signing the Pa Schedule C Ez 2008 2019 Form in Gmail

How to make an electronic signature for the Pa Schedule C Ez 2008 2019 Form straight from your smartphone

How to make an electronic signature for the Pa Schedule C Ez 2008 2019 Form on iOS devices

How to generate an eSignature for the Pa Schedule C Ez 2008 2019 Form on Android OS

People also ask

-

What is PA Schedule C?

PA Schedule C is a tax form used by sole proprietors in Pennsylvania to report income and expenses from their business activities. Understanding what is PA Schedule C is essential for accurate tax filing and compliance, ensuring that all deductions are properly accounted for.

-

How can airSlate SignNow help with completing PA Schedule C?

airSlate SignNow allows users to easily create, sign, and share documents online, which can include forms like PA Schedule C. By streamlining the document signing process, it helps ensure that your financial documentation is organized and accessible, aiding in your tax reporting.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing documents, including PA Schedule C filings. Pricing varies depending on features and the number of users, ensuring accessibility for everyone looking to simplify their workflows.

-

Are there any features specifically for tax forms like PA Schedule C in airSlate SignNow?

Yes, airSlate SignNow provides features that facilitate the management of tax forms such as PA Schedule C. With electronic signatures, customizable templates, and document tracking, users can efficiently handle their tax filings and ensure compliance with ease.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including PA Schedule C, increases efficiency and reduces the risk of errors. The platform provides secure storage, easy access to documents, and seamless eSigning capabilities, making tax preparation smoother and less stressful.

-

Can airSlate SignNow integrate with accounting software for handling PA Schedule C?

Certainly! airSlate SignNow integrates with various accounting and financial software, which is beneficial for managing documents like PA Schedule C. These integrations enhance your workflow by allowing direct import/export options, keeping your tax documentation organized.

-

Is it easy to use airSlate SignNow for first-time users handling PA Schedule C?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for first-time users to navigate. Whether you need to fill out PA Schedule C or manage other documents, the intuitive interface ensures a smooth experience for everyone.

Get more for Pa 40

- Gte form university of canberra uoc web01 squiz

- Wrha education fund form

- Medi cal rendering provider applicationdisclosure denti form

- Nebraska dr form 40 revised 01 traffic records nhtsa tsis

- Philequity redemption form 75274031

- Ocrp 102 fillable form

- 72lancaster3ohdvhwshrusulqwlq2 3777 form

- Search building department records form

Find out other Pa 40

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy