Form IL AG990 IL Fill Online, Printable, Fillable 2024

What is the Form IL AG990?

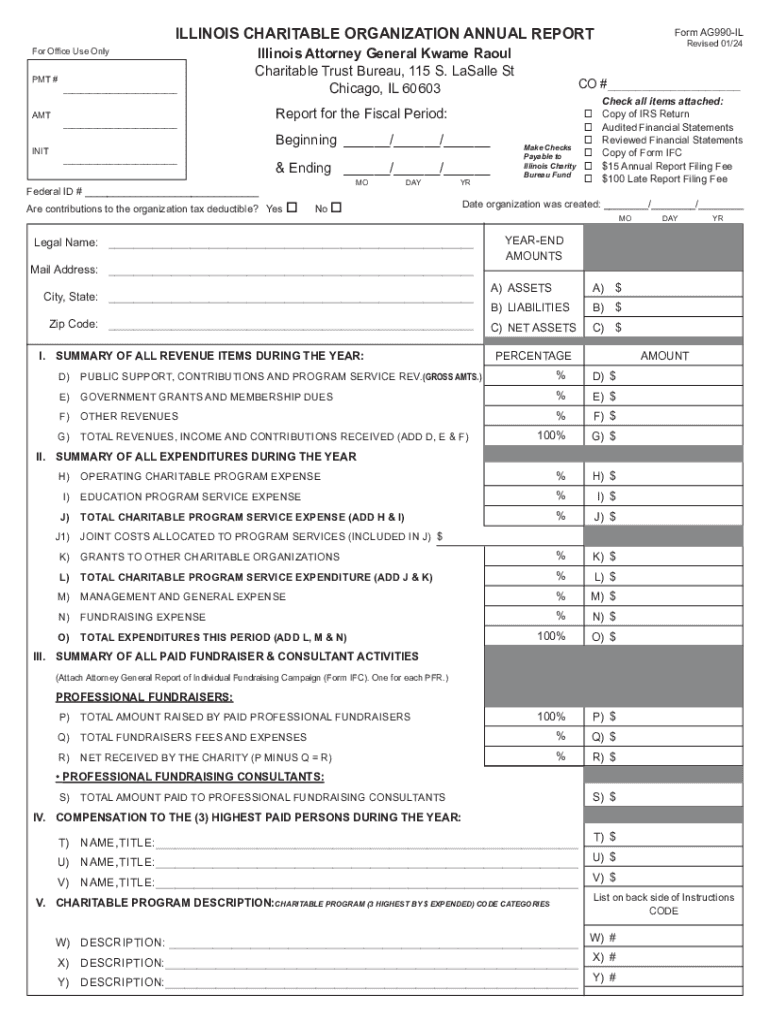

The Form IL AG990 is an important document used by charitable organizations in Illinois to report their annual activities and financial information to the Illinois Attorney General's office. This form is specifically designed for organizations that are registered as charitable entities under Illinois law. The form collects essential data about the organization's operations, including revenue, expenses, and program services, ensuring transparency and accountability in the nonprofit sector.

How to Use the Form IL AG990

To effectively use the Form IL AG990, organizations should first ensure they have all required financial records and documentation at hand. The form can be filled out online or printed for manual completion. When filling out the form, it is crucial to provide accurate and complete information, as this will be used to assess the organization's compliance with state regulations. After completing the form, organizations must submit it to the Illinois Attorney General's office by the specified deadline to avoid penalties.

Steps to Complete the Form IL AG990

Completing the Form IL AG990 involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Access the fillable form online or download it as a PDF.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Illinois Attorney General's office by the deadline.

Legal Use of the Form IL AG990

The legal use of the Form IL AG990 is mandated by Illinois law for all charitable organizations operating within the state. This form serves as a formal declaration of the organization's financial status and activities over the past year. Submitting this form is not only a legal requirement but also a best practice for maintaining transparency with donors and the public. Organizations that fail to file the form may face penalties, including fines or loss of their charitable status.

Filing Deadlines for the Form IL AG990

Organizations must be aware of the filing deadlines for the Form IL AG990 to ensure compliance. Typically, the form is due within six months after the end of the organization’s fiscal year. It is advisable for organizations to mark their calendars and prepare the necessary documentation well in advance to avoid last-minute complications.

Required Documents for the Form IL AG990

When completing the Form IL AG990, organizations must have several key documents ready, including:

- Financial statements, such as income and expense reports.

- Balance sheets detailing the organization’s assets and liabilities.

- Documentation of any significant changes in operations or financial status.

- Records of contributions and grants received during the reporting period.

Form Submission Methods for the IL AG990

The Form IL AG990 can be submitted through multiple methods to accommodate different organizational preferences. Organizations may choose to file the form online via the Illinois Attorney General's website, mail a printed copy to the appropriate office, or deliver it in person. Each method has its own requirements, so it is important to follow the specific instructions provided for the chosen submission method.

Quick guide on how to complete form il ag990 il fill online printable fillable

Prepare Form IL AG990 IL Fill Online, Printable, Fillable effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form IL AG990 IL Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Form IL AG990 IL Fill Online, Printable, Fillable with ease

- Find Form IL AG990 IL Fill Online, Printable, Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form IL AG990 IL Fill Online, Printable, Fillable and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il ag990 il fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the form il ag990 il fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ag990 il fillable form?

The ag990 il fillable form is a specific document designed for Illinois businesses to streamline their processes. It allows users to fill out necessary information electronically, making it easier to manage and submit. With airSlate SignNow, you can easily create and send this form for eSignature.

-

How can I create an ag990 il fillable form using airSlate SignNow?

Creating an ag990 il fillable form with airSlate SignNow is simple. You can start by uploading your document, then use our intuitive editor to add fillable fields. Once your form is ready, you can send it out for signatures directly from the platform.

-

Is there a cost associated with using the ag990 il fillable form?

Yes, there is a cost associated with using the ag990 il fillable form through airSlate SignNow. However, our pricing plans are designed to be cost-effective, ensuring that businesses of all sizes can access essential features. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow offer for the ag990 il fillable form?

airSlate SignNow offers a variety of features for the ag990 il fillable form, including customizable templates, eSignature capabilities, and secure cloud storage. Additionally, you can track the status of your documents in real-time, ensuring a smooth workflow.

-

Can I integrate the ag990 il fillable form with other applications?

Absolutely! airSlate SignNow allows you to integrate the ag990 il fillable form with various applications such as Google Drive, Dropbox, and CRM systems. This integration enhances your workflow and ensures that all your documents are easily accessible.

-

What are the benefits of using the ag990 il fillable form?

Using the ag990 il fillable form offers numerous benefits, including increased efficiency and reduced paperwork. It simplifies the process of collecting information and obtaining signatures, allowing your business to save time and resources. Additionally, it enhances accuracy by minimizing manual entry errors.

-

Is the ag990 il fillable form secure?

Yes, the ag990 il fillable form is secure when using airSlate SignNow. We prioritize data security and compliance, employing encryption and secure storage to protect your information. You can confidently send and receive documents knowing that your data is safe.

Get more for Form IL AG990 IL Fill Online, Printable, Fillable

Find out other Form IL AG990 IL Fill Online, Printable, Fillable

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA