Form MO CR Credit for Income Taxes Paid to Other States or Political Subdivisions 2023

What is the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

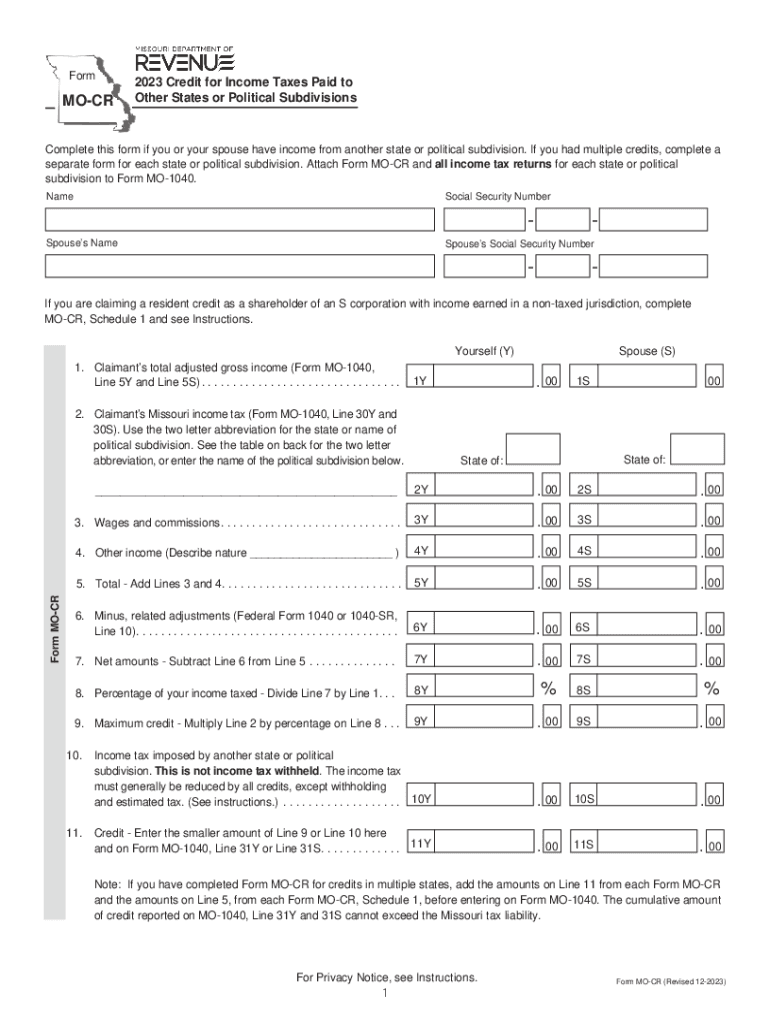

The Form MO CR is used by Missouri residents to claim a credit for income taxes paid to other states or political subdivisions. This credit helps to alleviate the burden of double taxation for individuals who earn income in multiple jurisdictions. By filing this form, taxpayers can receive a credit that reduces their Missouri tax liability, ensuring they are not taxed twice on the same income. Understanding the purpose of this form is essential for accurate tax reporting and maximizing potential refunds.

Steps to Complete the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

Completing the Form MO CR involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of taxes paid to other states. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Follow the instructions to report the amount of income earned in other states and the corresponding tax paid. Be sure to calculate the credit accurately based on the guidelines provided. Finally, review the form for completeness before submission.

Eligibility Criteria for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

To qualify for the credit claimed on Form MO CR, taxpayers must meet specific eligibility criteria. Primarily, individuals must be residents of Missouri and have paid income taxes to another state or political subdivision on income that is also taxable in Missouri. Additionally, the income must be reported on the Missouri tax return. It is essential to ensure that all income and tax payments are documented accurately to avoid issues during the filing process.

Required Documents for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

When filing the Form MO CR, certain documents are required to substantiate the claim. Taxpayers should prepare copies of tax returns filed with other states, including any schedules that detail income and taxes paid. Additionally, documentation such as W-2 forms, 1099 forms, or other income statements may be necessary to support the amounts reported on the form. Keeping thorough records will facilitate a smoother filing process and help in case of any inquiries from the Missouri Department of Revenue.

Filing Deadlines for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

Timely filing of the Form MO CR is crucial to ensure eligibility for the credit. The form must be submitted by the same deadline as the Missouri income tax return, typically April 15th of each year. If taxpayers need additional time, they may file for an extension, but they should be aware that any taxes owed must still be paid by the original deadline to avoid penalties and interest. Staying informed about filing deadlines helps taxpayers manage their tax obligations effectively.

Form Submission Methods for the Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

Taxpayers have several options for submitting the Form MO CR. The form can be filed electronically through the Missouri Department of Revenue's online portal, which offers a convenient and efficient method for submission. Alternatively, individuals may choose to mail the completed form to the appropriate address provided in the instructions. In-person submission is also an option at designated state tax offices. Each method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete form mo cr credit for income taxes paid to other states or political subdivisions

Complete Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Handle Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions with ease

- Find Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive content with functions that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or lost documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo cr credit for income taxes paid to other states or political subdivisions

Create this form in 5 minutes!

How to create an eSignature for the form mo cr credit for income taxes paid to other states or political subdivisions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo cr and how does it relate to airSlate SignNow?

Mo cr refers to the mobile capabilities of airSlate SignNow, allowing users to manage their documents on the go. With mo cr, you can easily send and eSign documents from your mobile device, ensuring that you never miss an opportunity to finalize important agreements.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is competitive and designed to fit various business needs. With mo cr features included, you can choose from different plans that offer flexibility and scalability, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides a range of features including eSigning, document templates, and real-time collaboration. The mo cr functionality enhances these features by allowing users to access and manage documents seamlessly from their mobile devices.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and more. This mo cr capability ensures that you can streamline your workflow and access your documents from multiple platforms effortlessly.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly improve your business's efficiency by reducing the time spent on document management. The mo cr features allow you to handle documents anytime, anywhere, which is essential for modern businesses that require flexibility.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. With mo cr, you can confidently manage sensitive documents on your mobile device without compromising security.

-

How does airSlate SignNow improve the signing process?

AirSlate SignNow simplifies the signing process by allowing users to eSign documents quickly and efficiently. The mo cr features enable you to complete signings on your mobile device, making it easier to finalize agreements without delays.

Get more for Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

- 9178pdf gr 107686 form

- Form epv generation guidelines software developer specifications

- Please see item description for information needed

- Quick guide united overseas bank form

- Use this schedule if form

- Alberta health care insurance plan notice of change forms

- Point of care test analyst application amp checklist mhds nv form

- Farmington high school guest dance pass homecoming form

Find out other Form MO CR Credit For Income Taxes Paid To Other States Or Political Subdivisions

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online