FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name under Age 50 I Form

What is the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

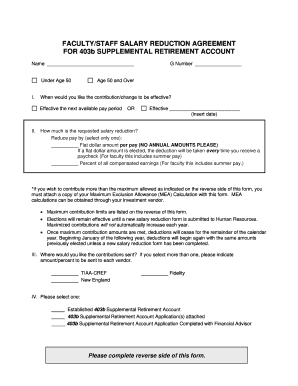

The FACULTYSTAFF SALARY REDUCTION AGREEMENT for a 403b supplemental retirement account is a legal document that allows eligible employees, specifically those under age fifty, to reduce their salary in order to contribute to a 403b retirement plan. This agreement is designed for faculty and staff members of educational institutions and certain non-profit organizations, enabling them to save for retirement while potentially reducing their taxable income. The contributions made through this agreement are typically pre-tax, which can lead to tax savings for the employee.

How to use the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

To effectively use the FACULTYSTAFF SALARY REDUCTION AGREEMENT, an employee should first review their eligibility and understand the contribution limits set by the IRS. Once confirmed, the employee needs to fill out the agreement form, specifying the amount they wish to contribute from their salary to the 403b account. After completing the form, it should be submitted to the appropriate human resources or payroll department for processing. It is essential to keep a copy of the agreement for personal records and future reference.

Steps to complete the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

Completing the FACULTYSTAFF SALARY REDUCTION AGREEMENT involves several straightforward steps:

- Review the eligibility criteria for the 403b plan to ensure compliance.

- Obtain the salary reduction agreement form from your institution's HR department or website.

- Fill in your personal information, including name, employee ID, and the desired contribution amount.

- Sign and date the agreement to validate your consent.

- Submit the completed form to your HR or payroll department for processing.

Key elements of the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

Important elements of the FACULTYSTAFF SALARY REDUCTION AGREEMENT include:

- Employee Information: Personal details such as name, employee ID, and contact information.

- Contribution Amount: The specific dollar amount or percentage of salary to be contributed to the 403b account.

- Effective Date: The date when the salary reduction will begin.

- Signature: Required for validation, indicating the employee's consent to the terms.

Eligibility Criteria

Eligibility for the FACULTYSTAFF SALARY REDUCTION AGREEMENT is generally determined by the employee's status within the institution. Typically, full-time faculty and staff members of qualifying educational or non-profit organizations can participate. Additionally, employees must be under age fifty to use this specific agreement, as it is designed to cater to younger employees who may have different retirement planning needs compared to those over fifty.

Legal use of the FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

The legal use of the FACULTYSTAFF SALARY REDUCTION AGREEMENT is governed by IRS regulations pertaining to 403b retirement plans. It is essential for employees to ensure that their contributions comply with the annual limits set by the IRS. Additionally, the agreement must be executed in accordance with the employer's policies and procedures to ensure its validity. Failure to adhere to these legal guidelines may result in penalties or disqualification from the retirement plan.

Quick guide on how to complete facultystaff salary reduction agreement for 403b supplemental retirement account name under age 50 i

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with everything required to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your alterations.

- Select how you want to submit your form, whether by email, SMS, or invite link, or choose to download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

Create this form in 5 minutes!

How to create an eSignature for the facultystaff salary reduction agreement for 403b supplemental retirement account name under age 50 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I?

A FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I is a legal document that allows eligible faculty and staff to allocate a portion of their salary to a 403b retirement account. This agreement helps in tax deferral and can signNowly enhance retirement savings.

-

How does the FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b work?

The FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b works by allowing employees to designate a specific amount of their salary to be contributed to their 403b account before taxes are deducted. This reduces their taxable income and helps in building a retirement fund effectively.

-

What are the benefits of using a FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b?

The benefits of using a FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b include tax savings, increased retirement savings, and the ability to grow investments tax-deferred. Additionally, it provides a structured way to save for retirement while enjoying the benefits of employer contributions.

-

Is there a cost associated with setting up a FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b?

Setting up a FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b typically does not incur direct costs for employees. However, there may be administrative fees associated with the 403b plan itself, which can vary by provider. It's advisable to review the plan details for any potential fees.

-

Can I change my contributions to the FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b?

Yes, you can change your contributions to the FACULTYSTAFF SALARY REDUCTION AGREEMENT for 403b at any time, subject to your employer's policies. This flexibility allows you to adjust your savings based on your financial situation and retirement goals.

-

What features does airSlate SignNow offer for managing FACULTYSTAFF SALARY REDUCTION AGREEMENTS?

airSlate SignNow offers features such as easy document creation, electronic signatures, and secure storage for managing FACULTYSTAFF SALARY REDUCTION AGREEMENTS. These tools streamline the process, making it efficient and user-friendly for both employees and administrators.

-

How does airSlate SignNow integrate with existing HR systems for FACULTYSTAFF SALARY REDUCTION AGREEMENTS?

airSlate SignNow seamlessly integrates with various HR systems, allowing for smooth data transfer and management of FACULTYSTAFF SALARY REDUCTION AGREEMENTS. This integration ensures that all employee information is up-to-date and accessible, enhancing overall efficiency.

Get more for FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

Find out other FACULTYSTAFF SALARY REDUCTION AGREEMENT FOR 403b SUPPLEMENTAL RETIREMENT ACCOUNT Name Under Age 50 I

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF