PASSTHROUGH ENTITY WITHHOLDING North Dakota 2020-2026

Understanding the North Dakota Individual Income Tax Return

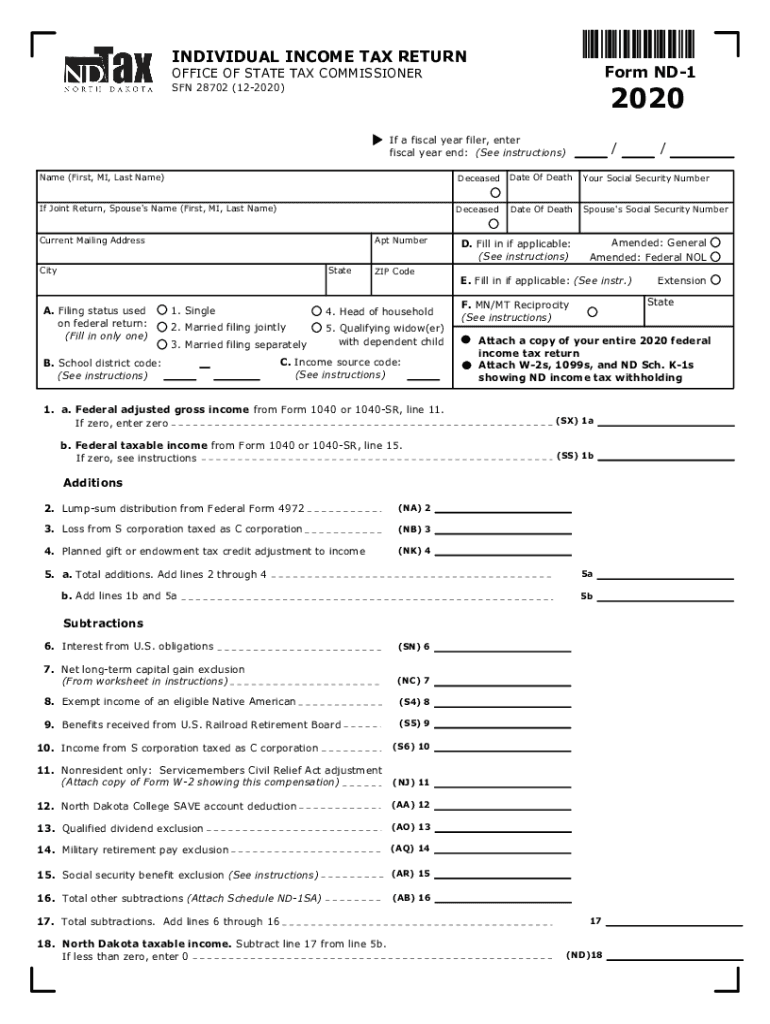

The North Dakota Individual Income Tax Return, commonly referred to as the form ND-1, is essential for residents to report their income and calculate their state tax obligations. This form is specifically designed for individuals who earn income in North Dakota and need to fulfill their tax responsibilities. It includes various sections that allow taxpayers to detail their income sources, deductions, and credits, ensuring compliance with state tax laws.

Steps to Complete the ND-1 Form

Completing the ND-1 form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy in the amounts listed.

- Claim any deductions or credits you qualify for, which can reduce your overall tax liability.

- Calculate your total tax due or refund based on the information provided.

- Sign and date the form before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the ND-1 form to avoid penalties. Typically, the deadline for submitting the form is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may need to file, which can be requested through the appropriate channels.

Required Documents for Submission

When filing the ND-1 form, certain documents are necessary to ensure a complete and accurate submission. These include:

- W-2 forms from employers detailing wages and withheld taxes.

- 1099 forms for any freelance or contract work performed.

- Documentation for any deductions claimed, such as receipts for charitable contributions or medical expenses.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods

Taxpayers have several options for submitting their ND-1 form. These methods include:

- Online submission through the North Dakota Department of Revenue's website, which provides a user-friendly interface for electronic filing.

- Mailing a printed version of the form to the appropriate tax office address, ensuring it is postmarked by the filing deadline.

- In-person submission at designated tax offices, where assistance may be available for those needing help with the form.

Penalties for Non-Compliance

Failing to file the ND-1 form by the deadline or providing inaccurate information can result in penalties. These penalties may include:

- Late filing fees, which can accumulate over time until the form is submitted.

- Interest on any unpaid taxes, which is calculated from the original due date.

- Potential legal action for severe cases of tax evasion or fraud.

Quick guide on how to complete passthrough entity withholding north dakota

Effortlessly complete PASSTHROUGH ENTITY WITHHOLDING North Dakota on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage PASSTHROUGH ENTITY WITHHOLDING North Dakota on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign PASSTHROUGH ENTITY WITHHOLDING North Dakota smoothly

- Locate PASSTHROUGH ENTITY WITHHOLDING North Dakota and click on Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign PASSTHROUGH ENTITY WITHHOLDING North Dakota and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct passthrough entity withholding north dakota

Create this form in 5 minutes!

How to create an eSignature for the passthrough entity withholding north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form nd 1 and how can it benefit my business?

The form nd 1 is a crucial document for businesses that need to streamline their signing processes. By using airSlate SignNow, you can easily create, send, and eSign the form nd 1, ensuring that your documents are processed quickly and efficiently. This not only saves time but also enhances the overall productivity of your team.

-

How much does it cost to use airSlate SignNow for the form nd 1?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Depending on the features you require for managing the form nd 1, you can choose from different subscription tiers. Each plan is designed to provide excellent value while ensuring you have the tools necessary for effective document management.

-

Can I integrate airSlate SignNow with other applications for managing the form nd 1?

Yes, airSlate SignNow supports integrations with a variety of applications, making it easy to manage the form nd 1 alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, you can seamlessly connect them with airSlate SignNow for a more efficient workflow.

-

Is it easy to eSign the form nd 1 using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that simplifies the eSigning process for the form nd 1. Users can quickly sign documents from any device, ensuring that approvals are obtained without unnecessary delays, which is essential for maintaining business momentum.

-

What features does airSlate SignNow offer for the form nd 1?

airSlate SignNow includes a range of features specifically designed to enhance the management of the form nd 1. These features include customizable templates, automated workflows, and real-time tracking, allowing you to monitor the status of your documents and ensure timely completion.

-

How secure is the airSlate SignNow platform for handling the form nd 1?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your data while handling the form nd 1. You can trust that your sensitive information is safeguarded throughout the signing process.

-

Can I customize the form nd 1 using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the form nd 1 to meet your specific business requirements. You can add fields, adjust layouts, and incorporate branding elements, ensuring that the document aligns with your company's identity and operational needs.

Get more for PASSTHROUGH ENTITY WITHHOLDING North Dakota

Find out other PASSTHROUGH ENTITY WITHHOLDING North Dakota

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now