TC 842 Utah State Tax Commission Utah Gov 2018

What is the TC 842 Utah State Tax Commission Utah gov

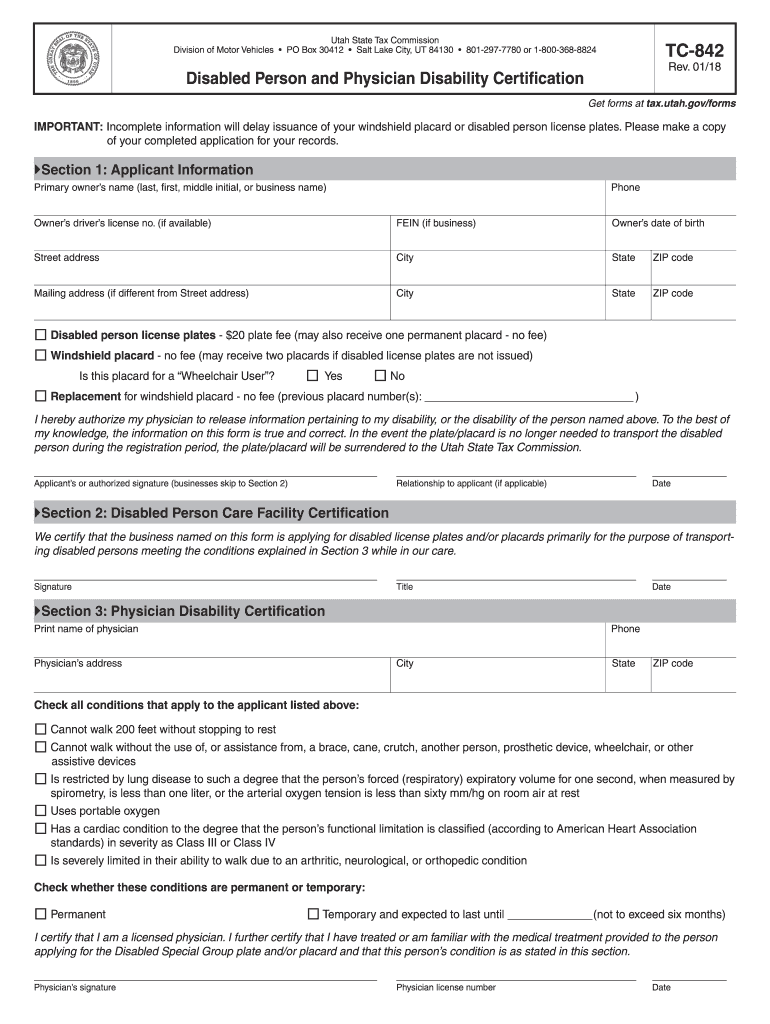

The TC 842 form is a crucial document issued by the Utah State Tax Commission, designed to assist taxpayers in reporting specific tax-related information. This form is essential for individuals and businesses operating within Utah, as it helps ensure compliance with state tax regulations. The TC 842 serves as a declaration of certain tax credits or deductions that may be applicable, depending on the taxpayer's circumstances. Understanding this form is vital for accurate tax reporting and to avoid potential penalties.

Steps to complete the TC 842 Utah State Tax Commission Utah gov

Completing the TC 842 form involves several straightforward steps. First, gather all necessary documentation, including income statements and any relevant tax credit information. Next, access the form through the Utah State Tax Commission's official website or a trusted source. Fill in the required fields, ensuring all information is accurate and complete. After completing the form, review it for any errors or omissions. Finally, submit the TC 842 electronically or via mail, depending on your preference and the submission guidelines provided by the Utah State Tax Commission.

How to obtain the TC 842 Utah State Tax Commission Utah gov

To obtain the TC 842 form, taxpayers can visit the Utah State Tax Commission's official website where the form is available for download. It is advisable to ensure that you are accessing the most current version of the form. Alternatively, taxpayers can request a physical copy by contacting the Tax Commission directly. Having the correct version of the TC 842 is essential for accurate tax reporting and compliance with state regulations.

Legal use of the TC 842 Utah State Tax Commission Utah gov

The TC 842 form is legally recognized as a valid document for reporting tax information in Utah. It must be completed accurately and submitted within the specified deadlines to ensure compliance with state tax laws. The form may be subject to review by the Utah State Tax Commission, and inaccuracies can lead to penalties or audits. Therefore, it is crucial to understand the legal implications of completing and submitting this form correctly.

Required Documents

When filling out the TC 842 form, certain documents are required to support the information provided. These may include income statements, previous tax returns, and documentation related to any tax credits or deductions being claimed. Ensuring that all necessary documents are available will facilitate a smoother completion process and help avoid delays in processing by the Utah State Tax Commission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the TC 842 form to avoid penalties. Typically, the form must be submitted by the same deadline as the annual state income tax return. Taxpayers should keep track of any changes in deadlines announced by the Utah State Tax Commission, especially during tax season, as these dates can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The TC 842 form can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file the form online via the Utah State Tax Commission's website, which often offers a streamlined process. Alternatively, taxpayers can mail the completed form to the designated address provided on the form. In-person submissions may also be possible at local tax commission offices, allowing for direct assistance if needed. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Quick guide on how to complete tc 842 utah state tax commission utahgov

Your assistance manual on how to prepare your TC 842 Utah State Tax Commission Utah gov

If you’re curious about how to finalize and submit your TC 842 Utah State Tax Commission Utah gov, here are a few concise guidelines on how to simplify tax filing.

To begin, you simply need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, draft, and finalize your tax paperwork with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your TC 842 Utah State Tax Commission Utah gov in no time:

- Create your account and commence working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Hit Get form to access your TC 842 Utah State Tax Commission Utah gov in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any errors.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay reimbursements. Of course, before e-filing your taxes, check the IRS website for filing requirements in your state.

Create this form in 5 minutes or less

Find and fill out the correct tc 842 utah state tax commission utahgov

Create this form in 5 minutes!

How to create an eSignature for the tc 842 utah state tax commission utahgov

How to make an electronic signature for the Tc 842 Utah State Tax Commission Utahgov in the online mode

How to create an electronic signature for your Tc 842 Utah State Tax Commission Utahgov in Chrome

How to make an eSignature for putting it on the Tc 842 Utah State Tax Commission Utahgov in Gmail

How to create an electronic signature for the Tc 842 Utah State Tax Commission Utahgov right from your mobile device

How to make an electronic signature for the Tc 842 Utah State Tax Commission Utahgov on iOS

How to make an eSignature for the Tc 842 Utah State Tax Commission Utahgov on Android devices

People also ask

-

What is the TC 842 form and how is it related to the Utah State Tax Commission?

The TC 842 form is a crucial document used by businesses in Utah for tax-related purposes, specifically for property tax exemption applications. It is essential to ensure compliance with regulations set forth by the Utah State Tax Commission. By utilizing the form accurately, businesses can effectively navigate their tax responsibilities under the Utah gov jurisdiction.

-

How can airSlate SignNow assist with the TC 842 process?

airSlate SignNow provides an efficient platform to complete, sign, and store the TC 842 form electronically. This streamlines the process of document management, making it easier for businesses to submit their forms to the Utah State Tax Commission promptly. Utilizing our platform, users can ensure all required information is included, reducing the chances of errors.

-

What are the pricing options for using airSlate SignNow to manage the TC 842 form?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options specifically designed for managing forms like the TC 842 with the Utah State Tax Commission. Our pricing structures are transparent, allowing you to select a plan that best suits your budget while utilizing the features necessary for efficient document signing and management.

-

What features does airSlate SignNow offer that are beneficial for the TC 842 form?

Key features of airSlate SignNow include document templates, secure electronic signatures, and real-time tracking, which are particularly beneficial for preparing the TC 842 form. These tools help ensure that the form is filled out accurately and delivered efficiently to the Utah State Tax Commission. Additionally, the user-friendly interface simplifies the entire signing process.

-

Are there integrations available when using airSlate SignNow for the TC 842 form?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that can enhance the process of managing the TC 842 form. By integrating with platforms such as CRM systems and cloud storage solutions, businesses can streamline their document workflows associated with the Utah State Tax Commission. This integration helps maintain organized records while facilitating easy access.

-

What benefits does airSlate SignNow provide when dealing with the Utah State Tax Commission?

Using airSlate SignNow for the TC 842 form offers numerous benefits, including enhanced efficiency, better compliance, and reduced paperwork. The solution simplifies the signing process, allowing businesses to focus more on their core activities rather than getting bogged down in administrative tasks. This ultimately leads to timely submissions to the Utah State Tax Commission.

-

Is it secure to use airSlate SignNow for submitting the TC 842 form?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents, including the TC 842 form, are protected with robust encryption measures. This guarantees that sensitive information sent to the Utah State Tax Commission remains confidential and secure throughout the transaction process. Users can trust that their data is handled with the highest level of security.

Get more for TC 842 Utah State Tax Commission Utah gov

- Agr jobs alaska form

- One way buy sell agreement between sole business owner and key employees form

- Divorce papers pinal county form

- Tdi fillable forms for mediation

- Bi weekly timesheet for non exempt employees form

- Ap 157 sole owner application formsend

- State of michigan mc321a form

- Order on petition to expunge court record of conviction form

Find out other TC 842 Utah State Tax Commission Utah gov

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure