Form St 18 2015

What is the Form St 18

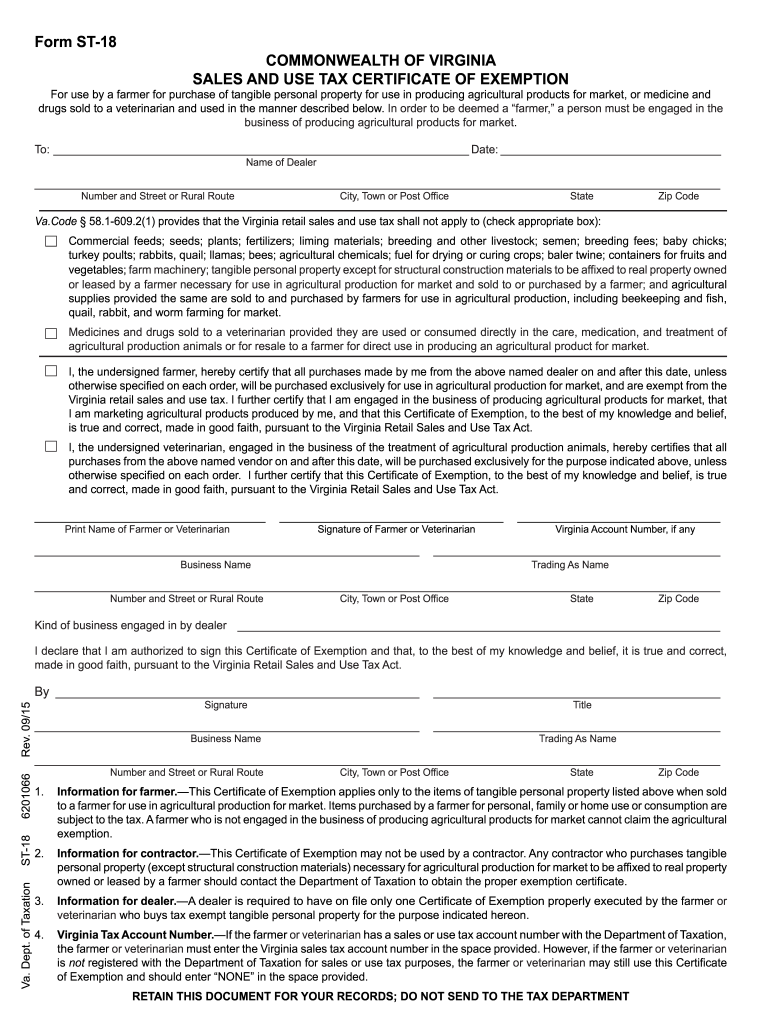

The Virginia Form St 18 is a tax form used by businesses to apply for a sales tax exemption. This form is essential for entities that qualify for tax relief under specific circumstances, such as non-profit organizations or government agencies. By submitting Form St 18, businesses can avoid paying sales tax on eligible purchases, which can lead to significant savings over time. Understanding the purpose of this form helps ensure compliance with state tax regulations.

Steps to Complete the Form St 18

Completing the Virginia Form St 18 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the specific reason for the exemption. Next, fill out the form completely, ensuring that all required fields are addressed. Pay attention to the instructions provided on the form, as they guide you through the process. After completing the form, review it for any errors before submission. Finally, submit the form according to the guidelines provided, either online or by mail.

Legal Use of the Form St 18

The legal use of Form St 18 is crucial for maintaining compliance with Virginia tax laws. This form must be used only by eligible entities that meet the criteria for sales tax exemption. Misuse of the form can result in penalties, including fines or back taxes owed. It is important to understand the legal implications of submitting this form and to ensure that all claims for exemption are valid and well-documented. This adherence protects both the taxpayer and the integrity of the state's tax system.

Form Submission Methods

Submitting the Virginia Form St 18 can be done through various methods, providing flexibility for businesses. The form can be submitted online through the Virginia Department of Taxation's website, which offers a streamlined process for electronic filing. Alternatively, businesses may choose to mail the completed form to the appropriate tax office. In-person submissions are also an option for those who prefer direct interaction. Each method has its own set of guidelines and timelines, so it is essential to choose the one that best fits your needs.

Required Documents

When completing the Virginia Form St 18, certain documents may be required to support your exemption claim. Typically, you will need to provide proof of your business status, such as a tax identification number or a certificate of incorporation. Additionally, documentation that verifies your eligibility for the exemption, such as a letter from a governing body or proof of non-profit status, may be necessary. Ensuring you have all required documents ready can facilitate a smoother application process.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Virginia Form St 18 is essential for compliance. While the form can be submitted at any time, it is advisable to file it before making tax-exempt purchases to avoid potential issues. Specific deadlines may vary based on the type of exemption being claimed, so it is important to stay informed about any changes in state regulations. Keeping track of these dates ensures that businesses can take full advantage of their tax exemptions without facing penalties.

Quick guide on how to complete st 18 tax 2015 2019 form

Your assistance manual on how to prepare your Form St 18

If you’re wondering how to generate and submit your Form St 18, here are some concise instructions on how to simplify tax reporting.

To commence, you merely need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and electronic signatures and return to amend details as necessary. Optimize your tax administration with enhanced PDF editing, eSigning, and efficient sharing.

Adhere to the steps below to complete your Form St 18 in just a few minutes:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form St 18 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to include your legally-binding electronic signature (if necessary).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in hard copy can lead to increased errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 18 tax 2015 2019 form

FAQs

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the st 18 tax 2015 2019 form

How to make an electronic signature for your St 18 Tax 2015 2019 Form online

How to make an electronic signature for the St 18 Tax 2015 2019 Form in Google Chrome

How to create an eSignature for putting it on the St 18 Tax 2015 2019 Form in Gmail

How to generate an eSignature for the St 18 Tax 2015 2019 Form from your smart phone

How to generate an eSignature for the St 18 Tax 2015 2019 Form on iOS devices

How to make an eSignature for the St 18 Tax 2015 2019 Form on Android OS

People also ask

-

What is the form st 18 used for?

The form st 18 is typically used for tax exemption purposes. It allows businesses to claim exemption from sales tax when purchasing materials or services by providing documentation to vendors. Understanding how to properly fill out the form st 18 can streamline your purchasing processes.

-

How can airSlate SignNow help with form st 18?

airSlate SignNow enables businesses to easily create, send, and eSign form st 18 documents securely. The platform allows for efficient collaboration and tracking of the document's status, ensuring timely submission and compliance. With airSlate SignNow, businesses can manage all necessary documentation seamlessly.

-

Is there a cost associated with using airSlate SignNow to handle form st 18?

Yes, airSlate SignNow offers various pricing plans based on the features needed, including eSigning, templates, and document integrations. Businesses can choose a plan that fits their budget while utilizing the efficient capabilities of airSlate SignNow to manage form st 18. A free trial is available to explore its benefits before committing.

-

What features does airSlate SignNow offer for form st 18?

airSlate SignNow provides features such as customizable templates for form st 18, real-time tracking of document status, and secure eSigning options. These features enhance the efficiency of managing tax exemption processes by reducing paperwork and administrative burdens. Users can also automate reminders for signatories, ensuring timely completion.

-

Can I integrate airSlate SignNow with other applications while handling form st 18?

Yes, airSlate SignNow offers integrations with various popular applications like Google Workspace, Salesforce, and Microsoft Office. This allows seamless management of form st 18 within your existing workflow. Integrating airSlate SignNow enhances productivity and ensures that your team has easy access to important documents.

-

What are the benefits of using airSlate SignNow for eSigning form st 18?

Using airSlate SignNow for eSigning form st 18 offers numerous benefits, including improved efficiency, enhanced security, and compliance with legal standards. The platform also eliminates the need for physical documents, saving time and resources. Overall, it simplifies the process of obtaining signatures for your form st 18.

-

Is airSlate SignNow user-friendly for managing form st 18?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing even non-technical users to navigate the platform with ease when managing form st 18. The intuitive interface and step-by-step guidance make it accessible for everyone, ensuring quick adaptation to the tool. Training resources are also available to assist users.

Get more for Form St 18

- Mc 354 0507 medi cal contact update california department dhcs ca form

- 89 107 texas prepaid higher education tuition program contract cancellation 89 107 texas prepaid higher education tuition form

- Notice of commencement new york form

- Trec unimproved contract no 9 11 form

- Internship application template 405794497 form

- Fnma safety hazard checklist safeguard properties form

- Volunteer application form jordan school district

- Emergency report form

Find out other Form St 18

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template