ILLINOIS CHARITABLE ORGANIZATION ANNUAL 2024-2026

What is the Illinois Charitable Organization Annual Report?

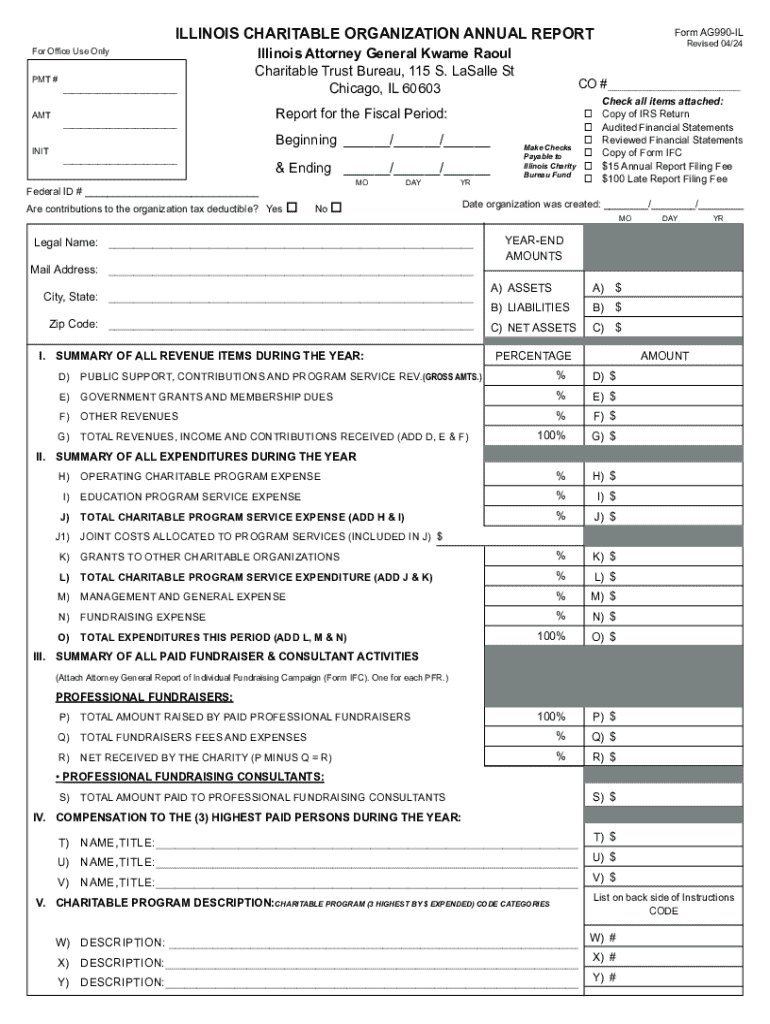

The Illinois Charitable Organization Annual Report, commonly referred to as the AG990 IL, is a mandatory document that charitable organizations operating in Illinois must file annually. This form provides essential information about the organization’s financial activities, governance, and overall operations during the fiscal year. It is designed to ensure transparency and accountability, allowing the Illinois Attorney General to monitor charitable organizations and protect the interests of the public.

Steps to Complete the Illinois Charitable Organization Annual Report

Completing the AG990 IL fillable form involves several key steps:

- Gather Required Information: Collect financial statements, a list of board members, and details about your organization's activities.

- Fill Out the Form: Access the AG990 IL fillable form online. Enter the required information accurately, ensuring all sections are completed.

- Review for Accuracy: Double-check all entries for errors or omissions. Accurate reporting is crucial to avoid penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—based on your organization’s preference.

Filing Deadlines / Important Dates

Organizations must file the AG990 IL by the 15th day of the fifth month following the end of their fiscal year. For example, if your fiscal year ends on December 31, the report is due by May 15 of the following year. It is essential to adhere to these deadlines to avoid potential penalties and maintain good standing with the Illinois Attorney General's office.

Legal Use of the Illinois Charitable Organization Annual Report

The AG990 IL serves as a legal document that fulfills the reporting requirements set forth by the Illinois Charitable Trust Act. Filing this report is not only a legal obligation but also a means to demonstrate compliance with state regulations. Organizations that fail to submit the AG990 IL may face legal repercussions, including fines or loss of charitable status.

Key Elements of the Illinois Charitable Organization Annual Report

The AG990 IL includes several critical components that organizations must complete:

- Organization Information: Name, address, and contact details of the charitable organization.

- Financial Overview: Summary of income, expenses, and net assets.

- Program Services: Description of the programs and activities conducted during the year.

- Board of Directors: List of current board members and their roles within the organization.

Who Issues the Form?

The Illinois Attorney General's office is responsible for issuing and overseeing the AG990 IL form. This office ensures that charitable organizations comply with state laws and regulations, promoting transparency and ethical practices within the charitable sector. Organizations can find guidance and additional resources related to the AG990 IL on the Attorney General's official website.

Quick guide on how to complete illinois charitable organization annual

Handle ILLINOIS CHARITABLE ORGANIZATION ANNUAL effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary features to create, modify, and eSign your documents swiftly without delays. Manage ILLINOIS CHARITABLE ORGANIZATION ANNUAL on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign ILLINOIS CHARITABLE ORGANIZATION ANNUAL with ease

- Find ILLINOIS CHARITABLE ORGANIZATION ANNUAL and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign ILLINOIS CHARITABLE ORGANIZATION ANNUAL to ensure smooth communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois charitable organization annual

Create this form in 5 minutes!

How to create an eSignature for the illinois charitable organization annual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ag990 il fillable form?

The ag990 il fillable form is a specific document designed for Illinois businesses to streamline their processes. It allows users to fill out necessary information electronically, ensuring accuracy and efficiency. By using the ag990 il fillable form, businesses can save time and reduce errors associated with manual entry.

-

How can I access the ag990 il fillable form?

You can easily access the ag990 il fillable form through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the ag990 il fillable form. This user-friendly interface makes it simple to find and utilize the form you need.

-

Is there a cost associated with using the ag990 il fillable form?

Using the ag990 il fillable form is part of the airSlate SignNow subscription plans, which are designed to be cost-effective for businesses of all sizes. Pricing varies based on the features and number of users, but you can expect competitive rates that provide great value. Check our pricing page for more details on plans that include the ag990 il fillable form.

-

What features does the ag990 il fillable form offer?

The ag990 il fillable form includes features such as electronic signatures, customizable fields, and secure storage. These features enhance the usability of the form, making it easier for users to complete and submit their documents. Additionally, the form can be integrated with other tools to streamline your workflow.

-

Can I integrate the ag990 il fillable form with other software?

Yes, the ag990 il fillable form can be integrated with various software applications to enhance your business processes. airSlate SignNow supports integrations with popular tools like Google Drive, Dropbox, and CRM systems. This flexibility allows you to manage your documents more efficiently.

-

What are the benefits of using the ag990 il fillable form?

Using the ag990 il fillable form offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. By digitizing the form, businesses can expedite their processes and minimize the risk of errors. Additionally, the ability to eSign documents enhances the overall experience for both businesses and clients.

-

Is the ag990 il fillable form secure?

Absolutely! The ag990 il fillable form is designed with security in mind. airSlate SignNow employs advanced encryption and security protocols to protect your data and ensure that your documents are safe from unauthorized access. You can confidently use the ag990 il fillable form knowing your information is secure.

Get more for ILLINOIS CHARITABLE ORGANIZATION ANNUAL

- Sheetrock drywall contract for contractor maryland form

- Flooring contract for contractor maryland form

- Maryland new home construction contract maryland form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract maryland form

- Notice of intent to enforce forfeiture provisions of contact for deed maryland form

- Final notice of forfeiture and request to vacate property under contract for deed maryland form

- Buyers request for accounting from seller under contract for deed maryland form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed maryland form

Find out other ILLINOIS CHARITABLE ORGANIZATION ANNUAL

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form