NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX Form

Understanding the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

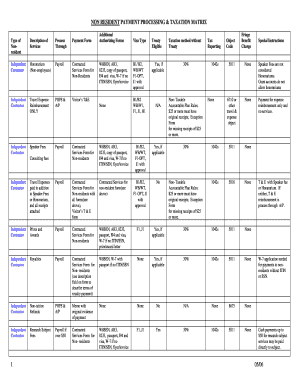

The NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX is a comprehensive tool designed to help businesses navigate the complexities of processing payments and managing tax obligations for non-resident individuals. This matrix outlines the various tax implications and payment requirements based on the residency status of the payee. It is essential for businesses that engage with non-residents to ensure compliance with U.S. tax laws and regulations.

The matrix typically includes information on withholding tax rates, reporting requirements, and any applicable treaties that may affect taxation. Understanding this matrix is crucial for avoiding penalties and ensuring that all financial transactions are processed correctly.

Steps to Complete the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

Completing the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX involves several key steps. First, identify the residency status of the individual or entity receiving payment. This determination is critical as it influences tax obligations. Next, gather necessary documentation, such as a W-8BEN form, which certifies the non-resident status and claims any applicable tax treaty benefits.

Once the documentation is collected, calculate the appropriate withholding tax based on the matrix guidelines. It is important to apply the correct rates to avoid over- or under-withholding. Finally, ensure that all required forms are submitted to the IRS and that proper records are maintained for future reference. Following these steps helps facilitate compliance and smooth payment processing.

Key Elements of the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

Several key elements are integral to the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX. These include:

- Withholding Tax Rates: The matrix specifies the applicable withholding tax rates based on the type of payment and the residency status of the payee.

- Documentation Requirements: It outlines the necessary forms, such as W-8BEN or W-8ECI, that must be completed to validate non-resident status.

- Reporting Obligations: Businesses must understand their reporting responsibilities, including deadlines for submitting forms to the IRS.

- Tax Treaties: The matrix may reference specific tax treaties that can reduce or eliminate withholding tax for certain countries.

These elements are vital for ensuring that businesses meet their tax obligations while optimizing payment processes for non-resident transactions.

IRS Guidelines for the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

The IRS provides specific guidelines that govern the use of the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX. These guidelines detail how to properly classify payments, determine withholding rates, and complete the necessary forms. It is essential for businesses to stay updated with IRS publications and announcements related to non-resident taxation.

Understanding these guidelines helps businesses avoid common pitfalls, such as misclassification of payments or failure to withhold the correct amount of tax. Regular consultation of IRS resources ensures compliance and helps businesses maintain accurate records for audits and reviews.

Required Documents for the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

To effectively utilize the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX, businesses must gather specific documents. These typically include:

- W-8BEN Form: This form certifies the non-resident status of the individual or entity and is essential for claiming tax treaty benefits.

- W-8ECI Form: Used for non-residents who receive income effectively connected with a U.S. trade or business.

- Tax Identification Number (TIN): Non-residents may need to provide a TIN or equivalent identification number from their home country.

Having these documents ready ensures that businesses can process payments efficiently and comply with all necessary tax regulations.

Penalties for Non-Compliance with the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

Non-compliance with the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX can lead to significant penalties for businesses. The IRS may impose fines for failing to withhold the correct amount of tax or for not submitting required forms on time. Additionally, businesses may be subject to interest charges on any unpaid taxes.

In severe cases, non-compliance can result in audits or further legal action. It is crucial for businesses to understand their obligations and ensure that they adhere to the guidelines outlined in the matrix to avoid these potential consequences.

Quick guide on how to complete non resident payment processing amp taxation matrix

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

Create this form in 5 minutes!

How to create an eSignature for the non resident payment processing amp taxation matrix

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

The NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX is a comprehensive framework designed to help businesses manage payments and tax obligations for non-resident clients. It provides clarity on how to navigate complex tax regulations while ensuring compliance. This matrix is essential for businesses looking to streamline their payment processes and minimize tax liabilities.

-

How does airSlate SignNow facilitate NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

airSlate SignNow simplifies the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX by offering an intuitive platform for document management and eSigning. Users can easily create, send, and sign documents related to non-resident payments, ensuring that all necessary tax information is included. This efficiency helps businesses stay compliant while saving time and resources.

-

What are the pricing options for using airSlate SignNow with the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses utilizing the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX. Plans vary based on features and user requirements, ensuring that companies of all sizes can find a suitable option. For detailed pricing information, it's best to visit our website or contact our sales team.

-

What features does airSlate SignNow provide for NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

Key features of airSlate SignNow for the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX include customizable templates, automated workflows, and secure eSigning capabilities. These features enhance the efficiency of managing non-resident payments and ensure that all tax documentation is handled correctly. Additionally, the platform offers real-time tracking and notifications for better oversight.

-

What benefits can businesses expect from using the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

By utilizing the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX, businesses can expect improved compliance with international tax regulations, reduced risk of errors, and enhanced operational efficiency. This matrix allows for better financial planning and management of non-resident transactions. Ultimately, it leads to cost savings and a more streamlined payment process.

-

Can airSlate SignNow integrate with other tools for NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

Yes, airSlate SignNow offers integrations with various accounting and payment processing tools that enhance the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX. These integrations allow for seamless data transfer and improved workflow efficiency. Businesses can connect their existing systems to ensure a cohesive approach to managing non-resident payments and taxation.

-

Is airSlate SignNow secure for handling NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX?

Absolutely, airSlate SignNow prioritizes security, especially when dealing with sensitive information related to the NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX. The platform employs advanced encryption and compliance with industry standards to protect user data. This commitment to security ensures that businesses can confidently manage their non-resident payment processes.

Get more for NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

- Insulation contract for contractor arkansas form

- Paving contract for contractor arkansas form

- Site work contract for contractor arkansas form

- Siding contract for contractor arkansas form

- Refrigeration contract for contractor arkansas form

- Drainage contract for contractor arkansas form

- Foundation contract for contractor arkansas form

- Plumbing contractor form

Find out other NON RESIDENT PAYMENT PROCESSING & TAXATION MATRIX

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe