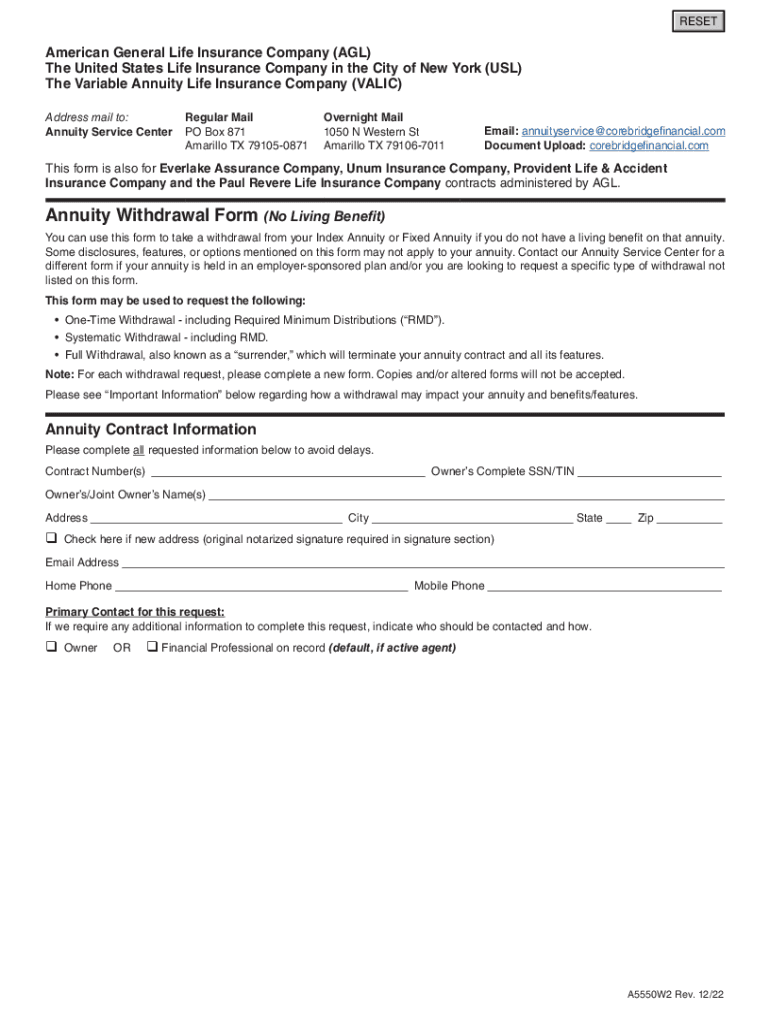

Annuity Withdrawal Form No Living Benefit

Understanding the Annuity Withdrawal Form Without Living Benefits

The general life annuity withdrawal form without living benefits is a specific document used by individuals to request withdrawals from their annuity contracts. Unlike other forms of annuities, this type does not provide ongoing payments to the annuitant in the event of their death. Understanding this form is crucial for individuals who want to manage their annuity funds effectively while being aware of the implications of withdrawing funds without the safety net of living benefits.

Steps to Complete the Annuity Withdrawal Form Without Living Benefits

Completing the general life insurance annuity withdrawal form involves several key steps:

- Gather necessary personal information, including your annuity contract number and identification details.

- Clearly indicate the amount you wish to withdraw, ensuring it aligns with the terms of your annuity contract.

- Provide any required documentation, such as proof of identity or additional forms as specified by your annuity provider.

- Review the form for accuracy, ensuring all information is complete and correct.

- Sign and date the form to validate your request.

Obtaining the Annuity Withdrawal Form Without Living Benefits

To obtain the general life insurance annuity withdrawal form, you can follow these methods:

- Visit the official website of your annuity provider, where you can often download the form directly.

- Contact customer service for your annuity company, who can send you the form via email or traditional mail.

- Check with your financial advisor, as they may have access to the form and can assist you in the process.

Legal Considerations for the Annuity Withdrawal Form Without Living Benefits

When using the general life annuity withdrawal form, it is essential to understand the legal implications. Withdrawals may impact your tax situation, as distributions from annuities can be subject to income tax. Additionally, if the withdrawal amount exceeds certain limits, penalties may apply. It is advisable to consult with a tax professional to ensure compliance with IRS guidelines and to understand how the withdrawal will affect your overall financial strategy.

Required Documents for the Annuity Withdrawal Form Without Living Benefits

When submitting the general life insurance annuity withdrawal form, you may need to include several documents to support your request:

- A copy of your government-issued identification, such as a driver's license or passport.

- Your annuity contract details, including the contract number and any previous correspondence related to your account.

- Any additional forms or documentation specified by your annuity provider to complete the withdrawal process.

Examples of Using the Annuity Withdrawal Form Without Living Benefits

There are various scenarios in which individuals may use the general life annuity withdrawal form. For instance, a retiree may decide to withdraw a portion of their annuity to cover unexpected medical expenses. Alternatively, someone may want to access funds for a major purchase, such as a home renovation. Each situation requires careful consideration of the financial and tax implications associated with the withdrawal.

Quick guide on how to complete annuity withdrawal form no living benefit

Complete Annuity Withdrawal Form No Living Benefit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Annuity Withdrawal Form No Living Benefit on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Annuity Withdrawal Form No Living Benefit with ease

- Obtain Annuity Withdrawal Form No Living Benefit and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and eSign Annuity Withdrawal Form No Living Benefit and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annuity withdrawal form no living benefit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a general life annuity withdrawal?

A general life annuity withdrawal refers to the process of accessing funds from a life annuity contract. This can be done through various methods, including lump-sum payments or periodic withdrawals. Understanding the terms and conditions of your annuity is crucial to ensure you maximize your benefits.

-

How can I initiate a general life annuity withdrawal?

To initiate a general life annuity withdrawal, you typically need to contact your annuity provider. They will guide you through the necessary paperwork and requirements. It's important to review your contract to understand any potential penalties or fees associated with the withdrawal.

-

Are there any fees associated with a general life annuity withdrawal?

Yes, there may be fees associated with a general life annuity withdrawal, depending on your contract terms. Some annuities impose surrender charges if you withdraw funds within a certain period. Always check your policy details to avoid unexpected costs.

-

What are the tax implications of a general life annuity withdrawal?

A general life annuity withdrawal can have tax implications, as the withdrawn amount may be subject to income tax. If you withdraw before the age of 59½, you might also incur an additional penalty. Consulting a tax advisor is recommended to understand your specific situation.

-

Can I withdraw from my general life annuity at any time?

While you can generally request a general life annuity withdrawal at any time, there may be restrictions based on your contract. Some annuities have specific withdrawal periods or limits. It's essential to review your contract for any such stipulations.

-

What are the benefits of a general life annuity withdrawal?

The primary benefit of a general life annuity withdrawal is the access to funds when needed, providing financial flexibility. Additionally, it allows you to manage your retirement income effectively. Understanding the benefits can help you make informed decisions about your financial future.

-

How does a general life annuity withdrawal affect my future payments?

A general life annuity withdrawal can impact your future payments, as withdrawing a signNow amount may reduce the remaining balance. This could lead to lower future income from the annuity. It's important to consider how much you withdraw to maintain a stable income stream.

Get more for Annuity Withdrawal Form No Living Benefit

Find out other Annuity Withdrawal Form No Living Benefit

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online