PROOF of DEATH CLAIMANTS STATEMENT 2024-2026

Understanding the Proof of Death Claimants Statement

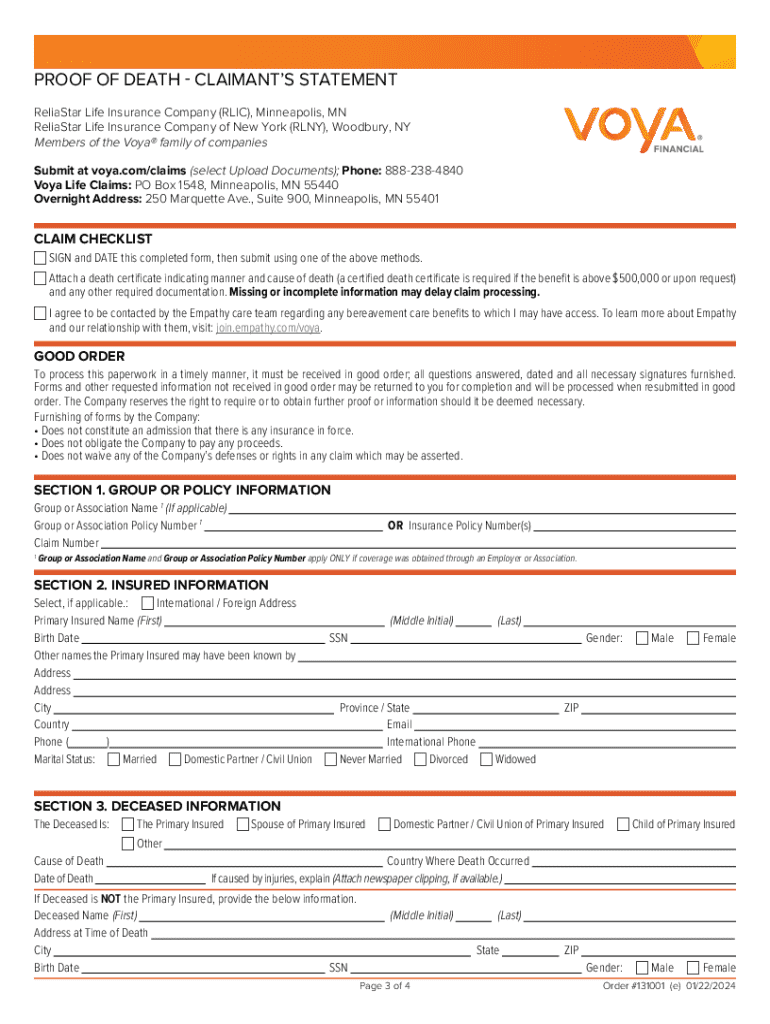

The Proof of Death Claimants Statement is a crucial document used to initiate a claim with the Security Life of Denver Insurance Company following the death of an insured individual. This form serves as a formal declaration by the claimant, confirming the death of the policyholder and providing essential details needed for processing the claim. It typically includes information such as the deceased's full name, policy number, date of death, and the relationship of the claimant to the deceased. Accurate completion of this form is vital to ensure timely processing of the insurance claim.

How to Utilize the Proof of Death Claimants Statement

To effectively use the Proof of Death Claimants Statement, start by obtaining the form from the Security Life of Denver Insurance Company. Once you have the form, carefully fill it out with the required information, ensuring that all details are accurate and complete. It is important to provide any additional documentation that may be requested, such as a certified copy of the death certificate. After completing the form, submit it according to the instructions provided by the insurance company, either online, by mail, or in person, to initiate the claims process.

Steps for Completing the Proof of Death Claimants Statement

Completing the Proof of Death Claimants Statement involves a series of clear steps:

- Obtain the form from the Security Life of Denver Insurance Company.

- Fill in the deceased's full name, policy number, and date of death.

- Provide your relationship to the deceased and contact information.

- Attach a certified copy of the death certificate and any other required documents.

- Review the completed form for accuracy.

- Submit the form as directed by the insurance company.

Legal Use of the Proof of Death Claimants Statement

The Proof of Death Claimants Statement is a legally recognized document that serves as evidence for the claims process. By submitting this form, the claimant affirms the validity of the information provided, which may be subject to verification by the Security Life of Denver Insurance Company. It is important to ensure that all statements made in the form are truthful, as any discrepancies or false information could lead to claim denial or legal repercussions.

Key Elements of the Proof of Death Claimants Statement

When filling out the Proof of Death Claimants Statement, several key elements must be included to ensure the form is complete:

- Full name of the deceased.

- Policy number associated with the insurance coverage.

- Date of death.

- Claimant's full name and contact information.

- Relationship to the deceased.

- Signature of the claimant, affirming the information provided.

Required Documents for the Proof of Death Claimants Statement

In addition to the completed Proof of Death Claimants Statement, several documents may be required to support the claim. These typically include:

- A certified copy of the death certificate.

- Any relevant insurance policy documents.

- Identification of the claimant, such as a driver's license or passport.

Quick guide on how to complete proof of death claimants statement

Complete PROOF OF DEATH CLAIMANTS STATEMENT effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents promptly without delays. Manage PROOF OF DEATH CLAIMANTS STATEMENT on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and eSign PROOF OF DEATH CLAIMANTS STATEMENT without any hassle

- Locate PROOF OF DEATH CLAIMANTS STATEMENT and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign PROOF OF DEATH CLAIMANTS STATEMENT and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct proof of death claimants statement

Create this form in 5 minutes!

How to create an eSignature for the proof of death claimants statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the security life of denver insurance company?

The security life of denver insurance company is a reputable provider of insurance solutions, focusing on delivering reliable coverage options. They offer a range of products designed to meet the diverse needs of individuals and businesses. Understanding their offerings can help you make informed decisions about your insurance needs.

-

How does airSlate SignNow enhance the security life of denver insurance company?

airSlate SignNow enhances the security life of denver insurance company by providing a secure platform for document management and eSigning. This ensures that sensitive information is protected while streamlining the signing process. With robust security features, businesses can confidently manage their insurance documents.

-

What are the pricing options for airSlate SignNow in relation to the security life of denver insurance company?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those related to the security life of denver insurance company. These plans are designed to be cost-effective while providing essential features for document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for the security life of denver insurance company?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for the security life of denver insurance company. These features help streamline the document workflow, making it easier for businesses to manage their insurance paperwork efficiently. Enhanced collaboration tools also facilitate communication among stakeholders.

-

What benefits can businesses expect from using airSlate SignNow with the security life of denver insurance company?

Businesses can expect numerous benefits from using airSlate SignNow alongside the security life of denver insurance company, including increased efficiency and reduced turnaround times for document signing. The platform's security measures ensure that sensitive insurance information is protected. Additionally, the ease of use allows teams to focus on their core activities rather than administrative tasks.

-

Can airSlate SignNow integrate with other tools used by the security life of denver insurance company?

Yes, airSlate SignNow can integrate with various tools commonly used by the security life of denver insurance company, such as CRM systems and document management software. This integration helps streamline workflows and enhances productivity by allowing seamless data transfer between platforms. Businesses can leverage these integrations to improve their overall efficiency.

-

Is airSlate SignNow compliant with industry regulations relevant to the security life of denver insurance company?

Absolutely, airSlate SignNow is designed to comply with industry regulations, ensuring that businesses associated with the security life of denver insurance company can operate within legal frameworks. This compliance includes adherence to data protection laws and electronic signature regulations. Businesses can trust that their document management practices meet necessary standards.

Get more for PROOF OF DEATH CLAIMANTS STATEMENT

Find out other PROOF OF DEATH CLAIMANTS STATEMENT

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast