Form it 260 I Tax Ny Gov New York State 2008

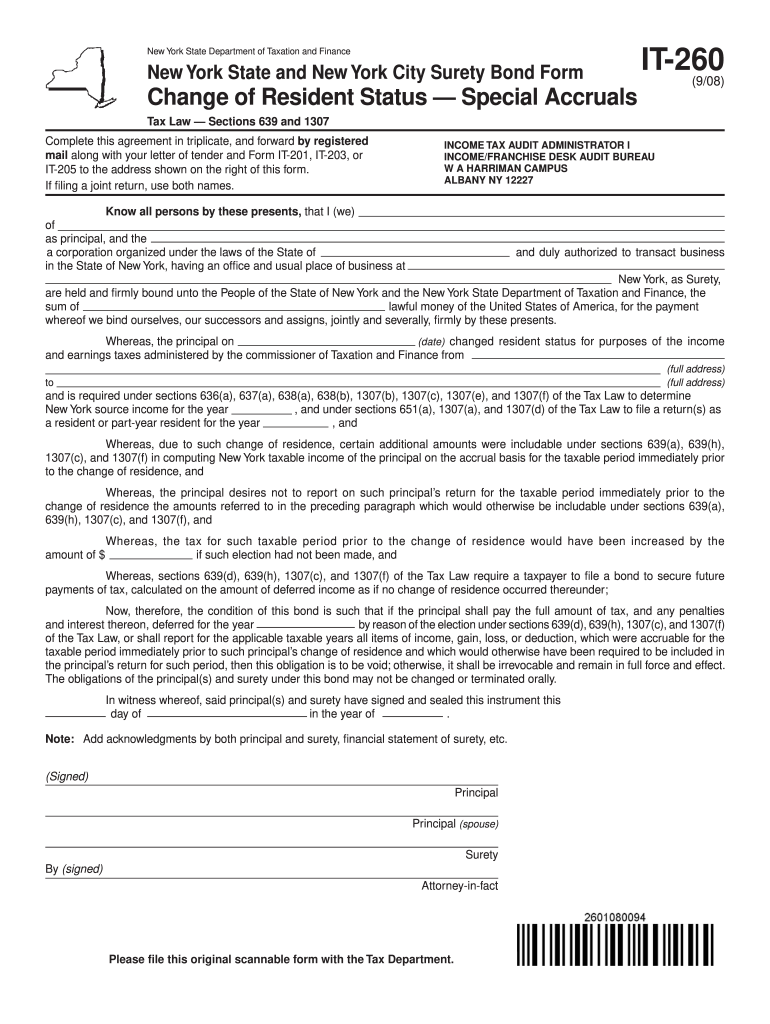

What is the Form IT-260 I?

The Form IT-260 I is a tax form used by residents of New York State to report certain information related to income and tax credits. This form is specifically designed for individuals who need to claim a credit for taxes paid to other jurisdictions. It plays a crucial role in ensuring that taxpayers receive appropriate credits, thereby reducing their overall tax liability in New York State.

How to Obtain the Form IT-260 I

The Form IT-260 I can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill it out at their convenience. Additionally, physical copies may be available at local tax offices or public libraries throughout New York State.

Steps to Complete the Form IT-260 I

Completing the Form IT-260 I involves several key steps:

- Gather necessary documentation, including income statements and proof of taxes paid to other jurisdictions.

- Fill out the personal information section, ensuring accuracy in names and addresses.

- Provide details about the taxes paid to other jurisdictions, including amounts and dates.

- Calculate the credit amount based on the information provided.

- Review the completed form for accuracy and completeness before submission.

Key Elements of the Form IT-260 I

Important elements of the Form IT-260 I include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Tax Information: Details regarding income earned and taxes paid to other jurisdictions must be accurately reported.

- Credit Calculation: Taxpayers must calculate the credit they are eligible for based on the provided information.

- Signature: The form must be signed and dated by the taxpayer or their authorized representative.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form IT-260 I. Typically, the form must be submitted by the same deadline as the New York State income tax return. Taxpayers should check the New York State Department of Taxation and Finance for specific dates, as these may vary each year.

Form Submission Methods

The Form IT-260 I can be submitted in various ways:

- Online: Taxpayers may have the option to file electronically through the New York State Department of Taxation and Finance's online services.

- Mail: The completed form can be mailed to the appropriate tax office as specified in the form instructions.

- In-Person: Taxpayers may also submit the form in person at designated tax offices.

Quick guide on how to complete form it 260 i tax ny gov new york state

Finalize Form IT 260 I Tax ny gov New York State effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your files swiftly without delays. Handle Form IT 260 I Tax ny gov New York State on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Form IT 260 I Tax ny gov New York State without hassle

- Locate Form IT 260 I Tax ny gov New York State and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 260 I Tax ny gov New York State and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 260 i tax ny gov new york state

Create this form in 5 minutes!

How to create an eSignature for the form it 260 i tax ny gov new york state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 260 I Tax ny gov New York State?

Form IT 260 I Tax ny gov New York State is a tax form used by individuals and businesses to claim a credit for taxes paid to other jurisdictions. This form is essential for ensuring that taxpayers receive the appropriate credits and avoid double taxation. Understanding how to fill out this form correctly can save you money and streamline your tax filing process.

-

How can airSlate SignNow help with Form IT 260 I Tax ny gov New York State?

airSlate SignNow provides an efficient platform for electronically signing and sending Form IT 260 I Tax ny gov New York State. Our solution simplifies the document management process, allowing you to complete your tax forms quickly and securely. With our user-friendly interface, you can ensure that your tax documents are handled with care and precision.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial. Our plans are designed to provide cost-effective solutions for managing documents, including Form IT 260 I Tax ny gov New York State. You can choose a plan that best fits your requirements and budget, ensuring you get the most value for your investment.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for documents like Form IT 260 I Tax ny gov New York State. These features enhance the efficiency of your document workflow, making it easier to manage tax forms and other important paperwork. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Is airSlate SignNow compliant with New York State regulations?

Yes, airSlate SignNow is fully compliant with New York State regulations regarding electronic signatures and document management. This compliance ensures that your use of Form IT 260 I Tax ny gov New York State is legally valid and recognized by state authorities. You can trust our platform to handle your sensitive tax documents securely and in accordance with the law.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various tax preparation software, allowing you to streamline your workflow when dealing with Form IT 260 I Tax ny gov New York State. This integration capability enhances productivity by enabling seamless data transfer between platforms, ensuring that your tax documents are always up-to-date and accessible.

-

What benefits does airSlate SignNow provide for businesses handling tax forms?

Using airSlate SignNow for handling tax forms like Form IT 260 I Tax ny gov New York State offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows businesses to manage their tax documents electronically, saving time and resources. Additionally, the ability to track document status in real-time ensures that you never miss a deadline.

Get more for Form IT 260 I Tax ny gov New York State

- Orientation packet template form

- Application for notary public commission cnmi office of the oagcnmi form

- Aamva form

- New summit school jackson ms transcript request form

- Wa violence restraining order form

- Staff record form fill and sign printable template onlineus legal

- Wisconsin and child support form

- Httpsapply07 grants govapplyformsschemas

Find out other Form IT 260 I Tax ny gov New York State

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form