MEASURE O SENIOR CITIZEN EXEMPTION CLAIM Form

What is the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM

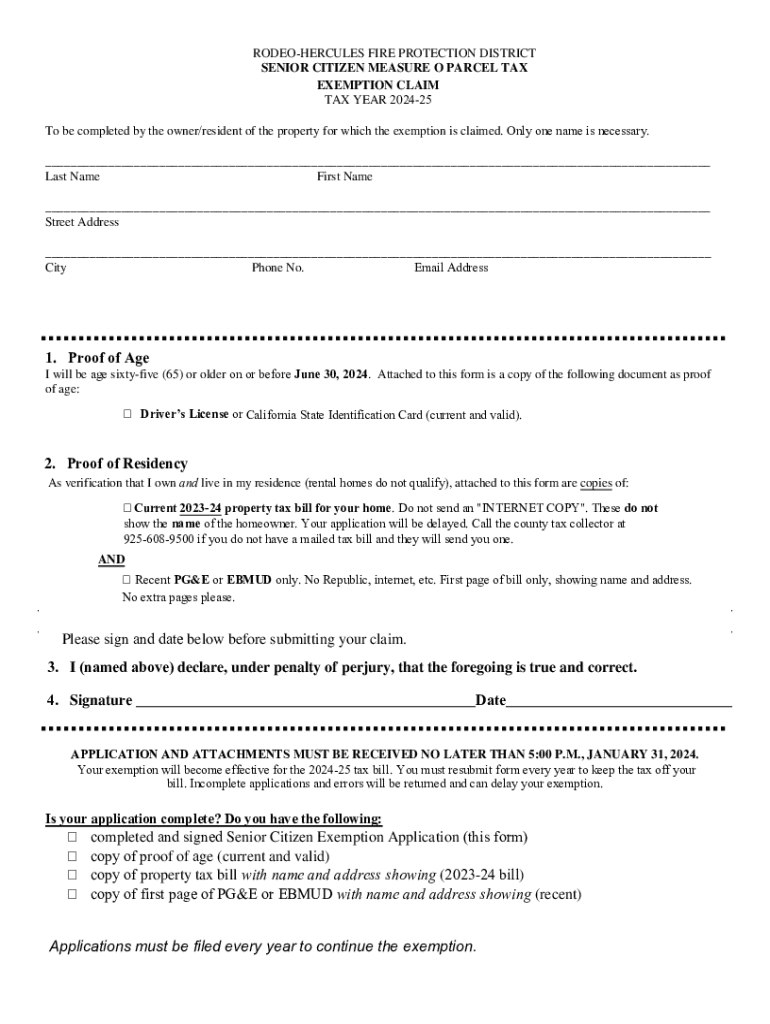

The MEASURE O SENIOR CITIZEN EXEMPTION CLAIM is a specific form designed to provide property tax relief to eligible senior citizens in certain jurisdictions. This exemption reduces the assessed value of a senior citizen's property, thereby lowering their property tax liability. The program aims to support older adults by making housing more affordable as they age, recognizing the fixed income many seniors may experience. Eligibility typically requires applicants to meet age, income, and residency criteria, which can vary by state or locality.

How to obtain the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM

To obtain the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM, individuals can usually access the form through their local tax assessor's office or the official website of their county or city government. Many jurisdictions offer downloadable versions of the form online, making it convenient for seniors to acquire the necessary documentation. In some cases, the form may also be available at community centers or senior service organizations, which can provide additional assistance in completing the claim.

Steps to complete the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM

Completing the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM involves several key steps:

- Gather required information: Collect personal identification details, proof of age, and income statements.

- Fill out the form: Provide accurate information as requested on the form, ensuring all sections are completed.

- Attach supporting documents: Include any necessary documentation that verifies eligibility, such as tax returns or bank statements.

- Review the form: Double-check all entries for accuracy and completeness to avoid delays.

- Submit the form: Follow the submission guidelines, which may include mailing the form, submitting it online, or delivering it in person.

Eligibility Criteria

Eligibility for the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM generally includes several criteria that applicants must meet:

- Age requirement: Applicants are typically required to be at least sixty-five years old.

- Income limits: Many jurisdictions impose income thresholds that must not be exceeded to qualify for the exemption.

- Residency: Applicants must usually be residents of the property for which they are claiming the exemption.

- Ownership: The property must be owned by the applicant, and it must be their primary residence.

Required Documents

When applying for the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM, applicants need to provide specific documentation to support their claim. Commonly required documents include:

- Proof of age, such as a birth certificate or government-issued ID.

- Income verification, which may include tax returns, Social Security statements, or pension documentation.

- Proof of residency, such as utility bills or a lease agreement.

- Property deed or title documents to confirm ownership.

Form Submission Methods

The MEASURE O SENIOR CITIZEN EXEMPTION CLAIM can typically be submitted through various methods, depending on local regulations:

- Online submission: Many jurisdictions offer an online portal for submitting the claim electronically.

- Mail: Applicants can send the completed form and supporting documents via postal service to their local tax assessor's office.

- In-person submission: Seniors may also choose to deliver the claim directly to the tax assessor's office for immediate processing.

Quick guide on how to complete measure o senior citizen exemption claim

Prepare MEASURE O SENIOR CITIZEN EXEMPTION CLAIM effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage MEASURE O SENIOR CITIZEN EXEMPTION CLAIM on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign MEASURE O SENIOR CITIZEN EXEMPTION CLAIM with ease

- Find MEASURE O SENIOR CITIZEN EXEMPTION CLAIM and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with specific tools that airSlate SignNow provides for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or errors that require new document prints. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign MEASURE O SENIOR CITIZEN EXEMPTION CLAIM and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the measure o senior citizen exemption claim

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

The MEASURE O SENIOR CITIZEN EXEMPTION CLAIM is a program designed to provide property tax relief to eligible senior citizens. This exemption can signNowly reduce the financial burden on seniors, allowing them to retain their homes while enjoying the benefits of reduced property taxes.

-

How can airSlate SignNow assist with the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM process?

airSlate SignNow simplifies the process of submitting your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM by allowing you to eSign and send necessary documents quickly and securely. Our platform ensures that your claims are processed efficiently, helping you take advantage of the exemption without unnecessary delays.

-

What features does airSlate SignNow offer for managing MEASURE O SENIOR CITIZEN EXEMPTION CLAIM documents?

With airSlate SignNow, you can easily create, edit, and manage documents related to your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. Our user-friendly interface allows you to track the status of your claims and receive notifications, ensuring you stay informed throughout the process.

-

Is there a cost associated with using airSlate SignNow for the MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

airSlate SignNow offers a cost-effective solution for managing your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. Our pricing plans are designed to fit various budgets, ensuring that you can access essential features without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for my MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM. Whether you use CRM systems or document management tools, our integrations streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Using airSlate SignNow for your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that your documents are securely signed and stored, giving you peace of mind throughout the exemption process.

-

How do I get started with airSlate SignNow for my MEASURE O SENIOR CITIZEN EXEMPTION CLAIM?

Getting started with airSlate SignNow for your MEASURE O SENIOR CITIZEN EXEMPTION CLAIM is simple. Sign up for an account, and you can begin creating and managing your documents right away. Our intuitive platform guides you through each step, making the process straightforward.

Get more for MEASURE O SENIOR CITIZEN EXEMPTION CLAIM

Find out other MEASURE O SENIOR CITIZEN EXEMPTION CLAIM

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT