990 Form a for the Calendar Year, or Tax Year Beginning Check F App Coca JUL 1, and Ending JUN 30, C Name of Organization Tinder

Understanding the 990 Form A

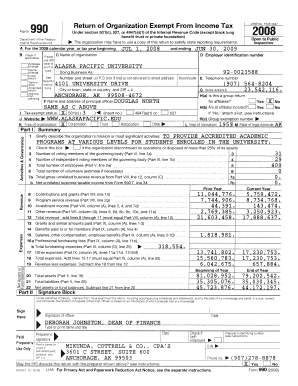

The 990 Form A is a crucial document for organizations classified under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. This form is specifically designed for the calendar year or tax year, beginning on July 1 and ending on June 30. Organizations must accurately complete this form to maintain compliance with IRS regulations. It serves as a financial report, detailing the organization’s income, expenses, and activities during the specified period. Understanding the nuances of this form is essential for ensuring proper filing and adherence to tax obligations.

Steps to Complete the 990 Form A

Completing the 990 Form A involves several key steps to ensure accuracy and compliance. The process begins with gathering necessary financial documents, including income statements and expense reports. Next, organizations should carefully fill out each section of the form, ensuring that all information is accurate and reflects the organization's activities. After completing the form, it is advisable to review it for any errors or omissions before submission. Finally, organizations must submit the form by the designated deadline to avoid penalties.

How to Obtain the 990 Form A

Organizations can obtain the 990 Form A through the IRS website or by contacting the IRS directly. The form is available in a downloadable format, allowing organizations to fill it out electronically or print it for manual completion. Additionally, many tax preparation software programs include this form, providing an efficient way to complete and file it. Ensuring that the most current version of the form is used is essential for compliance.

Key Elements of the 990 Form A

The 990 Form A contains several key elements that organizations must address. These include the organization’s name, tax identification number, and a detailed breakdown of revenue and expenses. It also requires information about the organization’s mission, programs, and governance structure. Each section must be filled out with precision to provide a clear picture of the organization’s financial health and operational activities.

Legal Use of the 990 Form A

The legal use of the 990 Form A is paramount for organizations to maintain their tax-exempt status. Filing this form accurately and on time demonstrates compliance with IRS regulations. Failure to submit the form can result in penalties, including the loss of tax-exempt status. Organizations must ensure that all information provided is truthful and complete, as inaccuracies can lead to legal repercussions.

Filing Deadlines and Important Dates

Organizations must be aware of the filing deadlines associated with the 990 Form A. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s tax year. For those following the calendar year, this means a deadline of May 15. Organizations should plan ahead to ensure timely submission and avoid any penalties associated with late filing.

Quick guide on how to complete 990 form a for the calendar year or tax year beginning check f app coca jul 1 and ending jun 30 c name of organization tinder

Manage [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly replacement for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 990 Form A For The Calendar Year, Or Tax Year Beginning Check F App Coca JUL 1, And Ending JUN 30, C Name Of Organization Tinder

Create this form in 5 minutes!

How to create an eSignature for the 990 form a for the calendar year or tax year beginning check f app coca jul 1 and ending jun 30 c name of organization tinder

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30?

The 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30, is a tax form required for organizations under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code. This form provides essential financial information to the IRS and helps maintain transparency for tax-exempt organizations.

-

How can airSlate SignNow assist with filing the 990 Form A?

airSlate SignNow simplifies the process of preparing and submitting the 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30. Our platform allows users to easily eSign and send documents, ensuring compliance and timely submission to the IRS.

-

What are the pricing options for using airSlate SignNow for 990 Form A submissions?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations. Whether you are a small nonprofit or a larger entity, our cost-effective solutions ensure you can efficiently manage your 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30.

-

What features does airSlate SignNow provide for managing tax documents?

Our platform includes features such as document templates, eSignature capabilities, and secure cloud storage, all designed to streamline the management of tax documents like the 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30. These tools enhance efficiency and ensure compliance.

-

Can airSlate SignNow integrate with other accounting software for 990 Form A processing?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, allowing for a smooth workflow when preparing the 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30. This integration helps ensure that all financial data is accurately reflected in your submissions.

-

What benefits does airSlate SignNow offer for nonprofits filing the 990 Form A?

By using airSlate SignNow, nonprofits can benefit from reduced paperwork, faster processing times, and enhanced security for their 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30. Our user-friendly interface makes it easy to manage and submit important tax documents.

-

Is there customer support available for questions about the 990 Form A?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions regarding the 990 Form A for the calendar year, or tax year beginning Check F App Coca JUL 1, and ending JUN 30. Our team is here to ensure you have the resources you need for successful submissions.

Get more for 990 Form A For The Calendar Year, Or Tax Year Beginning Check F App Coca JUL 1, And Ending JUN 30, C Name Of Organization Tinder

- Request that clerk mark lien void of record individual form

- Request that clerk mark lien void of record corporation form

- Objection to request that clerk mark lien void of record individual form

- Mechanics lien forms georgia mechanics lien hubspot

- State of georgia secretary of state corporations division form

- Important please provide the entitys primary email address when completing this form

- Clerk of superior court state court and magistrate court news form

- Rule 17 appendix a faqs cherokee county form

Find out other 990 Form A For The Calendar Year, Or Tax Year Beginning Check F App Coca JUL 1, And Ending JUN 30, C Name Of Organization Tinder

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe