Form M 990t 2018

What is the Form M 990t

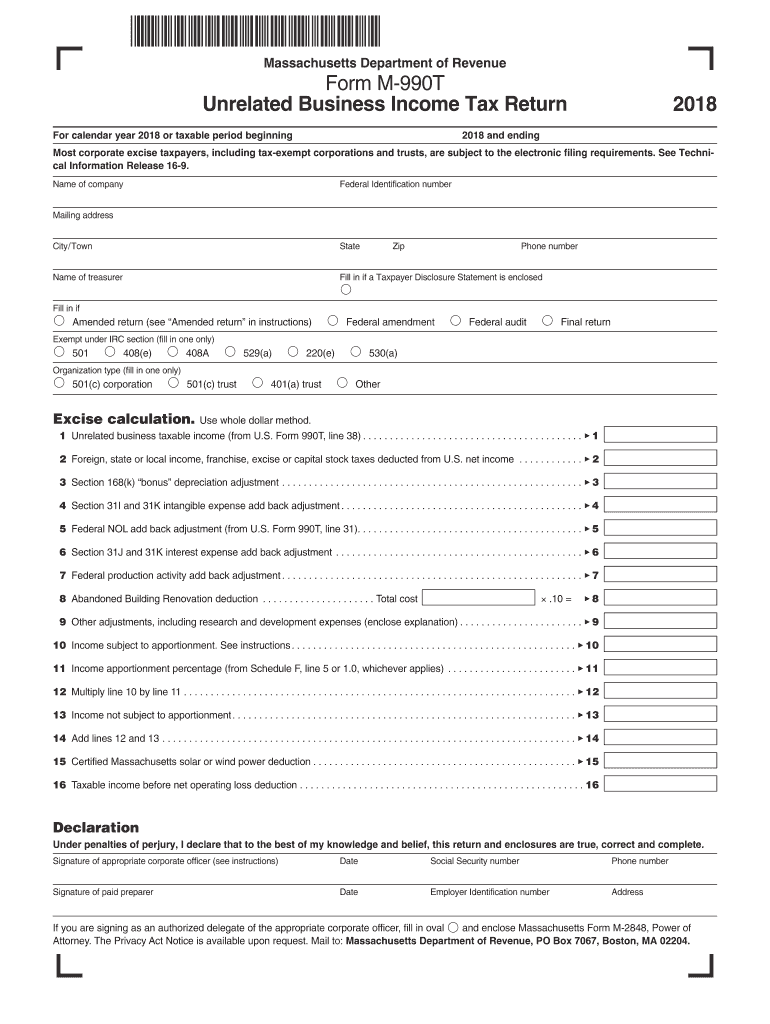

The Form M 990t is a tax return used by certain organizations in Massachusetts to report unrelated business income. This form is specifically designed for entities that are exempt from federal income tax but still generate income from activities that are not substantially related to their exempt purpose. The 2018 M 990t form allows these organizations to calculate and report their tax liability on that income, ensuring compliance with state tax laws.

How to use the Form M 990t

To use the Form M 990t effectively, organizations must first determine if they have any unrelated business income. This income may arise from activities such as advertising, rental income from properties, or sales of merchandise. Once the income is identified, organizations can complete the form by providing details of their income and expenses related to these activities. It is crucial to follow the instructions carefully to ensure accurate reporting and compliance with Massachusetts tax regulations.

Steps to complete the Form M 990t

Completing the Form M 990t involves several key steps:

- Gather all necessary financial records, including income statements and expense reports related to unrelated business activities.

- Fill out the identification section of the form, including the organization's name, address, and federal employer identification number (EIN).

- Report all unrelated business income in the appropriate sections of the form, ensuring that all figures are accurate and well-documented.

- Calculate any allowable deductions and expenses directly related to the unrelated business activities.

- Review the completed form for accuracy before signing and dating it.

Legal use of the Form M 990t

The legal use of the Form M 990t is essential for maintaining compliance with Massachusetts tax laws. Organizations must file this form if they have generated unrelated business income, as failure to do so may result in penalties or loss of tax-exempt status. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to audits or further legal implications.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form M 990t to avoid late fees and penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due on May fifteenth. Extensions may be available, but it is crucial to file for an extension before the original deadline to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form M 990t can be submitted through various methods, depending on the preferences of the organization. The form can be filed online through the Massachusetts Department of Revenue’s e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, organizations may choose to mail the completed form to the appropriate address provided by the state. In-person submissions may also be accepted at designated tax offices, but it is advisable to check local guidelines for specific instructions.

Quick guide on how to complete form m 990t unrelated business income tax return 2018

Your assistance manual on how to prepare your Form M 990t

If you’re wondering how to finalize and submit your Form M 990t, here are some straightforward directions to simplify your tax filing process.

First, you only need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to make changes whenever necessary. Optimize your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps outlined below to finish your Form M 990t in just a few minutes:

- Create your account and start processing PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through versions and schedules.

- Click Access form to launch your Form M 990t in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, checkmarks).

- Take advantage of the Signature Tool to append your legally-binding eSignature (if required).

- Review your document and correct any mistakes.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes using airSlate SignNow. Please keep in mind that submitting in paper form can elevate return mistakes and prolong refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form m 990t unrelated business income tax return 2018

FAQs

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the form m 990t unrelated business income tax return 2018

How to make an electronic signature for your Form M 990t Unrelated Business Income Tax Return 2018 in the online mode

How to generate an electronic signature for your Form M 990t Unrelated Business Income Tax Return 2018 in Google Chrome

How to generate an eSignature for putting it on the Form M 990t Unrelated Business Income Tax Return 2018 in Gmail

How to create an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2018 right from your mobile device

How to generate an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2018 on iOS devices

How to generate an eSignature for the Form M 990t Unrelated Business Income Tax Return 2018 on Android devices

People also ask

-

What is the significance of the 2018 m 990t form for businesses?

The 2018 m 990t form is crucial for organizations as it reports unrelated business taxable income to the IRS. Completing this form accurately ensures compliance with tax regulations and helps avoid penalties. Businesses using airSlate SignNow can easily manage and eSign documents related to their 2018 m 990t filings.

-

How can airSlate SignNow assist in preparing the 2018 m 990t?

airSlate SignNow simplifies the process of preparing the 2018 m 990t by allowing users to create, edit, and manage forms digitally. This leads to improved accuracy and efficiency in filing. With our easy-to-use interface, users can integrate their financial data seamlessly and keep track of all necessary documents.

-

What features does airSlate SignNow offer for managing the 2018 m 990t?

airSlate SignNow offers robust features such as eSignature, document templates, and real-time collaboration for managing the 2018 m 990t. These features streamline the document signing process, allowing stakeholders to review and sign documents easily. This enhances productivity and ensures timely submissions.

-

Is airSlate SignNow cost-effective for filing the 2018 m 990t?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the 2018 m 990t. With its flexible pricing plans, organizations can choose a plan that fits their budget and needs. The added efficiency and reduced paper usage also contribute to cost savings.

-

Can I integrate airSlate SignNow with other accounting software for the 2018 m 990t?

Absolutely! airSlate SignNow easily integrates with popular accounting software, facilitating the efficient handling of the 2018 m 990t. These integrations allow seamless data transfer, ensuring that all necessary information is accurately accounted for when completing the form.

-

How does airSlate SignNow ensure the security of my 2018 m 990t documents?

airSlate SignNow prioritizes security by utilizing encryption and secure storage for your 2018 m 990t documents. We implement robust security protocols to protect sensitive information, ensuring that your documents are safe from unauthorized access. You can conduct your business with peace of mind while using our platform.

-

What benefits does eSigning provide for the 2018 m 990t process?

ESigning with airSlate SignNow enhances the 2018 m 990t process by speeding up document turnaround times and reducing the need for physical handling of papers. This digital approach minimizes errors and ensures that all parties can quickly sign and return documents. It allows for a more efficient and hassle-free filing experience.

Get more for Form M 990t

Find out other Form M 990t

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online