Wisconsin Department of Revenue 2018-2026

What is the Wisconsin Department of Revenue?

The Wisconsin Department of Revenue (DOR) is the state agency responsible for administering tax laws and collecting revenue in Wisconsin. It oversees various tax-related functions, including income tax, sales tax, and property tax assessments. The DOR also plays a crucial role in ensuring compliance with state tax regulations and providing guidance to taxpayers.

Steps to Complete the Wisconsin Department of Revenue Form A 771

Completing the form A 771 requires careful attention to detail. The following steps outline the process:

- Gather Required Information: Collect all necessary documents, including income statements and previous tax returns.

- Access the Form: Obtain the form A 771 PDF from the Wisconsin Department of Revenue website.

- Fill Out the Form: Complete the form accurately, ensuring all fields are filled in as required.

- Review for Accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit the Form: Send the completed form to the appropriate address as indicated on the document.

Required Documents for Form A 771 Submission

When submitting the form A 771, certain documents are necessary to support your application. These may include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a driver's license or Social Security card.

- Any additional forms or documentation specified by the Wisconsin DOR.

Form Submission Methods for A 771

There are several methods to submit the form A 771 to the Wisconsin Department of Revenue:

- Online: Use the DOR's online portal for electronic submission, if available.

- Mail: Print the completed form and send it to the designated address.

- In-Person: Visit a local DOR office to submit the form directly.

Legal Use of the Wisconsin Department of Revenue Forms

Forms issued by the Wisconsin Department of Revenue, including the A 771, must be used in accordance with state laws. These forms are designed to facilitate compliance with tax regulations, and using them appropriately helps ensure that taxpayers meet their obligations. Failure to use the forms correctly can result in penalties or delays in processing.

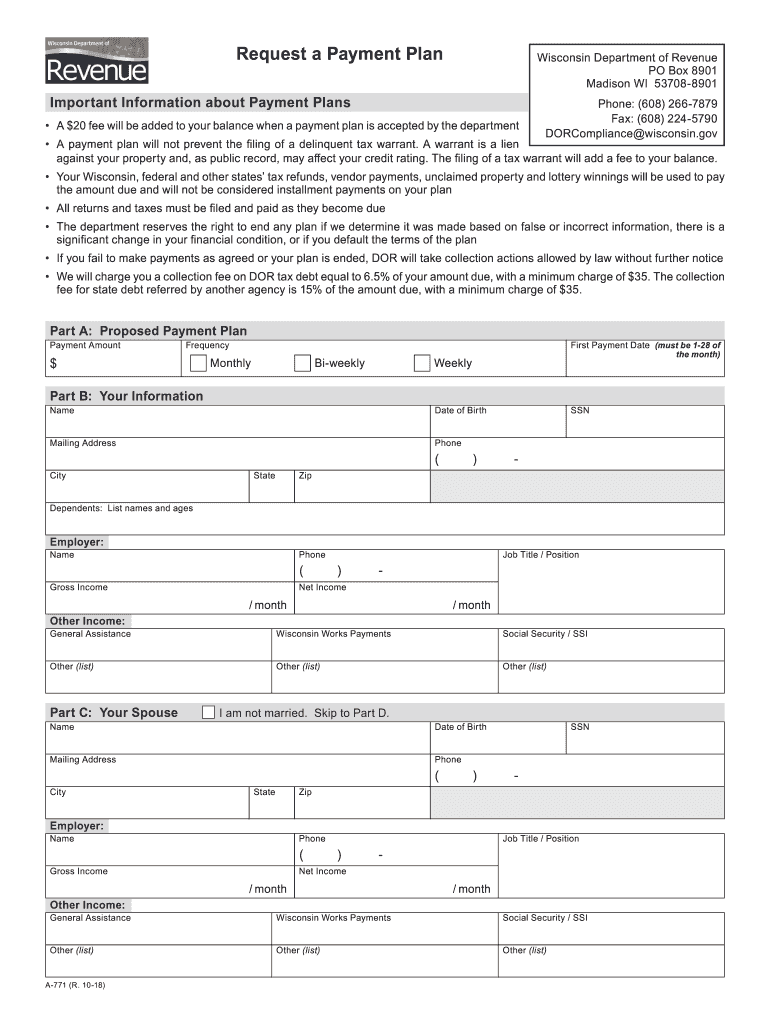

Key Elements of the A 771 Form

The A 771 form includes several key elements that are important for accurate completion:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Income Details: Taxpayers must provide information regarding their income sources and amounts.

- Signature: A valid signature is required to authenticate the form and confirm the information provided.

Quick guide on how to complete delnqtaxwisconsingov 2018 2019 form

Your assistance manual on how to prepare your Wisconsin Department Of Revenue

If you’re curious about how to generate and submit your Wisconsin Department Of Revenue, here are some straightforward instructions on making tax processing less challenging.

First, you need to create your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, generate, and finalize your tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to modify responses as necessary. Streamline your tax organization with enhanced PDF editing, eSigning, and easily shareable options.

Follow the steps outlined below to complete your Wisconsin Department Of Revenue in a short amount of time:

- Set up your account and begin working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through editions and schedules.

- Select Get form to access your Wisconsin Department Of Revenue in our editor.

- Fill out the necessary fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and amend any mistakes.

- Store changes, print your copy, deliver it to your recipient, and save it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in paper form may lead to return errors and postpone refunds. Furthermore, before e-filing your taxes, make sure to verify the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct delnqtaxwisconsingov 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the delnqtaxwisconsingov 2018 2019 form

How to make an eSignature for the Delnqtaxwisconsingov 2018 2019 Form online

How to make an eSignature for your Delnqtaxwisconsingov 2018 2019 Form in Chrome

How to generate an eSignature for putting it on the Delnqtaxwisconsingov 2018 2019 Form in Gmail

How to make an eSignature for the Delnqtaxwisconsingov 2018 2019 Form right from your smartphone

How to generate an electronic signature for the Delnqtaxwisconsingov 2018 2019 Form on iOS

How to make an eSignature for the Delnqtaxwisconsingov 2018 2019 Form on Android OS

People also ask

-

What is the Wisconsin payment plan offered by airSlate SignNow?

The Wisconsin payment plan from airSlate SignNow provides an affordable way for businesses to access eSigning and document management tools. This plan is designed to cater to the payment requirements of Wisconsin residents, making it easier for them to manage agreements and contracts efficiently.

-

How does the Wisconsin payment plan pricing work?

The pricing structure of the Wisconsin payment plan is competitive and based on a subscription model. Customers can choose between different tiers based on their usage needs, allowing them to find a solution that fits their budget while enjoying all the essential features of airSlate SignNow.

-

What features are included in the Wisconsin payment plan?

The Wisconsin payment plan includes a range of features such as unlimited eSignatures, customizable templates, and automated workflows. These tools help streamline document processes and enhance overall efficiency for businesses operating in Wisconsin.

-

What are the benefits of using the Wisconsin payment plan?

Using the Wisconsin payment plan provides numerous benefits including cost savings, enhanced security, and faster turnaround times. Users can enjoy the convenience of eSigning from anywhere, which helps accelerate business transactions and improve client satisfaction.

-

Are there any integration options with the Wisconsin payment plan?

Yes, the Wisconsin payment plan allows seamless integration with popular business applications such as CRM systems, cloud storage platforms, and accounting software. This ensures that users can work within their trusted environments while leveraging the powerful features of airSlate SignNow.

-

Is there a free trial available with the Wisconsin payment plan?

AirSlate SignNow offers a free trial for prospective users interested in the Wisconsin payment plan. This trial allows customers to explore the platform's capabilities and determine how it can meet their specific document signing needs before committing to a subscription.

-

Can I upgrade or downgrade my Wisconsin payment plan subscription?

Absolutely! AirSlate SignNow provides flexibility to upgrade or downgrade your Wisconsin payment plan subscription as your business needs change. This feature ensures that you are only paying for what you need and can adjust your plan accordingly.

Get more for Wisconsin Department Of Revenue

- Transfer of care form

- Arkansas state board of cosmetology form

- Rcycp renewal form

- Itgicgl01 iffcotokio general insurance company limited comprehensive general liability insurance proposal form this proposal

- Greatest headlines ever written pdf form

- Waiver of liability form texas

- F 31 troopgroup annual financial report troops and groups must submit this form to the community financial specialist by may 31

- C h yoe high school transcript request form for former

Find out other Wisconsin Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors