Mileage Reimbursement Form

What is the Mileage Reimbursement Form

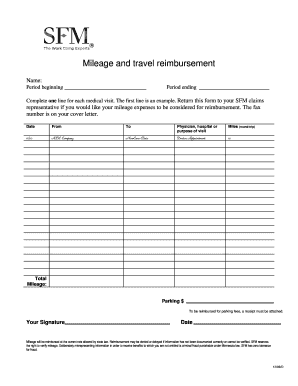

The mileage reimbursement form is a document used by employees to request compensation for travel expenses incurred while using their personal vehicles for business purposes. This form helps businesses track travel-related expenses and ensures that employees are reimbursed fairly for their mileage. It typically includes details such as the date of travel, purpose of the trip, starting and ending locations, and the total miles driven. By using this form, employers can maintain accurate records for accounting and tax purposes.

How to use the Mileage Reimbursement Form

Using the mileage reimbursement form involves several straightforward steps. First, employees should gather all necessary information related to their travel, including dates, destinations, and the purpose of each trip. Next, they should fill out the form with accurate details, ensuring that all required fields are completed. Once the form is filled out, it may need to be submitted to a supervisor or the finance department for approval. Depending on the organization’s policies, employees may submit the form digitally or in paper format. Keeping a copy of the submitted form is advisable for personal records.

Steps to complete the Mileage Reimbursement Form

Completing the mileage reimbursement form requires attention to detail. Here are the key steps:

- Begin by entering your personal information, including your name and employee ID.

- List the dates of travel and the corresponding destinations.

- Clearly state the purpose of each trip to justify the reimbursement.

- Calculate the total miles driven for each trip and provide the total mileage for the entire claim.

- Attach any necessary documentation, such as maps or odometer readings, if required by your employer.

- Review the completed form for accuracy before submission.

Legal use of the Mileage Reimbursement Form

The mileage reimbursement form is legally recognized when it adheres to specific guidelines. For a reimbursement claim to be valid, it must include accurate records of travel and comply with IRS regulations regarding business expenses. Employers should ensure that their reimbursement policies align with federal and state laws to prevent disputes. Properly executed forms can serve as evidence in case of audits or inquiries regarding travel expenses, making it essential to maintain thorough records and follow legal requirements.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that govern mileage reimbursement claims. According to IRS regulations, employers can reimburse employees for business-related travel at a standard mileage rate, which is updated annually. Employees must keep detailed records of their mileage, including the date, destination, and purpose of each trip. It is important to note that personal commuting miles are not eligible for reimbursement. Familiarity with these guidelines ensures compliance and helps prevent potential tax issues for both employees and employers.

Form Submission Methods

Submitting the mileage reimbursement form can be done through various methods, depending on company policies. Common submission methods include:

- Online Submission: Many organizations allow employees to submit forms digitally through internal systems or email.

- Mail: Employees may also send a printed version of the form via postal service to the appropriate department.

- In-Person: Some companies may require employees to submit forms directly to their supervisor or the finance office.

Understanding the preferred submission method can streamline the reimbursement process and ensure timely processing.

Quick guide on how to complete mileage reimbursement form

Complete Mileage Reimbursement Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Mileage Reimbursement Form on any interface using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Mileage Reimbursement Form seamlessly

- Access Mileage Reimbursement Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you would like to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Mileage Reimbursement Form while ensuring excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mileage reimbursement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mileage reimbursement form, and how can airSlate SignNow help?

A mileage reimbursement form is a document that employees use to request reimbursement for business-related travel expenses. airSlate SignNow simplifies this process by allowing you to create, send, and eSign mileage reimbursement forms easily, ensuring quick approval and payment.

-

How can I create a mileage reimbursement form using airSlate SignNow?

Creating a mileage reimbursement form with airSlate SignNow is simple. You can start with a customizable template and add relevant fields for distance, date, and other essential details. This allows for a streamlined process that saves time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for mileage reimbursement forms?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. Each plan includes access to features that simplify creating and managing mileage reimbursement forms, ensuring you get excellent value for your investment.

-

What are the benefits of using airSlate SignNow for mileage reimbursement forms?

Using airSlate SignNow for mileage reimbursement forms allows for a digital and efficient workflow. You can reduce paperwork, speed up processing times, and enhance tracking, leading to quicker reimbursements and increased employee satisfaction.

-

Can I integrate airSlate SignNow with other financial software for mileage reimbursement forms?

Absolutely! airSlate SignNow offers seamless integrations with various financial software to enhance your mileage reimbursement form process. This integration helps streamline data transfer and ensures that all financial records are updated automatically.

-

Are there any templates available for mileage reimbursement forms in airSlate SignNow?

Yes, airSlate SignNow provides a library of customizable templates for mileage reimbursement forms. These templates simplify the form creation process, allowing you to use pre-designed formats that meet your business requirements.

-

How secure is my data when using airSlate SignNow for mileage reimbursement forms?

Data security is a top priority for airSlate SignNow. We utilize advanced encryption and compliance protocols to protect your mileage reimbursement form data, ensuring that sensitive information remains safe and secure.

Get more for Mileage Reimbursement Form

Find out other Mileage Reimbursement Form

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation