Affidavit and Self Executing Waiver New Jersey Form L 8

Understanding the O-71 Form

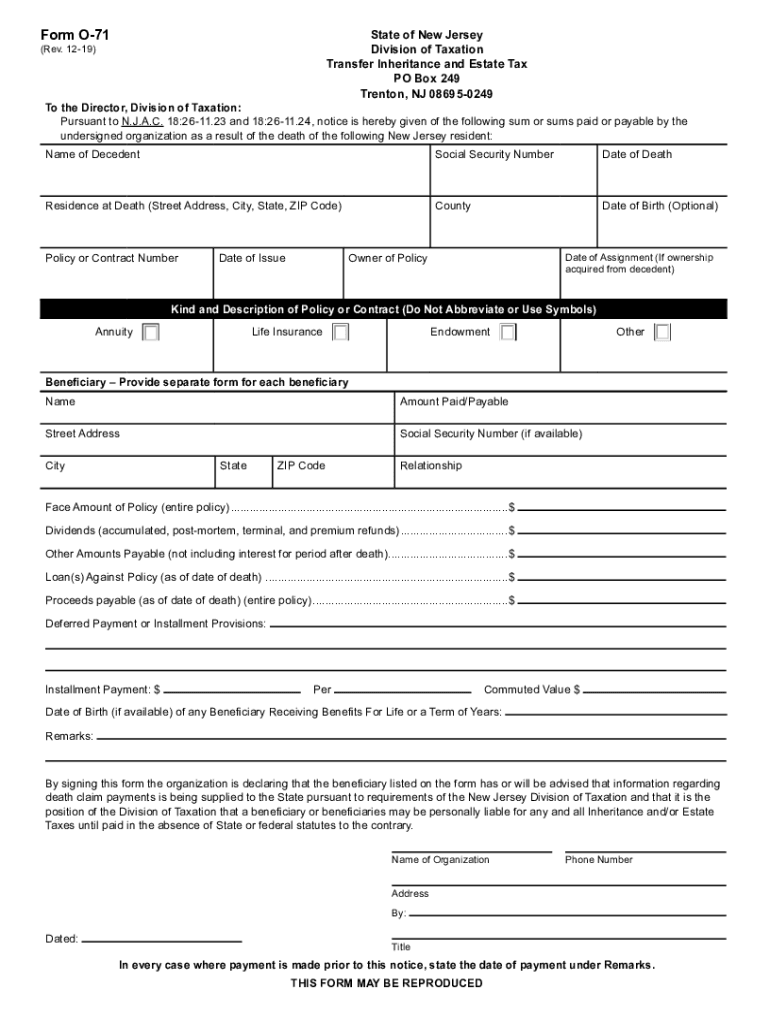

The O-71 form, also known as the New Jersey Transfer Inheritance Tax Form, is essential for individuals who are responsible for filing inheritance tax in New Jersey. This form is used to report the transfer of assets from a deceased individual to their beneficiaries. It is crucial for ensuring compliance with state tax laws and for determining the tax obligations of the heirs. Understanding the nuances of this form can help in accurately reporting the inheritance and avoiding potential penalties.

Steps to Complete the O-71 Form

Completing the O-71 form involves several steps to ensure accuracy and compliance. First, gather all necessary documentation related to the deceased's assets and liabilities. This includes property deeds, bank statements, and any other relevant financial records. Next, fill out the form by providing detailed information about the decedent and the beneficiaries. Be sure to include the value of the assets being transferred. Finally, review the completed form for accuracy before submission.

Required Documents for Filing the O-71 Form

When filing the O-71 form, several documents are required to support the information provided. These documents typically include:

- Death certificate of the deceased

- List of assets and their appraised values

- Any existing wills or trusts

- Proof of relationship between the deceased and the beneficiaries

Having these documents ready can streamline the filing process and help avoid delays.

Legal Use of the O-71 Form

The O-71 form serves a legal purpose in the context of New Jersey's inheritance tax laws. It is required by the state to assess the tax liability of beneficiaries receiving assets from a deceased individual. Failure to file this form can result in significant penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of the O-71 form is crucial for compliance and for protecting the rights of the beneficiaries.

Filing Deadlines for the O-71 Form

Timely filing of the O-71 form is essential to avoid penalties. In New Jersey, the form must typically be filed within eight months of the date of death of the decedent. If the form is not filed by the deadline, interest and penalties may accrue on any unpaid inheritance tax. It is advisable to check for any changes in deadlines or specific circumstances that may affect filing requirements.

Who Issues the O-71 Form

The O-71 form is issued by the New Jersey Division of Taxation. This state agency is responsible for overseeing tax compliance and ensuring that all inheritance taxes are collected as mandated by law. Individuals seeking to obtain the form can access it through the Division of Taxation's official channels, ensuring they have the most current version for filing.

Quick guide on how to complete affidavit and self executing waiver new jersey form l 8

Complete Affidavit And Self Executing Waiver New Jersey Form L 8 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Affidavit And Self Executing Waiver New Jersey Form L 8 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Affidavit And Self Executing Waiver New Jersey Form L 8 with ease

- Obtain Affidavit And Self Executing Waiver New Jersey Form L 8 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to preserve your changes.

- Select how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Affidavit And Self Executing Waiver New Jersey Form L 8 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit and self executing waiver new jersey form l 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is o71 and how does it relate to airSlate SignNow?

o71 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing o71, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost with the o71 feature?

The pricing for airSlate SignNow with the o71 feature is competitive and designed to fit various business needs. Plans start at an affordable monthly rate, allowing businesses of all sizes to access powerful eSigning tools. For detailed pricing information, it's best to visit our website or contact our sales team.

-

What are the main features of airSlate SignNow's o71?

The o71 feature includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. Additionally, it offers integrations with popular applications, making it a versatile solution for businesses. These features help users manage their documents more effectively and enhance collaboration.

-

How can o71 benefit my business?

Implementing o71 through airSlate SignNow can signNowly benefit your business by reducing the time spent on document processing. It allows for faster approvals and enhances the overall customer experience. By streamlining workflows, businesses can focus more on core activities rather than administrative tasks.

-

Does airSlate SignNow with o71 integrate with other software?

Yes, airSlate SignNow with the o71 feature integrates seamlessly with various software applications, including CRM and project management tools. This integration allows for a more cohesive workflow, enabling users to manage documents directly within their existing systems. This flexibility enhances productivity and reduces the need for switching between platforms.

-

Is airSlate SignNow secure when using the o71 feature?

Absolutely, airSlate SignNow prioritizes security, especially with the o71 feature. It employs industry-standard encryption and complies with regulations to ensure that all documents are protected. Users can confidently send and sign sensitive documents knowing that their information is secure.

-

Can I try airSlate SignNow with o71 before purchasing?

Yes, airSlate SignNow offers a free trial that includes access to the o71 feature. This allows prospective customers to explore the platform and understand how it can meet their document management needs. Sign up for the trial on our website to experience the benefits firsthand.

Get more for Affidavit And Self Executing Waiver New Jersey Form L 8

- Omb no 1845 0018 form

- 25 medical card renewal online florida form

- Procare software form

- Army sop template word form

- Launch online waiver form

- Social history form template

- Bgoliadb county fair jr commercial heifer show pen of goliad agrilife form

- Gear up education trust account qualified funds withdrawal form qfwf

Find out other Affidavit And Self Executing Waiver New Jersey Form L 8

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast