Federal Regulations Require the Office of Student Financial Aid to Use Financial Information from the FAFSA When

Understanding the Federal Regulations for Student Financial Aid

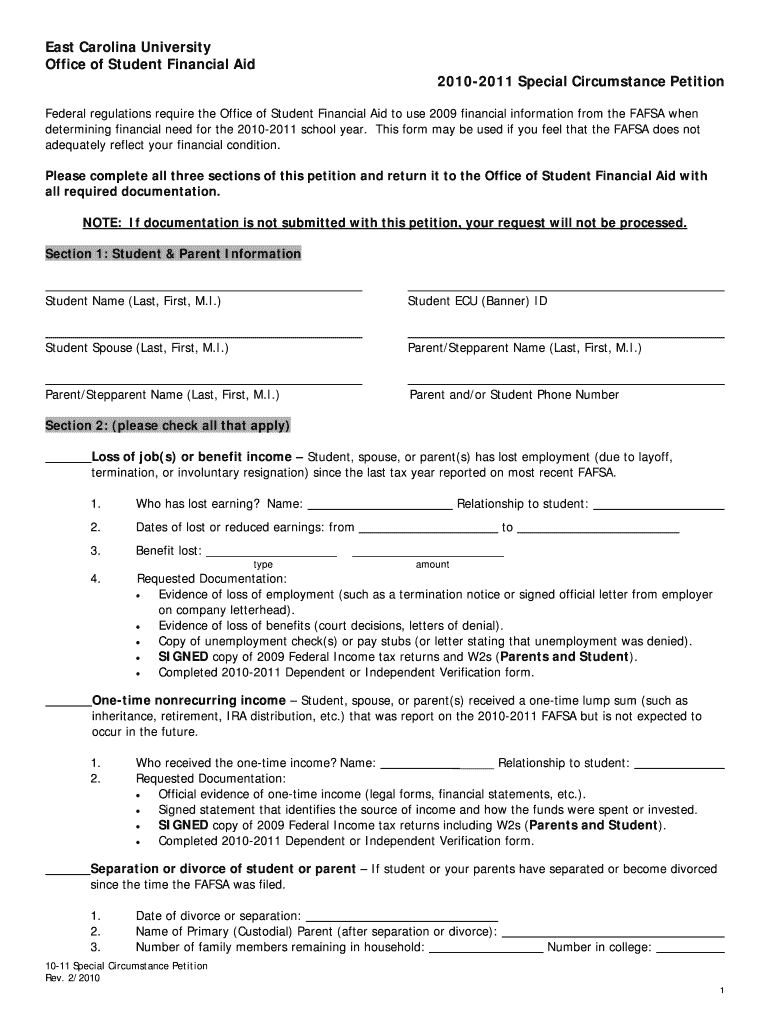

The Federal Regulations require the Office of Student Financial Aid to utilize financial information from the Free Application for Federal Student Aid (FAFSA) when determining a student's eligibility for federal financial aid. This regulation ensures that financial aid is allocated based on accurate and standardized financial data, allowing for fair access to educational resources.

Steps to Complete the FAFSA for Financial Aid

To comply with the Federal Regulations, students must follow specific steps when completing the FAFSA. First, gather necessary financial documents, including tax returns and income statements. Next, visit the official FAFSA website to create an account. Fill out the application form accurately, providing all required financial information. Review the application for any errors before submitting it. Once submitted, keep track of your application status and respond promptly to any requests for additional information from the Office of Student Financial Aid.

Key Elements Required in the FAFSA

When filling out the FAFSA, several key elements must be included to meet Federal Regulations. These include the student's and parents' Social Security numbers, tax information from the previous year, and details about any untaxed income. Additionally, students must provide information about the schools they wish to attend and their housing plans. Accurate completion of these elements is crucial for determining financial aid eligibility.

Legal Use of Financial Information from the FAFSA

The financial information collected through the FAFSA is protected under federal privacy laws. The Office of Student Financial Aid is legally obligated to use this information solely for the purpose of assessing financial aid eligibility. Misuse of this data can lead to legal consequences for both the institution and individuals involved. It is essential for students to understand their rights regarding the confidentiality of their financial information.

Required Documents for FAFSA Submission

To successfully submit the FAFSA, students need to prepare several documents. These typically include the previous year's tax returns, W-2 forms, and records of any untaxed income. Additionally, students may need to provide information about their bank statements and investment records. Having these documents ready will streamline the application process and ensure compliance with Federal Regulations.

Examples of Financial Situations Impacting FAFSA

Various financial situations can influence how the Office of Student Financial Aid uses information from the FAFSA. For instance, a student who has recently lost their job may qualify for additional aid due to a change in financial circumstances. Similarly, students from low-income families may receive more substantial financial support. Understanding these examples can help students navigate their financial aid options more effectively.

Quick guide on how to complete federal regulations require the office of student financial aid to use financial information from the fafsa when 12203794

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among enterprises and individuals alike. It serves as an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly and without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest method to alter and eSign [SKS] with minimal effort

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to finalize your changes.

- Choose how you wish to share your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and eSign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

Create this form in 5 minutes!

How to create an eSignature for the federal regulations require the office of student financial aid to use financial information from the fafsa when 12203794

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to student financial aid?

airSlate SignNow offers features that streamline the document signing process, which is crucial for compliance with federal regulations. Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing applications, and our platform ensures that all necessary documents are signed and stored securely.

-

How does airSlate SignNow ensure compliance with federal regulations?

Our platform is designed with compliance in mind, ensuring that all electronic signatures meet legal standards. Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When verifying student eligibility, and our solution helps maintain accurate records for audits.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various needs, from individual users to large institutions. Understanding that Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When managing financial aid, we provide cost-effective solutions that fit your budget.

-

Can airSlate SignNow integrate with other financial aid software?

Yes, airSlate SignNow seamlessly integrates with various financial aid management systems. This is particularly beneficial since Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing applications, allowing for a smooth workflow between systems.

-

What benefits does airSlate SignNow provide for financial aid offices?

airSlate SignNow enhances efficiency by reducing the time spent on paperwork and manual processes. Given that Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When determining aid eligibility, our solution helps streamline these processes, allowing staff to focus on student support.

-

Is airSlate SignNow secure for handling sensitive financial information?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Since Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When dealing with sensitive data, our platform ensures that all information is protected.

-

How can airSlate SignNow improve the student experience?

By simplifying the document signing process, airSlate SignNow enhances the overall student experience. As Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When processing aid, our user-friendly interface makes it easier for students to complete necessary paperwork quickly.

Get more for Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

- Recording of a transfer on death designation affidavit laws form

- Control number oh 036 78 form

- Transfer on death designation affidavit david smith ohio form

- Two individuals to one individual with alternative beneficiary form

- Control number oh 039 77 form

- Under ohio law an equine activity sponsor equine activity participant equine form

- Virginia mechanics lien law in construction faqs forms

- Two individuals to limited liability company form

Find out other Federal Regulations Require The Office Of Student Financial Aid To Use Financial Information From The FAFSA When

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement