IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return 2023

What is the IL 1065 X Amended Partnership Replacement Tax Return?

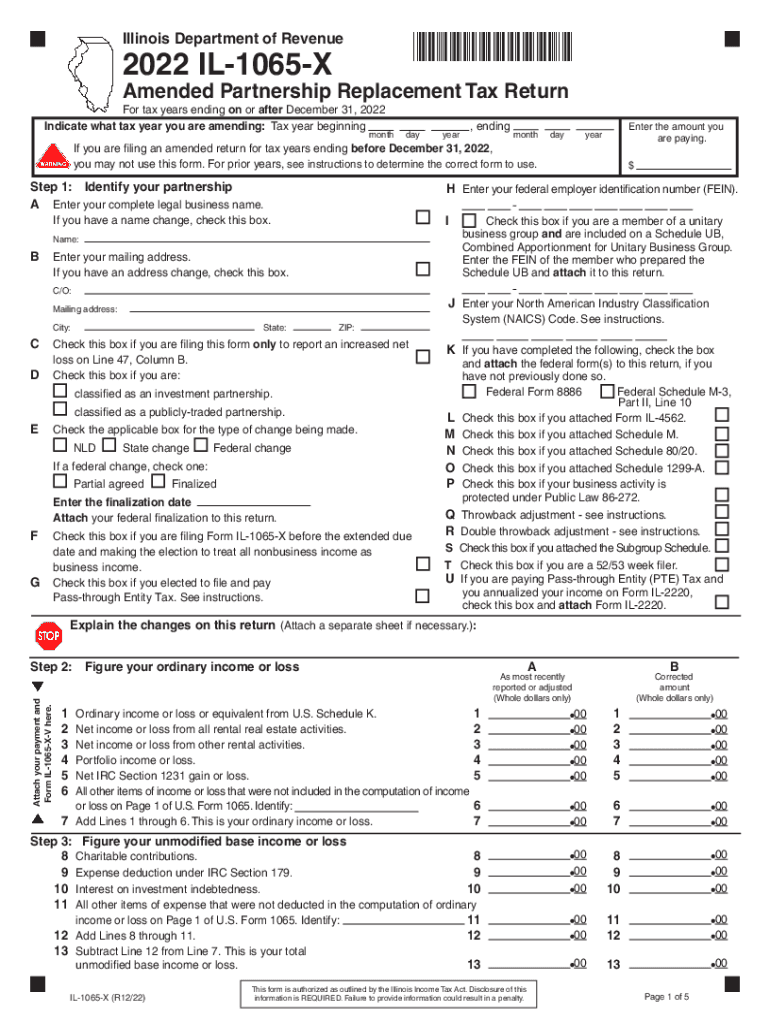

The IL 1065 X Amended Partnership Replacement Tax Return is a specific form used by partnerships in Illinois to amend previously filed partnership tax returns. This form allows partnerships to correct errors or omissions in their original submissions, ensuring compliance with state tax regulations. It is essential for partnerships that need to adjust their reported income, deductions, or credits to accurately reflect their financial situation.

Steps to Complete the IL 1065 X Amended Partnership Replacement Tax Return

Completing the IL 1065 X involves several key steps:

- Gather all relevant financial documents, including the original IL 1065 and any supporting schedules.

- Identify the specific errors or changes that necessitate the amendment.

- Fill out the IL 1065 X form, ensuring that all corrections are clearly indicated.

- Review the completed form for accuracy and completeness.

- Submit the form to the Illinois Department of Revenue, either electronically or by mail.

Required Documents for the IL 1065 X Amended Partnership Replacement Tax Return

When filing the IL 1065 X, partnerships must provide several documents to support their amendment:

- The original IL 1065 tax return.

- Any schedules or attachments that were included with the original submission.

- Documentation that substantiates the changes being made, such as corrected financial statements.

Filing Deadlines for the IL 1065 X Amended Partnership Replacement Tax Return

The deadline for submitting the IL 1065 X is typically within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later. It is important for partnerships to adhere to these deadlines to avoid penalties and ensure compliance with state tax laws.

Legal Use of the IL 1065 X Amended Partnership Replacement Tax Return

The IL 1065 X serves a legal purpose by allowing partnerships to amend their tax filings, which is crucial for maintaining accurate tax records. Filing this form correctly helps partnerships avoid potential legal issues related to misreporting or underreporting income. It also ensures that partnerships fulfill their tax obligations in accordance with Illinois law.

Examples of Using the IL 1065 X Amended Partnership Replacement Tax Return

Partnerships may need to file the IL 1065 X in various situations, such as:

- Correcting a miscalculation of income or expenses reported in the original return.

- Updating information regarding partners or ownership percentages.

- Adjusting for changes in tax credits or deductions that were overlooked initially.

Quick guide on how to complete il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return 636274152

Prepare IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return on any device using the airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The simplest way to modify and eSign IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return with ease

- Locate IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specially provided by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Revise and eSign IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return 636274152

Create this form in 5 minutes!

How to create an eSignature for the il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return 636274152

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 1065 X Amended Partnership Replacement Tax Return?

The IL 1065 X Amended Partnership Replacement Tax Return is a form used by partnerships in Illinois to amend their previously filed tax returns. This form allows businesses to correct errors or make changes to their tax information, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the IL 1065 X Amended Partnership Replacement Tax Return?

airSlate SignNow provides an easy-to-use platform for businesses to prepare, send, and eSign the IL 1065 X Amended Partnership Replacement Tax Return. Our solution streamlines the process, making it more efficient and reducing the risk of errors during submission.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can manage your IL 1065 X Amended Partnership Replacement Tax Return without breaking the bank, with various subscription options available.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the IL 1065 X Amended Partnership Replacement Tax Return. These features help users quickly fill out forms, track changes, and ensure all necessary signatures are obtained.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage your IL 1065 X Amended Partnership Replacement Tax Return alongside your other financial documents. This integration enhances workflow efficiency and ensures all your data is synchronized.

-

What are the benefits of using airSlate SignNow for my partnership tax returns?

Using airSlate SignNow for your partnership tax returns, including the IL 1065 X Amended Partnership Replacement Tax Return, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for your sensitive tax information.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IL 1065 X Amended Partnership Replacement Tax Return and other sensitive documents are protected. Our platform uses advanced encryption and security protocols to safeguard your data.

Get more for IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return

Find out other IL 1065 X Amended Partnership Replacement Tax Return IL 1065 X, Amended Partnership Replacement Tax Return

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online