Guidelines for Individual Executors & Trustees Form

Understanding the Guidelines for Individual Executors and Trustees

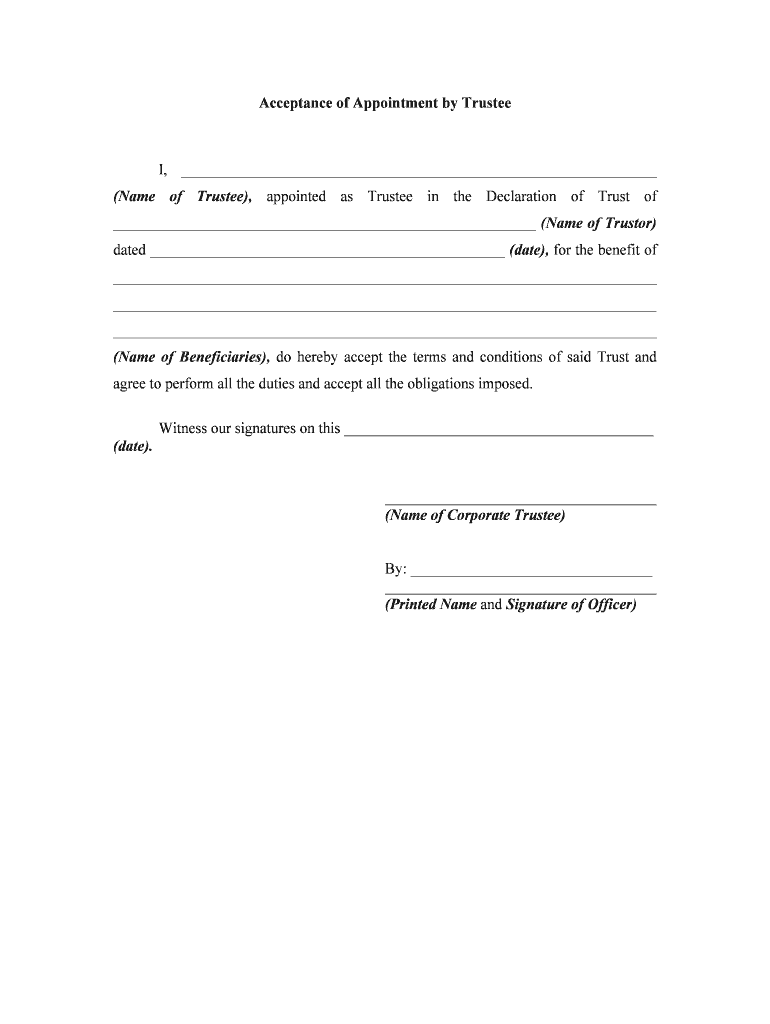

The Guidelines for Individual Executors and Trustees provide a framework for individuals appointed to manage the estate of a deceased person or to oversee a trust. These guidelines outline the responsibilities and duties of executors and trustees, ensuring that they act in the best interests of the beneficiaries while adhering to legal obligations. Executors are responsible for settling the deceased's estate, which includes paying debts, distributing assets, and filing necessary tax returns. Trustees, on the other hand, manage and administer the trust according to its terms and for the benefit of the beneficiaries.

Steps to Complete the Guidelines for Individual Executors and Trustees

Completing the Guidelines for Individual Executors and Trustees involves several key steps. First, individuals must carefully read and understand the guidelines to ensure compliance with legal requirements. Next, they should gather all necessary documents, including the will, trust documents, and any relevant financial records. After that, executors and trustees should create a detailed plan outlining how they will fulfill their duties, including timelines for completing tasks. Finally, they must document all actions taken and maintain clear records to provide transparency and accountability throughout the process.

Legal Use of the Guidelines for Individual Executors and Trustees

The legal use of the Guidelines for Individual Executors and Trustees is crucial for ensuring that all actions taken by executors and trustees are valid and enforceable. These guidelines comply with relevant state laws and regulations governing estate administration and trust management. It is essential for individuals to familiarize themselves with these laws, as they can vary significantly from state to state. By adhering to the guidelines, executors and trustees can minimize the risk of legal disputes and ensure that they are acting within their rights and responsibilities.

Key Elements of the Guidelines for Individual Executors and Trustees

Several key elements are central to the Guidelines for Individual Executors and Trustees. These include the identification of beneficiaries, the valuation of assets, the payment of debts and taxes, and the distribution of remaining assets. Additionally, the guidelines emphasize the importance of clear communication with beneficiaries throughout the process. Executors and trustees must also be aware of their fiduciary duties, which require them to act in good faith and with the utmost care and loyalty to the beneficiaries.

State-Specific Rules for the Guidelines for Individual Executors and Trustees

State-specific rules play a significant role in the application of the Guidelines for Individual Executors and Trustees. Each state has its own laws governing probate and trust administration, which can affect how executors and trustees must operate. It is important for individuals to consult their state’s probate court or a legal professional to understand the specific requirements and procedures that apply to their situation. This knowledge can help ensure compliance and facilitate a smoother administration process.

Required Documents for the Guidelines for Individual Executors and Trustees

To effectively implement the Guidelines for Individual Executors and Trustees, several documents are typically required. These may include the original will, trust agreements, death certificates, and any relevant financial statements. Additionally, executors may need to obtain court documents, such as letters testamentary, which grant them the authority to act on behalf of the estate. Proper documentation is essential for validating actions taken and ensuring that all legal requirements are met.

Quick guide on how to complete guidelines for individual executors ampamp trustees

Prepare Guidelines For Individual Executors & Trustees effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Manage Guidelines For Individual Executors & Trustees on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Guidelines For Individual Executors & Trustees with ease

- Find Guidelines For Individual Executors & Trustees and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight vital sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Guidelines For Individual Executors & Trustees and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the main Guidelines For Individual Executors & Trustees when using airSlate SignNow?

The Guidelines For Individual Executors & Trustees involve understanding the responsibilities and legal frameworks surrounding document handling. With airSlate SignNow, you can ensure that all documents are securely signed and stored, complying with necessary regulations.

-

How does airSlate SignNow support the needs of Individual Executors & Trustees?

airSlate SignNow tailors its features to meet the unique needs of Individual Executors & Trustees by offering intuitive eSigning capabilities and document management tools. The platform simplifies processes, helping executors manage estate-related documents efficiently.

-

What pricing options are available for Individual Executors & Trustees using airSlate SignNow?

airSlate SignNow provides various pricing plans that cater to Individual Executors & Trustees, ensuring accessibility for all budgets. Explore our flexible pricing models that allow you to choose a plan that best fits your needs while adhering to the Guidelines For Individual Executors & Trustees.

-

What features of airSlate SignNow are most beneficial for Executors & Trustees?

Key features, such as custom templates, automated workflows, and multi-device access, are beneficial for Executors & Trustees. These features enable users to adhere to the Guidelines For Individual Executors & Trustees by streamlining document processes and enhancing regulatory compliance.

-

How can I integrate airSlate SignNow with other tools for Executors & Trustees?

airSlate SignNow offers seamless integrations with various third-party applications used by Executors & Trustees. This ability to integrate enhances productivity and ensures compliance with the Guidelines For Individual Executors & Trustees through cohesive document management systems.

-

Is airSlate SignNow secure for handling sensitive documents related to Executors & Trustees?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents linked to Executors & Trustees. Following the Guidelines For Individual Executors & Trustees, we ensure your documents are encrypted and securely stored to maintain confidentiality.

-

Can I collaborate with other Executors & Trustees using airSlate SignNow?

Yes, airSlate SignNow facilitates collaboration among Executors & Trustees. By allowing multiple users to access and manage documents, it supports the effective execution of the Guidelines For Individual Executors & Trustees, fostering teamwork in document handling.

Get more for Guidelines For Individual Executors & Trustees

Find out other Guidelines For Individual Executors & Trustees

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template