Irs Form 3903

What is the IRS Form 3903

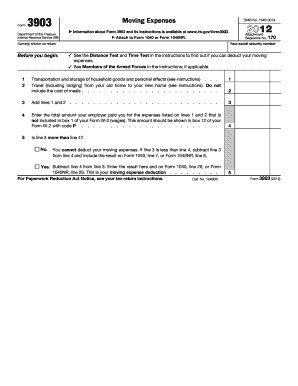

The IRS Form 3903 is used by taxpayers to claim the moving expenses deduction. This form allows individuals who have moved for work-related reasons to report their eligible moving costs and seek reimbursement or deduction on their tax returns. It is particularly relevant for employees who relocate due to a job change or for self-employed individuals who move their business operations. Understanding the purpose of this form is crucial for maximizing potential tax benefits related to moving expenses.

How to Use the IRS Form 3903

Using the IRS Form 3903 involves several steps. First, gather all relevant documents that detail your moving expenses, including receipts and invoices. Next, complete the form by entering your personal information and detailing the expenses incurred during your move. Ensure that you categorize your expenses correctly, as only certain costs are deductible. After filling out the form, it must be attached to your tax return when filing, whether electronically or by mail. It's essential to keep a copy of the completed form and all supporting documents for your records.

Steps to Complete the IRS Form 3903

Completing the IRS Form 3903 can be straightforward if you follow these steps:

- Gather necessary documentation, including receipts for moving expenses.

- Fill out your personal information at the top of the form.

- List your moving expenses in the appropriate sections, categorizing them as necessary.

- Calculate the total moving expenses and enter the total on the form.

- Review the form for accuracy before submitting it with your tax return.

Legal Use of the IRS Form 3903

The IRS Form 3903 must be used in compliance with IRS regulations. Taxpayers are responsible for ensuring that the expenses claimed are legitimate and fall within the guidelines set by the IRS. This includes understanding which moving expenses qualify for deduction and maintaining proper documentation to support the claims. Non-compliance can lead to penalties or disallowance of the deduction, so it is vital to adhere to the legal requirements associated with this form.

Filing Deadlines / Important Dates

When filing the IRS Form 3903, it's essential to be aware of important deadlines. Typically, the form must be submitted alongside your federal tax return, which is due on April fifteenth each year unless an extension is filed. If you are claiming moving expenses for the previous tax year, ensure that you meet this deadline to avoid penalties. Keeping track of these dates helps ensure that you can take advantage of the moving expense deduction without complications.

Required Documents

To successfully complete the IRS Form 3903, certain documents are required. These include:

- Receipts for moving expenses, such as transportation and storage costs.

- Invoices related to the move, including costs for packing and shipping personal items.

- Proof of employment change or business relocation documentation.

Having these documents ready will facilitate the accurate completion of the form and support your claims during tax filing.

Quick guide on how to complete irs form 3903

Effortlessly Complete Irs Form 3903 on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to efficiently create, edit, and electronically sign your documents without delays. Manage Irs Form 3903 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign Irs Form 3903 effortlessly

- Locate Irs Form 3903 and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just a few seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Irs Form 3903 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 3903

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 3903 and when do I need it?

IRS Form 3903 is used to claim a deduction for moving expenses incurred due to a job change. You will need this form when you move to a new home in connection with starting a new job or transferring to a new location. Filling out IRS Form 3903 can help reduce your taxable income, making it an important document for eligible taxpayers.

-

How can airSlate SignNow help with IRS Form 3903?

airSlate SignNow provides an efficient platform to electronically sign and send IRS Form 3903, simplifying the documentation process. With its user-friendly interface, you can quickly create, send, and track the progress of your form all in one place. This ensures your tax deductions are filed accurately and on time.

-

What are the pricing options for using airSlate SignNow for IRS Form 3903?

airSlate SignNow offers several pricing plans to cater to different needs, including individual and business subscriptions. Each plan provides access to eSigning features, document storage, and seamless integrations for filing your IRS Form 3903. You can choose a plan depending on your volume of use and additional features required.

-

Are there any integrations available with airSlate SignNow for IRS Form 3903?

Yes, airSlate SignNow integrates well with various applications like Google Drive, Dropbox, and other productivity tools. This allows you to easily manage your documents related to IRS Form 3903 alongside other essential files. These integrations enhance workflow efficiency and document accessibility.

-

What features does airSlate SignNow offer for managing IRS Form 3903?

airSlate SignNow includes features such as customizable templates, document sharing, and real-time collaboration. You can utilize these features to streamline the completion and submission of IRS Form 3903, making the entire process quick and straightforward. The platform ensures that all your documents are securely stored and easily retrievable.

-

Can I use airSlate SignNow on mobile devices for IRS Form 3903?

Absolutely! airSlate SignNow is available on both iOS and Android devices. This mobile capability allows you to fill out, sign, and send IRS Form 3903 from anywhere, providing the ultimate convenience for busy professionals. Whether you're at home or on the go, you can manage your important documents efficiently.

-

Is my data secure when using airSlate SignNow for IRS Form 3903?

Yes, airSlate SignNow prioritizes your security with advanced encryption protocols and data protection measures. All documents, including IRS Form 3903, are securely stored and shared only with authorized users. You can have peace of mind knowing that your sensitive tax information is safe.

Get more for Irs Form 3903

Find out other Irs Form 3903

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template