M 990t 2019-2026

What is the M 990t?

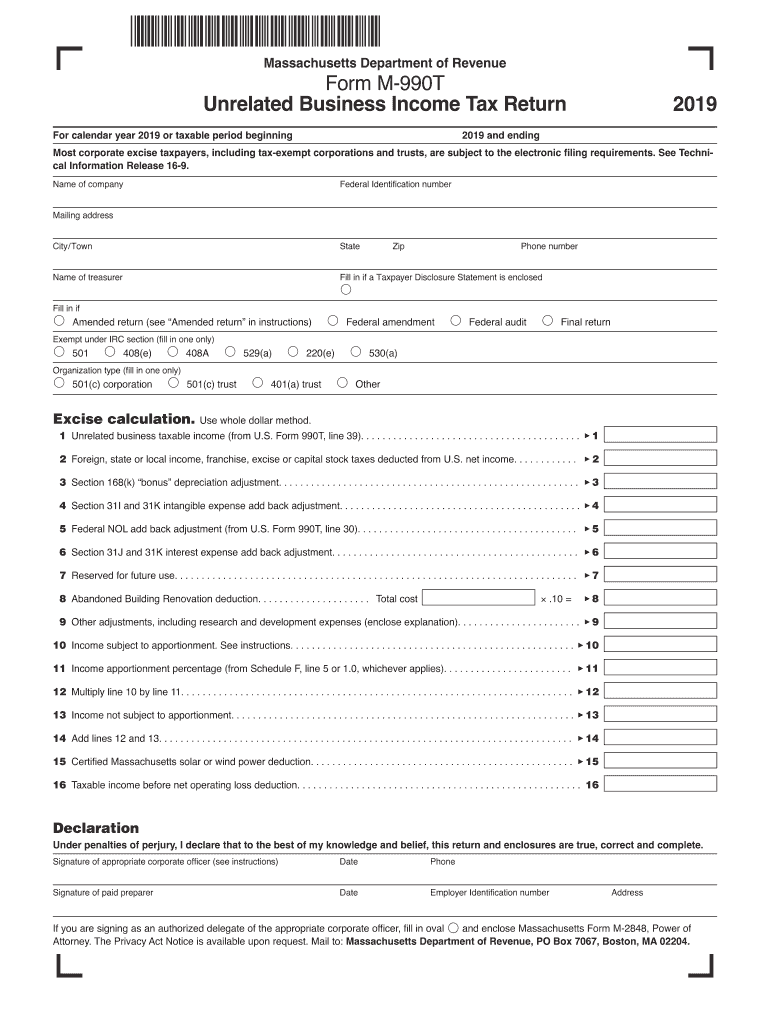

The M 990t is a tax form used in Massachusetts for reporting unrelated business income by tax-exempt organizations. This form is essential for organizations that generate income from activities not directly related to their primary exempt purpose. By filing the M 990t, these organizations ensure compliance with state tax regulations and accurately report their financial activities. The form helps the Massachusetts Department of Revenue (DOR) assess the tax liability of these entities based on their unrelated business income.

How to use the M 990t

Using the M 990t involves several steps to ensure accurate completion and submission. First, organizations must gather all necessary financial information related to their unrelated business activities. This includes income generated, expenses incurred, and any applicable deductions. Once the data is compiled, organizations can fill out the form, ensuring that all sections are completed accurately. It is crucial to review the form for any errors before submission. After completing the M 990t, organizations can file it electronically or by mail, adhering to the guidelines set by the Massachusetts DOR.

Steps to complete the M 990t

Completing the M 990t requires careful attention to detail. Follow these steps for successful submission:

- Gather all relevant financial documents, including income statements and expense records.

- Access the M 990t form from the Massachusetts DOR website or use a tax preparation software that supports this form.

- Fill in the organization’s identifying information, including name, address, and federal employer identification number (EIN).

- Report all unrelated business income and expenses in the appropriate sections of the form.

- Calculate the tax owed based on the reported income, applying any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the M 990t electronically or mail it to the designated address provided by the Massachusetts DOR.

Legal use of the M 990t

The legal use of the M 990t is governed by Massachusetts tax laws, which require tax-exempt organizations to report any unrelated business income. Filing this form is crucial for compliance with state regulations, as failure to do so can result in penalties. The M 990t serves as a formal declaration of income and ensures transparency in the financial activities of tax-exempt entities. Organizations must adhere to all filing requirements and deadlines to maintain their tax-exempt status and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the M 990t are critical for compliance. Typically, the form must be submitted by the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. It is important to be aware of any changes to deadlines, especially in light of state or federal extensions that may occur. Organizations should mark their calendars to ensure timely filing and avoid unnecessary penalties.

Required Documents

To complete the M 990t, organizations must have specific documents on hand. These include:

- Financial statements detailing income and expenses related to unrelated business activities.

- Documentation supporting any deductions claimed on the form.

- Previous year’s M 990t, if applicable, for reference and consistency.

- Any correspondence from the Massachusetts DOR regarding tax-exempt status or prior filings.

Having these documents ready can streamline the completion process and ensure accuracy in reporting.

Quick guide on how to complete form m 990t unrelated business income tax return 2019

Effortlessly Prepare M 990t on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Handle M 990t on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related operations today.

The easiest way to edit and electronically sign M 990t seamlessly

- Obtain M 990t and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or hide sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and press the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow tackles all your document management needs in just a few clicks from any device you choose. Edit and electronically sign M 990t and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m 990t unrelated business income tax return 2019

Create this form in 5 minutes!

How to create an eSignature for the form m 990t unrelated business income tax return 2019

How to create an eSignature for the Form M 990t Unrelated Business Income Tax Return 2019 in the online mode

How to generate an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2019 in Chrome

How to create an electronic signature for signing the Form M 990t Unrelated Business Income Tax Return 2019 in Gmail

How to generate an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2019 right from your smart phone

How to make an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2019 on iOS

How to make an electronic signature for the Form M 990t Unrelated Business Income Tax Return 2019 on Android devices

People also ask

-

What is the ma 990t tax and who needs to file it?

The ma 990t tax is a Massachusetts tax return required for certain tax-exempt organizations that generate unrelated business taxable income. Organizations such as nonprofits, charities, and other tax-exempt entities that earn income from non-related activities must file this form. Understanding the specifics of the ma 990t tax is crucial to ensuring compliance and avoiding penalties.

-

How can airSlate SignNow assist with filing the ma 990t tax?

airSlate SignNow provides an efficient platform for electronically signing and managing documents related to the ma 990t tax. By streamlining the document workflow, it allows organizations to gather signatures quickly and maintain compliance with filing requirements. This saves time and reduces headaches associated with traditional paper-based processes.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including those dealing with the ma 990t tax. Pricing levels range from individual to enterprise solutions, ensuring that organizations of all sizes can find an affordable option. This flexibility helps you manage costs effectively while ensuring access to essential features.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow comes with robust features designed for managing tax-related documents, including templates for the ma 990t tax filings and electronic signatures. These tools facilitate easy document preparation, enhance collaboration, and ensure that all necessary information is accurately captured. The result is a smoother, more efficient filing process.

-

Is airSlate SignNow compliant with Massachusetts tax regulations?

Yes, airSlate SignNow is compliant with Massachusetts tax regulations, including requirements for the ma 990t tax filing process. Its secure platform ensures that all data is handled according to legal standards, protecting sensitive information. This compliance gives organizations peace of mind as they manage their tax documents.

-

What are the benefits of using airSlate SignNow for the ma 990t tax?

Using airSlate SignNow for the ma 990t tax provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for faster turnaround times when obtaining signatures, which can lead to quicker filing and fewer penalties. Its intuitive interface ensures that users can easily navigate the process, making tax compliance straightforward.

-

Does airSlate SignNow integrate with accounting software for tax management?

Yes, airSlate SignNow offers integrations with various accounting software solutions to assist with tax management, including the ma 990t tax. This integration allows users to import data, streamline document preparation, and ensure accurate filings. Such compatibility makes it easier for organizations to manage their entire tax process seamlessly.

Get more for M 990t

Find out other M 990t

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template