Transient Occupancy Tax Los Angeles 2017

What is the Transient Occupancy Tax Los Angeles

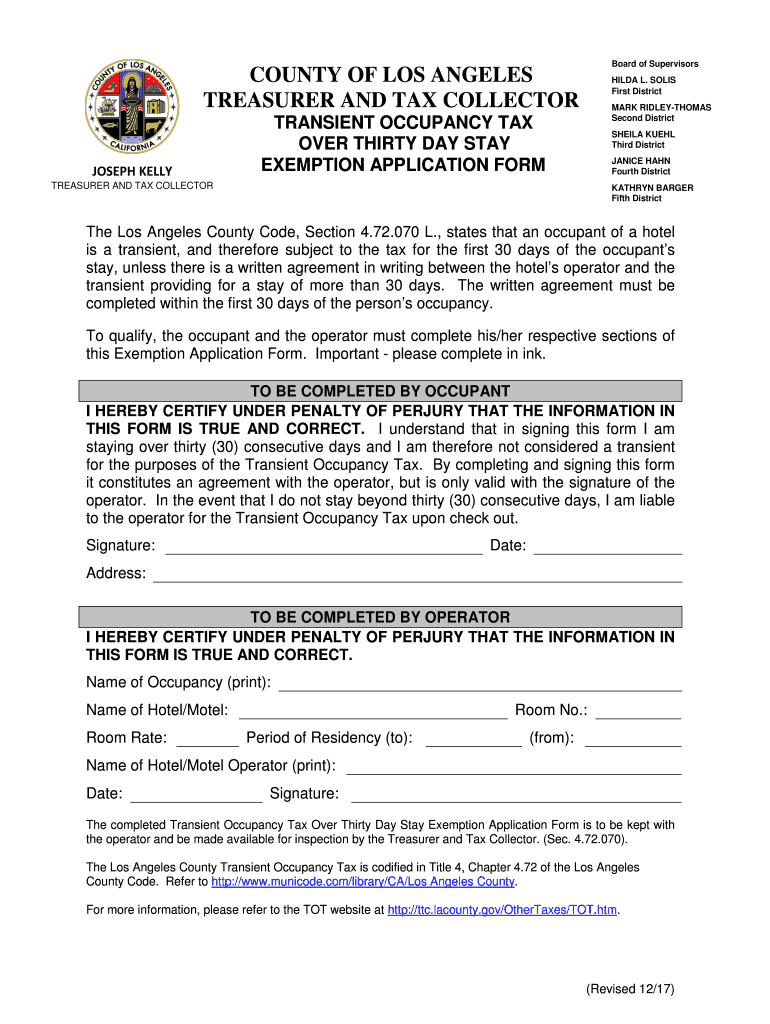

The transient occupancy tax in the city of Los Angeles is a tax imposed on individuals who rent lodging for a period of less than thirty days. This tax applies to hotels, motels, and other short-term rental accommodations. The revenue generated from this tax is used to fund various city services and initiatives, including tourism promotion and infrastructure improvements. Understanding this tax is essential for both property owners and guests to ensure compliance with local regulations.

Steps to complete the Transient Occupancy Tax Los Angeles

Filling out the city of Los Angeles transient occupancy tax form involves several key steps:

- Gather necessary information, including the rental property's address and the total number of nights rented.

- Access the transient occupancy tax form online or obtain a physical copy from the city’s tax office.

- Fill in the required fields accurately, ensuring to include all relevant details such as guest names and payment information.

- Review the completed form for accuracy to avoid any potential penalties or issues.

- Submit the form electronically or via mail to the appropriate city department.

Legal use of the Transient Occupancy Tax Los Angeles

To legally utilize the transient occupancy tax in Los Angeles, property owners must comply with city regulations. This includes registering their rental property with the city and obtaining a business license if necessary. Additionally, property owners should ensure that they are charging the correct tax rate and remitting the collected taxes to the city on time. Failure to adhere to these legal requirements can result in fines and other penalties.

Filing Deadlines / Important Dates

Property owners must be aware of specific deadlines for filing the transient occupancy tax form. Typically, the tax is due on a monthly basis, with forms required to be submitted by the last day of the month following the rental period. For example, if rentals occurred in January, the form would need to be submitted by the end of February. Staying informed about these deadlines is crucial to avoid late fees and ensure compliance.

Required Documents

When completing the transient occupancy tax form, property owners should have several documents on hand. These typically include:

- Rental agreements or contracts with guests.

- Records of the number of nights rented.

- Payment receipts or transaction records.

- Any previous tax filings for reference.

Having these documents readily available can streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The city of Los Angeles offers multiple methods for submitting the transient occupancy tax form. Property owners can choose to file online through the city’s official tax portal, which provides a convenient and efficient way to complete the process. Alternatively, forms can be mailed to the designated city department or submitted in person at local tax offices. Each method has its advantages, and property owners should select the one that best fits their needs.

Quick guide on how to complete over thirty day stay

Your assistance manual on how to prepare your Transient Occupancy Tax Los Angeles

If you’re wondering how to fill out and submit your Transient Occupancy Tax Los Angeles, here are a few concise instructions on how to simplify tax filing.

First, you simply need to create your airSlate SignNow profile to transform the way you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to modify, create, and finalize your income tax forms with simplicity. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to alter information as necessary. Enhance your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Transient Occupancy Tax Los Angeles in just a few minutes:

- Establish your account and begin working on PDFs within moments.

- Utilize our catalog to find any IRS tax form; browse through versions and schedules.

- Click Get form to access your Transient Occupancy Tax Los Angeles in our editor.

- Complete the mandatory fillable fields with your data (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please be aware that paper filing can lead to return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct over thirty day stay

FAQs

-

What are the best stories to prove that everything happens for a reason?

Miracles Happen –True story By Brian BoyleThey said that I was in God’s Hands because I was; I am living proof that miracles happen. My name is Brian Boyle, and this is my story.A month after I graduated high school in 2004, I was coming home from swim practice and was involved in a near fatal car accident with a dump truck.The impact of the crash violently ripped my heart across my chest, shattering my ribs/clavicle/pelvis, collapsing my lungs, damage to every single organ and failure of my kidneys and liver, removal of spleen and gallbladder, losing 60% of my blood, severe nerve damage to my left shoulder, and in a coma where I was on life support for over two months at Prince Georges Hospital Center in Cheverly, Maryland, USA.I don’t have a memory of the accident, or the few days before the day of the accident. The first thing that I remember after the collision, which is still so vivid in my mind even today, is being in this very large white tube. In this tube was a boy sitting to my left, and many other boys and girls on my right side (I use the term “boys and girls” because they appeared to be my age); I didn’t know why I was there or how I even got there in the first place.The more I sat there, the more I was able to visualize my surroundings. The boy to my left had a cell phone, and he asked me if I needed him to call anyone for me. I told him “yes, can you call my parents and tell them that I love them.” The next thing that I remember is waking up in a hospital bed, chemically paralyzed and hooked up to all these machines. Through all the buzzes and beeps going off from the medical equipment that was saving my life at that instant, I could hear my mom and dad telling me in between dramatic pauses of crying hysterically that I was going to be okay.Only moments before, I believe I was waiting in line to meet my final judgment, but it must have not been my time. Moments later, I had come back to life. This was just the beginning of my suffering.I died eight times while I was in the intensive care unit and even when I woke up from my coma, I couldn’t talk or communicate. The day that they knew that I would live, was the day that I either left my room in a wheelchair or a body bag. As far as the future, it didn’t exist. Walking was never going to happen again due to all the extreme injuries and because of the shattered pelvis. The thought of swimming was just that, only a thought. Just like my body, my dreams were shattered. But, I didn’t give up because I knew that God had a plan for me.After spending two months in a coma, 14 operations, 36 blood transfusions, 13 plasma treatments, I lost a total of 100 pounds and had to go to a rehabilitation center in Baltimore. I had to learn how to talk, eat, walk, shower, and live independently again. After that agonizing experience, I had to go to outpatient therapy in Waldorf, MD. After spending a few months in a wheelchair, I took baby steps to walk on my own. It was a miracle that I could walk again, but I wanted to prove the doctors wrong and not only walk, but run. After I accomplished that, I wanted to get back in the pool again. After a few lung tests, I was able to go in the pool a little bit each week.Before the accident I had three goals: to go to college, swim on the team, and compete in an ironman triathlon one day. After a few months of swimming a few laps here and there with my training partner and good buddy, Sam Fleming, I decided that I was not going to let my injuries stop me from living my dream, and six months after that I began my freshman year at St. Mary’s College of Maryland and also was one of the swimmers to watch on the team. It’s very easy to go through and list these facts and make it look like everything just seemed to easily fall in it’s own perfect little place, but the truth of the matter is that it didn’t. It wasn’t easy, not then, and not now. The pain and the agony was real and it existed all the way through, in the good times and the very bad. It was not an easy situation to be in where you’re laying in a bed, staring at the ceiling, knowing that your life is over while your looking at a priest give you the last rights. I thought to myself over and over, why this situation had to happen to me. I was always a good kid, received good grades in school, and went to church. Why would something as horrific as this happen to me? Why would God allow this? I went on and on for days asking why?And, then it hit me. All that thinking and pondering on the what-if scenario’s and the questionable doubt only stirred up another question – why was I saved? I didn’t have anymore questions after that. I know what my purpose in life finally is. With the 50 year life expectancy I was given from the doctors, I am just trying to live each day to the fullest and motivate and hopefully inspire other people, in their lives and in the faith. I have been labeled on several occasions that I am “Lazarus-like” because God brought me back to life. To inspire even more, I just successfully completed the Steelhead 70.3 half-ironman race in Michigan a few months ago, and was also given the inspirational athlete media slot to compete in the 2007 Ford Ironman World Championship where my story and race footage was broadcasted in the Ironman show premiere as the main feature on NBC on Dec. 1.My story is about the recovery and the comeback, but I want to make it much more than that, I want to make a positive impact on the world. I am just trying to live each day to the fullest and motivate and hopefully inspire other people through my endeavors to never give up on their dreams, and to never stop believing in their faith in God no matter how bad a situation is because Everything happens for a reason.Brian Boyle Photos Gallery::)

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

If you are in the USA and you allow someone to stay at your apartment for over thirty days is it true that they now have a right to stay unless you go to court and have them evicted?

The law is probably all over the map on this, but I can tell you that, as a police officer, if I saw someone had established functional residency in a dwelling, I was not willing to force them to leave. If they had clothes in closets, toiletries in the bathroom, and a space within the house considered theirs, where they had a reasonable expectation of privacy (able to shut/lock their bedroom door, and so on), I interpreted that situation as their living in that residence, and I was always unwilling to intervene. I can't adjudicate tenancy issues on the street behind a badge, and I wasn't about to throw someone out of their own house.I ran into this all the time as a police officer. One night a guy called and wanted me to throw a guy out of his house. The caller had allowed a homeless man to live in his mobile home for two weeks, but now wanted him gone. The man had all of his possessions in a bedroom he had been sleeping in the entire time. I had sympathy for the caller, because I would have wanted him gone too - he was completely deranged. When I asked the guy his name, he beat his chest and proclaimed, "I am the annunciation of Jesus Christ upon a dying world!!" (The call went south from there.) Even given that circumstance, this isn't a criminal issue - it's a civil issue. It's not trespassing, because you gave permission to establish residency, however transitory you thought it might be. Do they have a right to stay? I don't know - I'm not an attorney, and even if I were, it would depend on where you live. But as a police officer, I could not intervene in civil issues regarding property or residency, even if the answer was common sense or I actually wanted to get involved. I often got called with the hopes of having me forcibly remove the person in question - but it was never going to happen. All I could do was refer a complaintant in these cases to the Sheriff's Office for eviction protocol information or to a competent, licensed attorney for a discussion of their legal options. By the way, it doesn't matter whether they are or are not on the lease. You can have residency without being on a lease agreement.Beyond mediating the situation as a police officer between the two parties, my hands were completely tied. Thus, even though you may technically be in the right in certain circumstances, the process of actually getting them out might be somewhat delicate.

-

If we know the apocalypse is going to happen exactly 30 days from now, what steps would you take in preparation to increase your odds of survival? Why?

I love these types of questions.If we had thirty days to prepare for an all out apocalypse I'm going to assume that everyone else knows this warning as well. I'm also going to assume that society is still held together and the economy is still functioning during the 30 day period. I live in Australia.Firstly I would go on the Internet and order as many survival books and manuals on all sorts of topics of survival (fishing, farming, how to make ). For the first few days of the 30 days warning time, I would go around to my most trusted friends and family and I would ask around 15-20 to join me, I will only choose the most trusted. We would gather around and make a plan so the work of preparation is split evenly and we would each work efficiently. We would gather as many tools, seeds, dogs and equipment as we could possibly bring. We would probably purchase a truck to heavy lift our supplies. I wouldn't want to stay anywhere near populated centres as I know that they would collapse and would turn into bandit filled wastelands within months of the apocalypse. We would gather as many building tools and materials and drive as far away from the city and towns as we could. We would eventually signNow an area with a water source, some protection and wide open areas for farming and building. We would first, using our knowledge from books and job training (we may bring people who were previously builders), begin construction of a large wooden/stone building to serve as housing. We would sleep in tents and use the surrounding resources for water and building materials while the building was being built. While some of us would be building, others would be sowing the land and preparing to plant the seeds we brought with us. We would use our skills we learnt from books to keep warm and avoid deadly wild life (we're in S'traya after all) and stay safe from diseases (using the medicines and home made ). We would use the radio to listen and learn about what is occurring all over the world. I presume that by time the 30 days is over and the apocalypse had begun, we would be settling in and not dependant on technology for survival. For the next 6 months or so we would be living in the temporary dwellings (tents, caves) until the main building is completed, after that we would move in and begin to try make a normal life. We would harvest the crops we planted and we would begin to make ourselves completely self suffient. The dogs we brought could help us defend ourselves, and they could also help us hunt large wildlife (camels or escaped farm animals). After around a year or so when we were fully settled in, we would begin construction of new smaller houses around the large lodge, this is to give privacy to families and also to help maintain the fact that this is our new home. The large original building would become a communal 'town hall' and kitchen/ dining area. When we became 100% fully self suffient we would start to intercept wanderers and try to assimilate them into our tiny town. Rules would be extremely strict and very harshly enforced. In any society, law and order must be enforced or the society cannot function. As we would take in new survivors, we would need to filter them out (interviews and skill tests) so only the best and most stable individuals could join. Murder and any form of violence would be extremely harshly punished with some crimes leading to executions or exile. As our small society continues to take in more people, our housing areas and farming areas would also grow and we would need to expand our operating areas to ensure a supply of water and arable land. After we signNow a certain population, say 250, we would need to establish a 'government ' and 'taxing' system to ensure the long term survival of the town. The governing system would most likely be a democracy with a main council, which would consist of elected and trusted citizens, who would come up with laws. Normal citizens would gather in the de facto town hall (the original lodging) to vote for or against the decision or law. This would be the most effective and fair method of ruling a population that is this small.The economy of the town would be very interesting as it is a self sustaining but prospering town. In the first days of the colony , every townsperson needed to specialise in multiple trades (builder, farmer, hunter, raider) but as the population expanded, many of the people only needed to focus on one primary job. We would try to establish a currency system to make the economy run smoother and more efficiently (bottle caps anyone?). A person working a particular job, say hunter, would hunt animals and sell them to a builder who would give him some of the money he made from building a well, for example, which was commissioned and paid for by the 'government'. The hunter, with his newly earned bottle caps (money) would then go and buy clothes from a tailor (for example). Everyone would pay a percentage of their income to the government every so often in return for infrastructure, security and other benifits provided by the government. After around 20 or 30 years, many people would call our colony home, with its established economy, abundant resources, services and security it would be a utopia. Eventually there would be trade with other colonies or survivors who had also managed to make it through in a technology-less world. After this period of time, there would be many children born who would be educated by teachers and who would grow up to be productive and educated members of a free and democratic society. Maybe one day, long in the future, our colony will begin rediscovering how to build machines and electrical production, maybe it will be a home to hundreds of thousands of people and maybe the people of the region would unite their colonies to make countries with many of the modern infrastructure we have now. Who knows?I absolutely love this subject and I could keep going on all day if I could. Thanks for reading and I hope you enjoyed!

-

When is the 1st day to fill out the form for JoSAA’s special round?

First of all special round isn't organised by josaa it is organised by CSAB. And for that registration is going to start from 27th July 2017. For detailed schedule visit CSAB website.

Create this form in 5 minutes!

How to create an eSignature for the over thirty day stay

How to make an eSignature for your Over Thirty Day Stay in the online mode

How to generate an electronic signature for your Over Thirty Day Stay in Chrome

How to make an electronic signature for signing the Over Thirty Day Stay in Gmail

How to generate an electronic signature for the Over Thirty Day Stay straight from your smart phone

How to create an electronic signature for the Over Thirty Day Stay on iOS devices

How to make an electronic signature for the Over Thirty Day Stay on Android

People also ask

-

What is the city of Los Angeles transient occupancy tax form?

The city of Los Angeles transient occupancy tax form is a document that lodging operators are required to submit to collect taxes on temporary accommodations. This tax applies to hotels, motels, and short-term rentals in the city. Understanding this form is essential for compliance with local regulations.

-

How can airSlate SignNow help with the city of Los Angeles transient occupancy tax form?

airSlate SignNow streamlines the process of completing and submitting the city of Los Angeles transient occupancy tax form. Our platform allows you to fill out, eSign, and send documents efficiently, reducing paperwork and saving time. With our user-friendly interface, navigating tax forms becomes a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the city of Los Angeles transient occupancy tax form?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. While exact pricing may vary, our platform remains a cost-effective solution compared to traditional methods of handling the city of Los Angeles transient occupancy tax form. Investing in our services will ultimately save you time and improve your workflow.

-

What features does airSlate SignNow offer for managing the city of Los Angeles transient occupancy tax form?

Our platform includes features such as document templates, eSignature capabilities, and automated workflows specifically designed for forms like the city of Los Angeles transient occupancy tax form. These tools help ensure accuracy and compliance while making the document management process more efficient.

-

Does airSlate SignNow integrate with other software to assist with the city of Los Angeles transient occupancy tax form?

Absolutely! airSlate SignNow provides integrations with various accounting and property management systems. This means you can seamlessly incorporate your city of Los Angeles transient occupancy tax form management into your existing workflows, ensuring all data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for the city of Los Angeles transient occupancy tax form?

Using airSlate SignNow offers numerous benefits, including faster document turnaround times, reduced errors, and improved compliance with municipal regulations, especially for the city of Los Angeles transient occupancy tax form. Our platform also enhances security, ensuring your sensitive information is protected.

-

Can I access the city of Los Angeles transient occupancy tax form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully mobile-compatible, allowing you to access the city of Los Angeles transient occupancy tax form from any device. This flexibility enables you to manage and submit your tax forms while on the go, ensuring compliance without being tethered to a desk.

Get more for Transient Occupancy Tax Los Angeles

- Aetna prior authorization form 7655

- Acls megacode checklist form

- The biology of osmosis jones form

- Intacapital swiss form

- Modle autorisation paternelle algrie form

- Grant payment request calepa 220 california environmental calepa ca 43890057 form

- Architectural design contract template form

- Architectural photography contract template form

Find out other Transient Occupancy Tax Los Angeles

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form