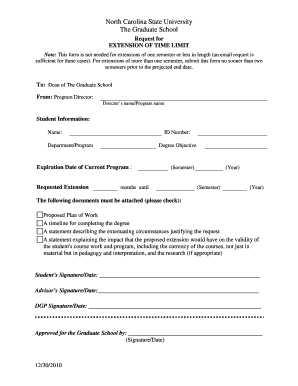

EXTENSION of TIME LIMIT Form

What is the EXTENSION OF TIME LIMIT

The EXTENSION OF TIME LIMIT is a formal request that allows individuals or businesses to extend the deadline for submitting specific documents or fulfilling obligations. This process is often utilized in various contexts, including tax filings, legal submissions, and other regulatory requirements. By obtaining an extension, taxpayers can avoid penalties associated with late submissions while ensuring they have adequate time to prepare their documents accurately.

How to use the EXTENSION OF TIME LIMIT

To effectively use the EXTENSION OF TIME LIMIT, individuals or businesses must first determine the specific deadline they are seeking to extend. This involves identifying the original due date and understanding the requirements set forth by the relevant authority. Once this information is gathered, the appropriate form or application must be completed and submitted in accordance with the guidelines provided by the issuing body.

Steps to complete the EXTENSION OF TIME LIMIT

Completing the EXTENSION OF TIME LIMIT typically involves several key steps:

- Identify the original deadline for the submission.

- Review the eligibility criteria for requesting an extension.

- Obtain the necessary form or documentation required for the extension request.

- Fill out the form accurately, providing all required information.

- Submit the completed form by the original deadline to ensure compliance.

Key elements of the EXTENSION OF TIME LIMIT

When considering the EXTENSION OF TIME LIMIT, several key elements should be noted:

- Eligibility: Not all requests for extensions may be granted. It is essential to meet specific criteria.

- Submission Method: Extensions can often be requested online, by mail, or in person, depending on the issuing authority.

- Documentation: Required documents may vary based on the type of extension being requested.

- Duration: Extensions typically grant additional time for a specified period, which must be adhered to.

Filing Deadlines / Important Dates

Filing deadlines for the EXTENSION OF TIME LIMIT can vary based on the type of document or obligation. It is crucial to be aware of these dates to avoid penalties. For instance, tax-related extensions often have specific deadlines that align with the original tax filing dates. Keeping a calendar of these important dates can help ensure timely submissions.

Penalties for Non-Compliance

Failing to comply with the EXTENSION OF TIME LIMIT can result in significant penalties. These may include fines, interest on unpaid amounts, or other legal repercussions. Understanding the consequences of non-compliance emphasizes the importance of adhering to submission deadlines and maintaining accurate records.

Quick guide on how to complete extension of time limit

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EXTENSION OF TIME LIMIT

Create this form in 5 minutes!

How to create an eSignature for the extension of time limit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EXTENSION OF TIME LIMIT feature in airSlate SignNow?

The EXTENSION OF TIME LIMIT feature in airSlate SignNow allows users to extend the time for signing documents. This is particularly useful for ensuring that all parties have adequate time to review and sign important documents without the pressure of tight deadlines.

-

How does the EXTENSION OF TIME LIMIT affect document workflows?

Implementing the EXTENSION OF TIME LIMIT in your document workflows can enhance efficiency. It allows for smoother transitions and reduces the risk of delays, ensuring that all necessary signatures are collected in a timely manner.

-

Is there an additional cost for using the EXTENSION OF TIME LIMIT feature?

No, the EXTENSION OF TIME LIMIT feature is included in the standard pricing of airSlate SignNow. This means you can take advantage of this functionality without incurring extra charges, making it a cost-effective solution for your business.

-

Can I customize the EXTENSION OF TIME LIMIT settings?

Yes, airSlate SignNow allows users to customize the EXTENSION OF TIME LIMIT settings according to their needs. You can set specific time frames for each document, ensuring that the signing process aligns with your business requirements.

-

What are the benefits of using the EXTENSION OF TIME LIMIT feature?

The EXTENSION OF TIME LIMIT feature provides several benefits, including improved document management and reduced stress for signers. By allowing more time for signatures, you can enhance collaboration and ensure that all parties are fully informed before signing.

-

Does the EXTENSION OF TIME LIMIT feature integrate with other tools?

Yes, the EXTENSION OF TIME LIMIT feature seamlessly integrates with various tools and platforms. This integration helps streamline your document processes and enhances overall productivity by connecting with your existing workflows.

-

How can I track the EXTENSION OF TIME LIMIT for my documents?

You can easily track the EXTENSION OF TIME LIMIT for your documents through the airSlate SignNow dashboard. The platform provides real-time updates and notifications, allowing you to monitor the status of your documents and ensure timely completion.

Get more for EXTENSION OF TIME LIMIT

- Nevada letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration form

- Nevada agreed cancellation of lease form

- Nevada notice of lease for recording form

- Notice landlord cure form

- New york letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by form

- Letter tenant landlord 481375012 form

- Letter tenant unauthorized form

- Notice default form 481375014

Find out other EXTENSION OF TIME LIMIT

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter