Tax Table Form

What is the Tax Table

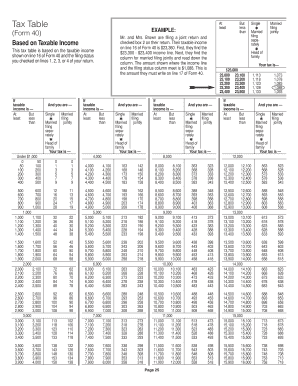

The tax table is a crucial resource used by individuals and businesses in the United States to determine the amount of income tax owed based on their taxable income. It provides a structured format that outlines different income brackets and the corresponding tax rates. The tax table is typically updated annually by the IRS to reflect changes in tax laws and inflation adjustments. Understanding how to read and use the tax table is essential for accurate tax reporting and compliance.

How to Use the Tax Table

To effectively use the tax table, taxpayers should follow these steps:

- Identify your filing status, such as single, married filing jointly, or head of household.

- Determine your taxable income for the year. This is your gross income minus any deductions or exemptions.

- Locate the appropriate section of the tax table that corresponds to your filing status.

- Find your taxable income within the table to see the corresponding tax amount owed.

Using the tax table helps ensure that taxpayers accurately calculate their tax liabilities, which is essential for avoiding penalties and ensuring compliance with IRS regulations.

Steps to Complete the Tax Table

Completing the tax table involves several important steps:

- Gather all necessary financial documents, including W-2s, 1099s, and other income statements.

- Calculate your total income and any applicable deductions.

- Fill out the appropriate tax form, such as Form 1040, where you will reference the tax table.

- Use the tax table to determine your tax liability based on your taxable income.

- Double-check your calculations to ensure accuracy before submission.

Legal Use of the Tax Table

The tax table is legally binding when used correctly in accordance with IRS guidelines. It is essential for taxpayers to ensure they are using the most current version of the tax table, as outdated information can lead to incorrect tax filings. Compliance with tax laws is critical, and using the tax table correctly helps in fulfilling legal obligations.

IRS Guidelines

The IRS provides specific guidelines on how to use the tax table effectively. These guidelines include:

- Using the correct filing status to ensure accurate tax calculations.

- Understanding the implications of tax credits and deductions on taxable income.

- Staying informed about annual updates to the tax table and tax laws.

Following IRS guidelines not only aids in accurate tax filing but also helps in avoiding potential audits or penalties.

Filing Deadlines / Important Dates

Taxpayers should be aware of key filing deadlines to avoid penalties. The typical deadline for filing individual income tax returns is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should consider deadlines for estimated tax payments, which are typically due quarterly. Staying informed about these dates is crucial for timely and compliant tax filing.

Quick guide on how to complete tax table

Complete Tax Table effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents quickly without interruptions. Manage Tax Table on any platform with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign Tax Table with ease

- Obtain Tax Table and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tax Table and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it legal to have an unregistered off-the-grid (no birth certificate) baby in the USA?

I was actually roommates with someone in College whose parents decided to have him “off-grid”. Let me just say this: Stop even entertaining the idea of having a baby off-grid. It really makes your child’s life unnecessarily hard and your kid will forever resent you for putting that pain on them.I’ll get into the details in a moment, but first let me address the question proposed above. Yes, technically speaking it is not a crime to have your baby off-the-grid in the U.S.A. However, a lot of details surrounding the event would be illegal. First of all, any licensed midwife or doctor is required by law to file a birth certificate or they actually risk losing their license and getting a misdemeanor. If you forced them or threatened them to not file the birth certificate that would make you a likely accomplice and would not go over well with the authorities.But let’s ignore that for a moment and just assume you know how to birth a child on your own and can do it in your basement without any professional medical physician there to oversee you (which would be the only way you could pull this off). In this case you wouldn’t get thrown in jail for failing to get a birth certificate and no crime would have been committed. However you just set up a very difficult life for your child.These are some of the things I was told from by my roommate who didn’t have a social security number until he was 20 years old.No, he could not get a (legal) jobQuite literally he didn’t qualify to get even a job at McDonalds. If you remember the last job you got no matter how prestigious or demeaning it was, you had to fill out a bunch of paperwork. Most of these forms require you to have a SSN (social security number) to properly fill them out. However the important one is the form labeled I-9. This form is required to be submitted by every employer after hiring a new employee. This form serves only one purpose, to determine that you are eligible to work in the United States. Your child (and my roommate) would not be able to complete this form which every employer must get filled out before starting employment with a new employee. Your child will not be able to get a job because of this.Yes, he can evade paying taxes.Okay, so this sounds like a perk I guess. But my roommate did not have to pay taxes. The government basically didn’t know he existed, so they never knew he was not paying. But then again he didn’t have a job. So would you rather have a job and pay some taxes or not ever be able to work except under the table for below minimum wage? Given that choice, taxes sound pretty awesome! Keep in mind that this also means your child is not eligible for any tax benefits or credits such as those that students get while going to college.No, You as the parent can not claim him as a dependent on your taxesYou’re already dealing with a child, wouldn’t it be great to get that child tax credit? Every year you'll basically be paying out of pocket for deciding not to get them a SSN.Yes, he can attend public school through 12th gradeHe would be able to attend school through high school without a social security number.No, he can not attend collegeWhile high school and lower education is okay, your child will never be able to attend collegeYes, he can go to the doctorThe doctor will still see your child and provide him his shots. However…No, he will not be covered under your family insurance (or qualify for Medicare/Medicaid)So you’ll need to plan on paying for all doctor appointments out of pocket.No, he can not travel abroad (even to Canada)You’d best hope none of your child’s friends decide to go to Cancun for spring break. Your child will not be eligible to leave the country or return to the US if he manages to leave (unless he plans to climb Trump’s wall)No, he will not be able to drive a carOkay, well nothing is stopping him from physically driving a car, but he would not be able to get a driver’s license and thus, can not LEGALLY drive. Hope he doesn’t get pulled over.No, he will not be able to voteOnce old enough he will not be able to register to vote.Yes, he can avoid the draftWell the good news is that like taxes, he can skirt the requirement to join the draft when he turns 18.No, he can’t get a loanThis means no credit cards, no car loan, no home, nothing. I’m sure plenty of people will claim these are all evil anyway, but these have powerful impacts on someone’s life. There might be times he needs it. (and when used properly none of these are bad things).No, he will not have a credit scoreThis goes with the above one, but he will not be able to work on this which affects your entire life/future. This also will disqualify him from renting most homes or apartments he is looking at.Basically your child will be treated as an illegal immigrant. Why put them through this when they are entitled to the benefits that the United States provides its citizens? There are people in other countries dying to get what your child is entitled to and you are (considering) denying your child those abilities? It just doesn’t make sense.Get them a SSN and if your child decides at 20 that he wants to live off-the-grid than he can burn his Social Security Card and go in the woods and hide from the government. But don’t be selfish enough to make that decision for them.My roommate resents his parents for not giving him a SSN. While all his friends in high school were driving, he couldn’t. While his friends go to Cancun for spring break, he had golden handcuffs in the U.S. and can’t leave. And worst of all he said was that while all his friends were earning money from jobs in high school, he couldn’t get a job.The job part was the hardest for him. He couldn’t leave the house or move out when he turned 18. He was stuck at home.Him working on getting a social security number was difficult and took him two years. He started when he turned 18 to get one once he realized he couldn’t go to college, he couldn’t get a job, he couldn’t rent an apartment, and thus will never really be able to be independent from his parents. It took two years and then at 20 he was able to get one and start working and going to school.He forever resented his parents. Don’t be those parents…

-

What would happen if Israeli Arabs did not pay tax to Israel in solidarity with Palestinian prisoners and Palestine independence?

Taxes in Israel (the major ones):Salary tax is deducted automatically from your salary by your employer. If your employer dodges salary taxes, he’d find himself paying exorbitant fines, or losing the business. Not to say that it’s not done, but it can’t be widespread.City tax - most Israeli arabs live in arab centric cities. Not paying city tax would mean not getting services from their own city. It would only harm themselves. It used to be the norm in the past (Arab Israeli cities had an extremely low tax collection level), but got improved quite a lot in the last couple of years.VAT - again, this is payed to the country by the seller or the provider of the goods, and not by the customer. VAT dodging is common for provided services (payment for a contractor paving your house for example), but is really rare when paying for real world goods (which have an obvious trail, and the fines on the business not paying the VAT are exorbitant),State insurance and state health insurance - If you work, your employer takes care of paying that (and deducting from your salary). If you don’t work (or are self employed) - you have to be really stupid to dodge those two taxes. They provide a security net, and losing that security net by dodging the tax is pretty lame.New car tax (107%) - can’t dodge that obviously (you’re not paying it directly).Building taxes, and zoning taxes (e.g., the amount you need to pay to in order to get a permit to build a house in your land). You can certainly dodge that, but then you find out that you can’t connect to the water system directly (no permit) and you can’t connect to the electric system directly (no permit) and so on. Not to mention that you might get sued by the state, and forced to demolish your home.

-

How can you make online form filling fun?

Personally, I feel filling forms are never fun, We can just make it less boring with some techniques. As far as,the fun element is concerned, they can always be added through visual aids. Our mind fundamentally is more of a visual tool than that of a Textual tool. Even the fun elements can be added as part of design, here are some suggestions:Lets reduce the Cognitive load with adding simple interaction elements like Buttons, sliders, drop down menu. The idea is to include the natural human tendency to act in a certain way. A lot of animations and Jquery can actually make the form unusable.The Visual Load can be reduced with keeping the basic eye movements under consideration while designing the fields. In below image we can see how designing form in certain way can lower visual load. The Motor load can be diminished with the use of larger intuitive buttons.I am writing down some of the ideas that I know with which we can make Form Filling Less cumbersome if not playful or fun, You may add in comments too.The idea is create Engagement/Interactions not forms. E.g. Take for example Tripit. This application for managing your travel plans by using your travel confirmation emails could easily have asked all new members to sign up through a registration form. Instead, to the join the service new members simply have to send Tripit a travel confirmation email. From this email, Tripit creates an account and extracts the information it needs to create a rich travel plan for new members. No form required. People sign up for Tripit by using it and learning what the application can do for them.A different type of Sign Up form Minimize the Key Inputs, try to make it point and click for web and Touch oriented for Mobiles.Using Web Services for Login : Web services allow people to log-in to a new service using their profile and contact information from other Web sites. The idea here is to make use of information people have already provided elsewhere instead of having them fill it all in again on your sign-up form.Other Communication Tools like Email. Tripit already uses it, Posterous, which is a blogging service, let you write a blog post in your email, attach a photo, send it over to Posterous, and they'll essentially publish that whole thing for you, no need to ever get out of your email client. The idea is that input can come from anywhere. You can use your email client to provide input. You can use your IM client to provide input. You can use Twitter, or you can use your calendar. You can use book marklets or browser extensions. Mad Libs forms ask people the same questions found in typical sign-up forms in a narrative format. They present input fields to people as blanks within sentences. Create Data Extractions points at various points of user interaction. Asking people for information once they are already using an application is often more successful than asking them before they start using the application. These days linkedin.com is trying to do the same.

-

How smart are you?

It’s odd, isn’t it?I like to think that I’m smart. I’m always winning Kahoots in class. I watch The Chase fairly regularly and often do better than the contestants. If we’re doing a family trivia quiz, and we’re not sure of the answer, everyone goes with what I’m thinking.You wanna know the capital of Honduras? Or the square root of 784? Or the 69th element in the Periodic Table? I’ve gotcha. This is my turf.And fine, it’s great having a lot of knowledge about these matters. I like to learn, and my memory makes that a lot easier.But does that really help me? Am I gonna be helped out in four years’ time if I’m trying to fill out a tax form or if I’m applying for a loan? Great, mitochondria’s the powerhouse of the cell, but that does fuck all for me. Never in my life is knowing how to analyse every part of a centuries-old book gonna benefit me. It doesn’t help that school is, to quote CGP Grey, “a babysitting service obsessed with an endless game of Trivial Pursuit”.And that’s not all.If someone tells me a joke, I often can’t tell if they’re serious. I struggle to detect sarcasm. My own feelings and emotions don’t make sense to me, and neither do anyone else’s. I often make situations worse by trying to help and I can’t really read body language at all. Double meanings, puns, jokes all go over my head.I don’t understand a thing about socializing.I don’t get people. And I never will.How smart am I really? Not at all.

-

Why is 40% being taken out of my paycheck and how do I change it?

You haven’t specified what country you are in. If you are in Australia, it could be that you haven’t given your payroll office your tax file number (or you don’t have a tax file number). If this is the case, your employer is obliged to assume a very high tax rate, but it will be refunded at the end of the financial year when you file your tax return.You can fix this by getting in touch with your payroll/HR office and, if you haven’t already, filling in a form to give them your tax file number. If you don’t yet have a tax file number, you can quickly apply for one through the tax office.Fortnightly tax table: what if I don’t give my tax file number?How to apply for a TFN

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

-

Are you able to remember things the average person can't? If so, how do you think differently?

Are you able to remember things the average person can't? If so, how do you think differently?I have been accused of having a photographic memory (properly referred to as "an eidetic memory"), but I would say that my memory is (at best) above average. That is to say, it's not *that* I remember things better than other people, but *what* I choose to remember and how I choose to organize that information. Specifically, I was watching an episode of Modern Family, and Gloria (one of the characters on the show) was taking a citizenship test where she was asked a couple of easy questions about American government, then told that she had passed. She then asked for a tough question to show how hard she had studied. That question was, "How many Members of Congress are there?"I had a general idea that there were 535 Members of Congress, but I really couldn't say for sure, much less why. What I did know was that senators are considered Members of Congress, that each of the 50 states has two senators, and that the House of Representatives currently has 435 voting members along with a number of other members who are not able to vote. (See Wikipedia - Non-voting members of the United States House of Representatives.) I then tried to work backwards from the math of the electoral college, which includes three electors from the District of Columbia meaning that the number of congressional representatives should be about 269 times two, which would be a tie, minus three. I then contemplated whether the Vice President of the United States would be considered a Member of Congress, since he[sic] is President of the Senate. Finally, I googled it.People with total recall are seldom at any real advantage over people who have access to computers and the Internet and know how to use that access. That is to say, what I am best at remembering are the high level, general concepts that help me find more detailed, granular information when I need it. To this end, I take a lot of notes, keep detailed records, and spend a lot of time compiling and organizing detailed records, files, and databases for myself, for my clients, and for people I don't even know and will probably never meet. This is the essence of how and why I contribute to Quora.There are people who enjoy cultivating their memory and showing off with some truly impressive feats, and they will usually be the first ones to admit that almost anyone can learn to do what they do. However, as a practical matter, our brains are constantly making adjustments to our memories and cognitive abilities based on what really matters to us on a day to day basis. On this note, there was a time when I could quickly add up several columns of several figures in my head, a time when I could rattle off all the state and national capitals, a time when I could recall all the symbols, names, and numbers on the periodic table of the elements, and a time when I could rattle off the lyrics to any song that Elton John ever sang. However, as that information became less meaningful to me on a day to day basis, other, more meaningful information (to me) pushed less useful information to the deeper recesses of my mind.

-

With earnings $50k/yr in Utah, how much would I have to pay in state/federal taxes?

Basically, you're asking people to do a two tax returns for you based on incomplete information.This is not a 'back of the envelope' type calculation.Your eventual state and federal tax liabilities are determined by a number of factors including (but not limited to) your filing status (single, married, head of household), other investment income (which you may or may not have), itemized deductions (interest paid on mortage, medical, state income taxes withheld, etc.), age, number of dependents and a laundry list of items too long to describe in this answer.What is deducted from your paycheck almost never equals your eventual tax bill (return), which is the reason you file a tax return (to either receive a refund of the overpayments you've made through payroll deductions or to pay a balance due, based on a shortfall of payroll deductions).

-

How does a lawyer and the legal profession, in general, justify its ridiculously high fees?

I have a friend who is a graphic designer, and she also gets this question all the time. Angry clients that ask, “It took you 30 minutes to do this! How can you justify charging me $100 for that?!”Her response: it took ten years to learn how to do that in 30 minutes. That’s what you’re paying for.It took me the years spent to get an undergraduate degree. The years spent in law school. The months studying for the bar exam 12 hours a day. The days continuing legal education I need to stay current in the field. The hours I need to spend doing legal research for your specific case.That’s what it takes to do what I do, and at the high level at which I do it.You’re paying for my experience, my knowledge, my skills, and my professionalism. You’re paying for me to do something relatively few people are capable of doing, and to do it right with no mistakes.If it seems easy, it’s because I’ve done my job right.Addendum: Attorneys are ethically prohibited from charging unreasonable fees, and a good attorney will always make clear what the fee arrangement is before taking the case. If you feel that an attorney has charged excessively high or unreasonable fees, there is an ethics board in every state that will hear those complaints. If you’ve tried going to several different attorneys and you discover they’re all in about the same ballpark fees, that’s a good sign that the fees are appropriate to your case, expensive as that may be.

Create this form in 5 minutes!

How to create an eSignature for the tax table

How to make an eSignature for your Tax Table online

How to generate an eSignature for the Tax Table in Chrome

How to generate an eSignature for putting it on the Tax Table in Gmail

How to generate an eSignature for the Tax Table right from your mobile device

How to create an eSignature for the Tax Table on iOS devices

How to create an eSignature for the Tax Table on Android

People also ask

-

What is a Tax Table in airSlate SignNow?

The Tax Table in airSlate SignNow is a feature that allows users to easily manage and apply different tax rates to their documents. This ensures that all your eSigned documents are compliant with the required tax regulations. By utilizing the Tax Table, businesses can streamline their tax calculations and improve accuracy in their transactions.

-

How does the Tax Table feature benefit my business?

The Tax Table feature streamlines the process of applying taxes to your documents, which saves time and reduces errors. With airSlate SignNow, you can customize tax rates for different regions or products, ensuring compliance and efficiency. This not only enhances your workflow but also provides peace of mind during audits.

-

Is the Tax Table included in the airSlate SignNow pricing plans?

Yes, the Tax Table feature is included in all airSlate SignNow pricing plans, making it accessible for businesses of all sizes. Whether you choose the basic or advanced plan, you can utilize the Tax Table without any additional cost. This ensures that all users can simplify their tax management.

-

Can I integrate the Tax Table with other software?

Absolutely! The Tax Table in airSlate SignNow can be integrated with various accounting and business management software. This seamless integration ensures that your tax data is consistent across platforms, allowing for better financial tracking and reporting.

-

How do I set up the Tax Table in airSlate SignNow?

Setting up the Tax Table in airSlate SignNow is straightforward. Simply navigate to the settings section, where you can enter your tax rates and customize them according to your needs. Once set up, these rates will automatically apply to your documents, simplifying your workflow.

-

Can I edit tax rates in the Tax Table after they are set?

Yes, you can easily edit tax rates in the Tax Table at any time. If tax laws change or your business needs evolve, simply access the Tax Table settings to make adjustments. This flexibility ensures your documents always reflect the correct tax information.

-

What types of documents can I use the Tax Table with?

You can use the Tax Table with various document types in airSlate SignNow, including invoices, contracts, and agreements. This versatility allows you to apply the necessary tax calculations across all your business documents seamlessly. By leveraging the Tax Table, you ensure all your transactions are compliant.

Get more for Tax Table

Find out other Tax Table

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document