Planilla De Contribucuion Sobre Donaciones 2015-2026

What is the Planilla De Contribucuion Sobre Donaciones

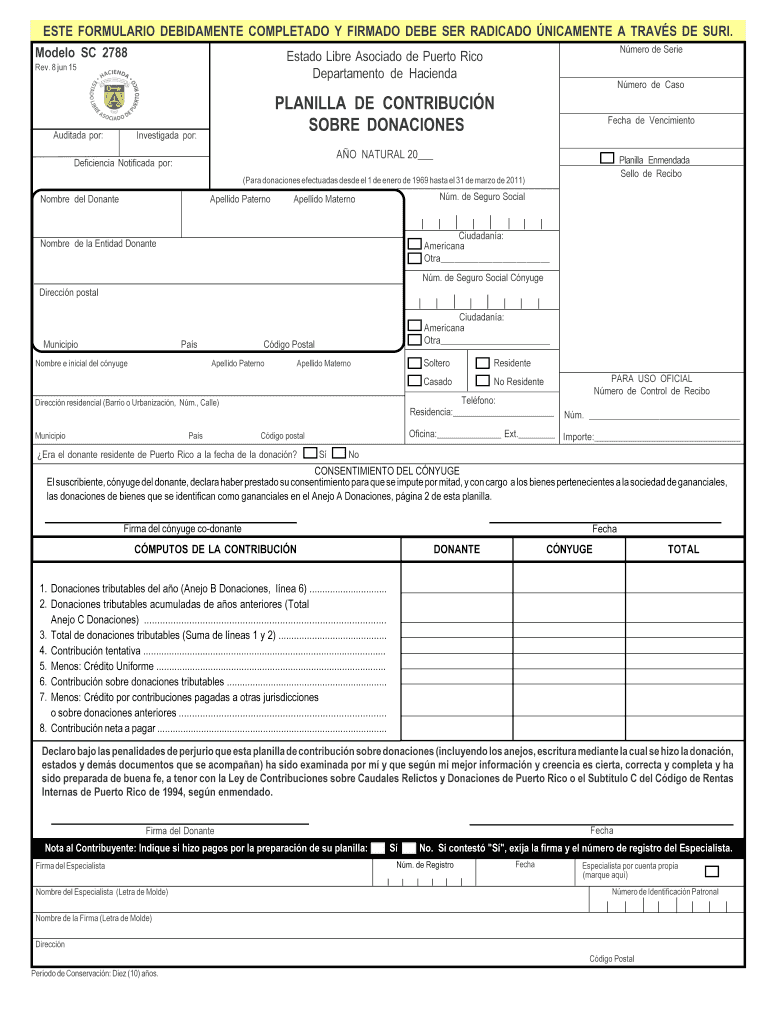

The Planilla De Contribucuion Sobre Donaciones, commonly referred to as the planilla donaciones, is a tax form used primarily in Puerto Rico for reporting donations made by individuals and entities. This form is essential for ensuring compliance with local tax regulations and allows taxpayers to claim deductions for charitable contributions. Understanding the specifics of this form is crucial for accurate tax reporting and maximizing potential tax benefits.

How to use the Planilla De Contribucuion Sobre Donaciones

Using the planilla donaciones involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant documentation related to the donations made during the tax year. This includes receipts, acknowledgment letters from charitable organizations, and any other supporting materials. Next, fill out the form with detailed information about each donation, including the recipient's name, the amount donated, and the date of the contribution. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Planilla De Contribucuion Sobre Donaciones

Completing the planilla donaciones requires careful attention to detail. Follow these steps:

- Collect all necessary documents, including donation receipts and letters.

- Access the planilla donaciones form, which can be found online or obtained from tax offices.

- Fill in personal information, such as your name, address, and taxpayer identification number.

- List each donation, including the name of the charity, the amount, and the date.

- Calculate the total amount of donations to report.

- Sign and date the form to validate it.

- Submit the completed form either electronically or by mail, following the instructions provided.

Legal use of the Planilla De Contribucuion Sobre Donaciones

The legal use of the planilla donaciones is governed by tax laws in Puerto Rico. Taxpayers must ensure that the donations reported are made to qualified organizations to be eligible for deductions. It is important to maintain proper documentation as proof of the donations, as the tax authorities may request this information during audits. Failure to adhere to these regulations can result in penalties or disallowed deductions.

Filing Deadlines / Important Dates

Filing deadlines for the planilla donaciones are typically aligned with the overall tax filing deadlines in Puerto Rico. Taxpayers should be aware of these dates to ensure timely submission. Generally, the deadline for filing personal income tax returns, including the planilla donaciones, falls on April fifteenth. However, it is advisable to check for any updates or changes to the schedule each tax year.

Form Submission Methods (Online / Mail / In-Person)

The planilla donaciones can be submitted through various methods to accommodate taxpayer preferences. Options typically include:

- Online Submission: Many taxpayers choose to file electronically through approved platforms, which can expedite processing times.

- Mail: The completed form can be mailed to the designated tax authority, ensuring that it is postmarked by the filing deadline.

- In-Person: Taxpayers may also submit the form in person at local tax offices, where assistance may be available if needed.

Quick guide on how to complete sc 2788 rev 25 ene 11 sc 2788 rev 25 ene 11

Your assistance manual on how to prepare your Planilla De Contribucuion Sobre Donaciones

If you wish to learn how to finalize and submit your Planilla De Contribucuion Sobre Donaciones, here are a few concise recommendations to make tax filing more manageable.

To begin, all you need to do is set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an incredibly intuitive and effective document solution that enables you to modify, draft, and finalize your tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures, and revisit to amend information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to finalize your Planilla De Contribucuion Sobre Donaciones in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; navigate through versions and schedules.

- Click Obtain form to access your Planilla De Contribucuion Sobre Donaciones in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to attach your legally-binding eSignature (if needed).

- Examine your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting on paper can increase return errors and delay refunds. Additionally, prior to e-filing your taxes, review the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct sc 2788 rev 25 ene 11 sc 2788 rev 25 ene 11

Create this form in 5 minutes!

How to create an eSignature for the sc 2788 rev 25 ene 11 sc 2788 rev 25 ene 11

How to create an eSignature for your Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 online

How to generate an eSignature for your Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 in Google Chrome

How to create an electronic signature for putting it on the Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 in Gmail

How to create an eSignature for the Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 right from your smartphone

How to generate an eSignature for the Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 on iOS devices

How to create an electronic signature for the Sc 2788 Rev 25 Ene 11 Sc 2788 Rev 25 Ene 11 on Android OS

People also ask

-

¿Qué es una planilla donaciones y cómo se utiliza en airSlate SignNow?

Una planilla donaciones es un documento que permite a las organizaciones recopilar y gestionar contribuciones de manera eficiente. Con airSlate SignNow, puedes crear y enviar tu planilla donaciones de forma sencilla, permitiendo que los donantes firmen electrónicamente y envíen sus contribuciones al instante.

-

¿Cuáles son las características clave de la planilla donaciones en airSlate SignNow?

La planilla donaciones en airSlate SignNow incluye características como la firma electrónica, plantillas personalizables y seguimiento en tiempo real. Estas herramientas facilitan la gestión de donaciones, asegurando que el proceso sea rápido y seguro para ambas partes.

-

¿Cuánto cuesta utilizar la planilla donaciones con airSlate SignNow?

Los precios para utilizar la planilla donaciones con airSlate SignNow son competitivos y varían según el plan seleccionado. Ofrecemos opciones flexibles que se adaptan al tamaño de tu organización y a tus necesidades específicas de gestión de donaciones.

-

¿Pueden integrarse otras herramientas con la planilla donaciones de airSlate SignNow?

Sí, airSlate SignNow permite integraciones con diversas plataformas y aplicaciones que pueden facilitar el uso de tu planilla donaciones. Esto incluye CRM, herramientas de gestión de proyectos y software de contabilidad, optimizando así tu proceso de gestión de donaciones.

-

¿Cómo puedo personalizar mi planilla donaciones en airSlate SignNow?

Puedes personalizar tu planilla donaciones en airSlate SignNow utilizando nuestra interfaz intuitiva. Modifica campos, agrega tu branding y ajusta el diseño para que se alinee con la identidad de tu organización y las necesidades específicas de tus donantes.

-

¿Aumenta la eficiencia de las donaciones el uso de una planilla donaciones en airSlate SignNow?

Sí, el uso de una planilla donaciones en airSlate SignNow incrementa la eficiencia al reducir el tiempo de procesamiento de documentos, eliminando las tareas manuales. Además, permite a tus donantes completar el proceso en minutos, facilitando así un mayor número de contribuciones.

-

¿La planilla donaciones es segura y cumple con las normativas?

Absolutamente, la planilla donaciones en airSlate SignNow se adhiere a los más altos estándares de seguridad y cumplimiento. Utilizamos encriptación de datos y métodos de autenticación para proteger la información sensible de tus donantes y asegurarnos de que todos los procesos sean legales.

Get more for Planilla De Contribucuion Sobre Donaciones

- Backflow prevention device test report gloucester county virginia gloucesterva form

- Address confirmation affidavit bitx bitx form

- Bookmark contest entry form dpisd org

- Interglobal claim form 27686073

- 254247 education code form

- Lampt workman ompensation policy form

- San francisco flower mart badge renewal form

- Tsp loan application 958089 form

Find out other Planilla De Contribucuion Sobre Donaciones

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online