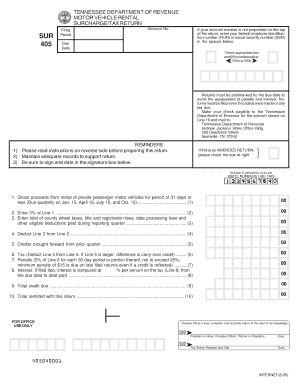

Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge 2005

What is the Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge

The Motor Vehicle Rental Surcharge Tax Return is a specific tax return form used by businesses that rent out vehicles. This form is designed to report and remit the surcharge collected from customers who rent vehicles, which is often mandated by state or local governments. The surcharge is typically a percentage of the rental fee and is intended to fund transportation infrastructure or other public services. Understanding this tax return is crucial for compliance and accurate financial reporting.

Steps to complete the Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge

Completing the Motor Vehicle Rental Surcharge Tax Return involves several key steps that ensure accuracy and compliance. First, gather all relevant rental transaction records, including invoices and receipts that detail the surcharge collected. Next, calculate the total surcharge amount based on the applicable rate for your jurisdiction. After that, fill out the tax return form with the required information, including your business details and the total surcharge amount. Finally, review the form for accuracy before submitting it to the appropriate tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Motor Vehicle Rental Surcharge Tax Return can vary depending on the state or local jurisdiction. Generally, businesses must submit this return quarterly or annually, depending on the amount of surcharge collected. It is essential to be aware of these deadlines to avoid penalties. Mark your calendar with the due dates for each filing period and ensure that you submit your return on time to maintain compliance.

Required Documents

To successfully file the Motor Vehicle Rental Surcharge Tax Return, several documents are typically required. These include detailed records of all rental transactions, including rental agreements, invoices, and receipts that show the surcharge collected. Additionally, you may need to provide your business identification number and any previous tax returns related to vehicle rentals. Having these documents organized will streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the requirements of the Motor Vehicle Rental Surcharge Tax Return can result in significant penalties. Common penalties include fines for late submissions, interest on unpaid surcharges, and potential legal action from tax authorities. To avoid these consequences, it is crucial to understand the filing requirements and deadlines associated with this tax return. Regularly reviewing compliance practices can help mitigate the risk of non-compliance.

State-specific rules for the Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge

Each state may have unique rules and regulations regarding the Motor Vehicle Rental Surcharge Tax Return. These rules can include varying surcharge rates, different filing frequencies, and specific documentation requirements. It is important for businesses to familiarize themselves with the regulations in their state to ensure compliance. Consulting with a tax professional or the state tax authority can provide clarity on these specific rules.

Quick guide on how to complete motor vehicle rental surcharge tax return auto rental surcharge

Effortlessly Prepare Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Modify and eSign Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge with Ease

- Obtain Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motor vehicle rental surcharge tax return auto rental surcharge

Create this form in 5 minutes!

How to create an eSignature for the motor vehicle rental surcharge tax return auto rental surcharge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Motor Vehicle Rental Surcharge Tax Return?

The Motor Vehicle Rental Surcharge Tax Return is a tax document that businesses must file to report and remit the surcharge collected from customers renting vehicles. This return ensures compliance with state regulations regarding auto rental surcharges. By using airSlate SignNow, you can easily prepare and eSign your Motor Vehicle Rental Surcharge Tax Return, streamlining the filing process.

-

How does airSlate SignNow help with Auto Rental Surcharge documentation?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning documents related to Auto Rental Surcharge. With our solution, you can efficiently manage your rental agreements and tax returns, ensuring all necessary documentation is in order. This helps businesses stay compliant and reduces the risk of errors in the Motor Vehicle Rental Surcharge Tax Return.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that simplify the preparation of the Motor Vehicle Rental Surcharge Tax Return and other essential documents. You can choose a plan that fits your budget while ensuring you have access to all necessary tools for managing Auto Rental Surcharge documentation.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax management software. This integration allows you to synchronize your data and streamline the process of filing your Motor Vehicle Rental Surcharge Tax Return. By connecting with your existing systems, you can enhance efficiency and ensure accurate reporting of Auto Rental Surcharge.

-

What features does airSlate SignNow offer for managing rental agreements?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools make it easy to create and manage rental agreements, ensuring compliance with Auto Rental Surcharge regulations. With our platform, you can focus on your business while we handle the complexities of the Motor Vehicle Rental Surcharge Tax Return.

-

How secure is the information shared through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information shared on our platform, including documents related to the Motor Vehicle Rental Surcharge Tax Return. You can trust that your data, including Auto Rental Surcharge details, is safe and secure with us.

-

Is there customer support available for airSlate SignNow users?

Absolutely! airSlate SignNow offers dedicated customer support to assist users with any questions or issues they may encounter. Whether you need help with the Motor Vehicle Rental Surcharge Tax Return or other features, our support team is ready to provide guidance and ensure a smooth experience with our platform.

Get more for Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge

Find out other Motor Vehicle Rental Surcharge Tax Return, Auto Rental Surcharge

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report