Form MO CR Credit for Income Taxes Paid to Other States or Political Subdivisions 2023

Understanding the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

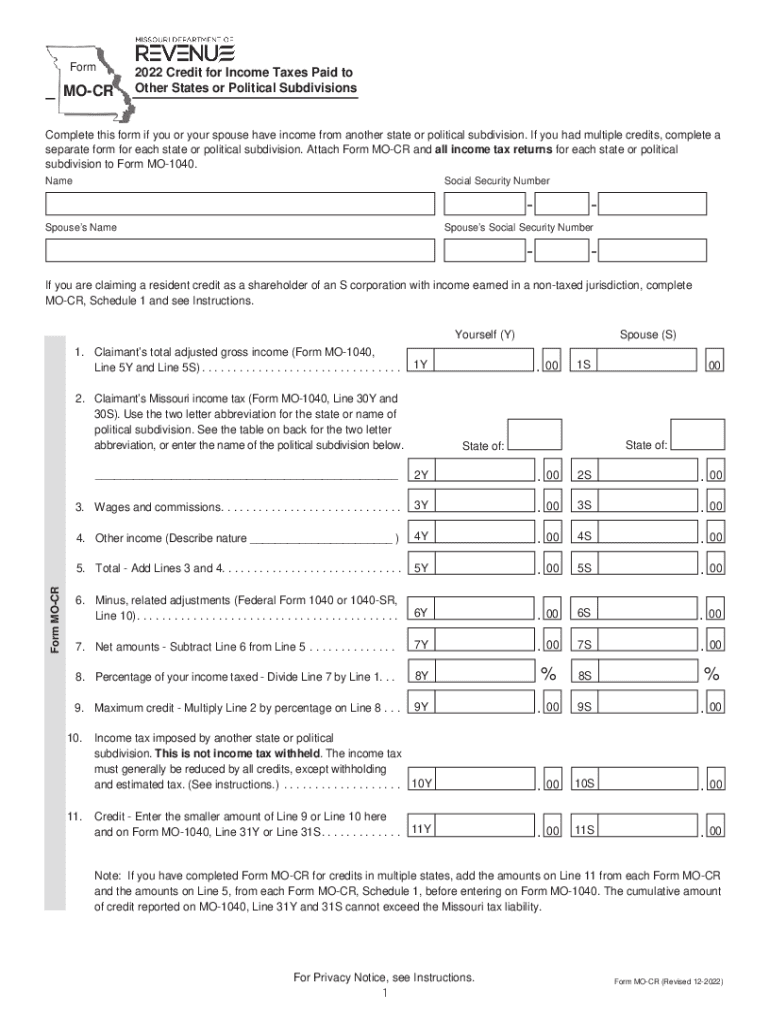

The Form MO CR is specifically designed for Missouri residents who have paid income taxes to other states or political subdivisions. This form allows taxpayers to claim a credit for those taxes, reducing their overall Missouri tax liability. It is essential for individuals who earn income in multiple jurisdictions to ensure they do not pay taxes twice on the same income.

How to Complete the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

Filling out the Form MO CR requires careful attention to detail. Taxpayers must provide information about their income, the taxes paid to other states, and the specific amounts they wish to claim as a credit. It is crucial to follow the instructions provided with the form closely to ensure accuracy and compliance with Missouri tax laws.

Eligibility Criteria for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

To qualify for the credit, taxpayers must be residents of Missouri and have paid income taxes to another state or political subdivision on income that is also subject to Missouri tax. Additionally, the income must be reported on the Missouri tax return to be eligible for the credit. Understanding these criteria helps taxpayers determine their eligibility before filing.

Required Documents for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

When completing the Form MO CR, taxpayers need to gather specific documents to support their claim. This includes proof of income earned in other states, tax returns from those states, and any payment receipts for taxes paid. Having these documents ready can streamline the filing process and ensure all necessary information is accurately reported.

Submission Methods for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

The Form MO CR can be submitted through various methods, including online filing through the Missouri Department of Revenue's website, by mail, or in person at designated tax offices. Each method has its own procedures and timelines, so taxpayers should choose the one that best fits their needs and ensure they meet any deadlines associated with their submission.

Common Mistakes to Avoid When Filing the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

When completing the Form MO CR, taxpayers often make common errors that can lead to delays or rejections. These mistakes include incorrect calculations of the credit, failure to attach required documentation, and missing signatures. By reviewing the form carefully and double-checking all entries, taxpayers can avoid these pitfalls and ensure a smoother filing experience.

Quick guide on how to complete form mo cr credit for income taxes paid to other states or political subdivisions 623940848

Complete Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions seamlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and electronically sign Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions effortlessly

- Obtain Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device you choose. Modify and electronically sign Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo cr credit for income taxes paid to other states or political subdivisions 623940848

Create this form in 5 minutes!

How to create an eSignature for the form mo cr credit for income taxes paid to other states or political subdivisions 623940848

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions is a tax form used by Missouri residents to claim a credit for income taxes paid to other states or political subdivisions. This form helps reduce the tax burden for individuals who earn income in multiple jurisdictions, ensuring they are not taxed twice on the same income.

-

How can airSlate SignNow help with Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

airSlate SignNow provides an efficient platform for businesses to prepare, send, and eSign Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions. With our user-friendly interface, you can streamline the document management process, making it easier to handle tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our cost-effective solutions ensure that you can manage Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for managing tax forms like Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing tax forms like Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions. These features enhance efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for handling Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easier to manage Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions alongside your existing tools. This integration helps streamline your workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

Using airSlate SignNow for Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions provides numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling sensitive documents like Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive documents such as Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions. You can trust that your information is safe while using our platform.

Get more for Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

- West virginia code chapter 31d article 14 dissolution form

- Coasts and seas of the united kingdom jncc adviser to form

- State of west virginia hereinafter referred to as the trustor whether one or form

- As provided in this agreement and the laws of the state of west virginia form

- Or to others for the consequences of the exercise and a dissenting trustee is not form

- Amendment to trustget free legal forms

- Assignment for value received the wvhdf form

- Name or names of person form

Find out other Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter