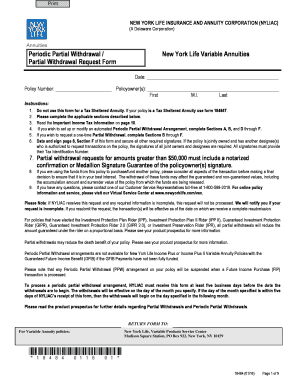

Do Not Use This Form for a Tax Sheltered Annuity 2016

Key elements of the New York Life Insurance Application Form

The New York Life Insurance application form is essential for individuals seeking to secure life insurance coverage. Understanding its key elements can simplify the application process. The form typically requires personal information, including:

- Full name: The applicant's legal name as it appears on identification.

- Date of birth: Necessary for determining age and eligibility.

- Social Security number: Used for identification and tax purposes.

- Contact information: Address, phone number, and email for correspondence.

- Beneficiary details: Information about individuals designated to receive benefits.

- Health history: Questions regarding medical conditions, medications, and lifestyle choices.

Completing these sections accurately is crucial for the timely processing of the application.

Steps to complete the New York Life Insurance Application Form

Filling out the New York Life Insurance application form involves several straightforward steps. Following this guide can help ensure that the process runs smoothly:

- Gather necessary documents: Collect identification, Social Security number, and health records.

- Complete personal information: Fill in your name, date of birth, and contact details accurately.

- Specify coverage needs: Indicate the type and amount of insurance coverage desired.

- Provide beneficiary information: Clearly list beneficiaries and their relationship to you.

- Answer health questions: Be honest about your medical history to avoid issues later.

- Review the application: Check for errors or omissions before submission.

- Submit the application: Follow the specified method for submission, whether online or by mail.

Taking the time to follow these steps can help facilitate a smoother application experience.

Eligibility Criteria for the New York Life Insurance Application Form

Eligibility for the New York Life Insurance application form is determined by several factors. Understanding these criteria can help applicants assess their qualifications:

- Age: Applicants typically must be at least eighteen years old.

- Residency: Must be a legal resident of the United States.

- Health status: Must meet specific health guidelines based on the insurer's standards.

- Financial need: Some policies may require proof of financial responsibility or need.

Reviewing these criteria before starting the application can save time and effort.

Required Documents for the New York Life Insurance Application Form

When filling out the New York Life Insurance application form, certain documents are essential to ensure completeness and accuracy. Applicants should prepare the following documents:

- Identification: A government-issued ID, such as a driver's license or passport.

- Social Security card: For verification of identity and eligibility.

- Medical records: Recent health assessments or reports may be required.

- Proof of income: Documents like pay stubs or tax returns to support financial assessments.

Having these documents ready can expedite the application process and reduce the chances of delays.

Form Submission Methods for the New York Life Insurance Application Form

Submitting the New York Life Insurance application form can be done through various methods, depending on the applicant's preference and the insurer's guidelines. Common submission methods include:

- Online submission: Completing the form through the official New York Life website for immediate processing.

- Mail: Printing the completed form and sending it to the designated address.

- In-person submission: Visiting a local New York Life office to submit the application directly.

Choosing the right method can enhance convenience and ensure timely processing of the application.

IRS Guidelines related to the New York Life Insurance Application Form

Understanding IRS guidelines is crucial when applying for life insurance. These guidelines can affect taxation and benefits associated with the New York Life Insurance application form. Key points include:

- Tax implications: Life insurance benefits are generally not subject to income tax for beneficiaries.

- Reporting requirements: Certain policies may require reporting on tax documents, especially if cash value is involved.

- Policy loans: Borrowing against a policy's cash value may have tax consequences if not managed correctly.

Familiarizing oneself with these guidelines can help applicants make informed decisions regarding their life insurance policies.

Quick guide on how to complete do not use this form for a tax sheltered annuity

Explore the simplified approach to handle your Do Not Use This Form For A Tax Sheltered Annuity

The traditional methods of filling out and approving documents consume an unreasonable amount of time when compared to contemporary document management tools. In the past, you would need to look for the right social forms, print them, fill in all the details, and mail them. Nowadays, you can obtain, fill out, and sign your Do Not Use This Form For A Tax Sheltered Annuity all within a single browser tab using airSlate SignNow. Preparing your Do Not Use This Form For A Tax Sheltered Annuity has never been more straightforward.

Steps to fill out your Do Not Use This Form For A Tax Sheltered Annuity with airSlate SignNow

- Access the category page relevant to you and locate your state-specific Do Not Use This Form For A Tax Sheltered Annuity. Alternatively, utilize the search bar.

- Verify that the version of the form is accurate by previewing it.

- Click Get form to enter editing mode.

- Fill in your document with the necessary information using the editing tools.

- Review the information added and select the Sign tool to validate your form.

- Choose the most convenient option to create your signature: generate it, draw your signature, or upload its image.

- Click DONE to apply changes.

- Download the document onto your device or proceed to Sharing settings to send it electronically.

Efficient online tools like airSlate SignNow make filling out and submitting your forms easier. Give it a try to discover how quickly document management and approval processes can actually be. You’ll save a signNow amount of time.

Create this form in 5 minutes or less

Find and fill out the correct do not use this form for a tax sheltered annuity

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the do not use this form for a tax sheltered annuity

How to generate an electronic signature for the Do Not Use This Form For A Tax Sheltered Annuity in the online mode

How to create an eSignature for the Do Not Use This Form For A Tax Sheltered Annuity in Google Chrome

How to generate an eSignature for signing the Do Not Use This Form For A Tax Sheltered Annuity in Gmail

How to make an electronic signature for the Do Not Use This Form For A Tax Sheltered Annuity right from your smartphone

How to generate an eSignature for the Do Not Use This Form For A Tax Sheltered Annuity on iOS devices

How to generate an electronic signature for the Do Not Use This Form For A Tax Sheltered Annuity on Android

People also ask

-

What is the new york life insurance application form?

The new york life insurance application form is a crucial document required to apply for life insurance coverage through New York Life. This form collects essential information about the applicant's health, financial situation, and preferences to help determine eligibility and premium rates.

-

How do I fill out the new york life insurance application form?

Filling out the new york life insurance application form involves providing personal details, such as your age, health history, and beneficiaries. It's important to answer all questions accurately, as this information will be used to assess your application and determine the terms of your policy.

-

What features does the new york life insurance application form offer?

The new york life insurance application form offers a user-friendly layout that simplifies the application process. With clear guidance and fields that are easy to understand, applicants can quickly and efficiently complete their submissions, ensuring a smoother overall experience.

-

Are there any fees associated with the new york life insurance application form?

Typically, there are no fees for submitting the new york life insurance application form itself. However, applicants should be aware of premium payments that will be required once their policy is approved and activated. It's advisable to inquire about any potential costs with your advisor.

-

What are the benefits of using the new york life insurance application form?

The primary benefit of using the new york life insurance application form is its streamlined process, which enhances efficiency and reduces the time required for policy approval. Additionally, having a structured format helps ensure that all necessary details are captured, improving the accuracy of your application.

-

How can I submit the new york life insurance application form?

You can submit the new york life insurance application form either online through the New York Life website or by mailing a physical copy to the designated office. Online submission is typically faster and allows you to track the status of your application more easily.

-

What integrations are available with the new york life insurance application form?

The new york life insurance application form can be integrated with various digital platforms to facilitate a smoother workflow. These integrations enhance data collection and management by enabling real-time updates and seamless communications between applicants and New York Life representatives.

Get more for Do Not Use This Form For A Tax Sheltered Annuity

- Tachs applicant record form

- Personal income tax checklist raincoastadvisors com form

- Ajs unlimited tanning coupons form

- Form dd 293

- Payroll contract template form

- Uia 1471 t protest of a redetermination michigan form

- Employee pledge form united way of central maryland uwcm

- Market service contract template form

Find out other Do Not Use This Form For A Tax Sheltered Annuity

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template