AU 262 3, Nonresident Audit Questionnaire 720 Form

What is the AU 262 3, Nonresident Audit Questionnaire 720

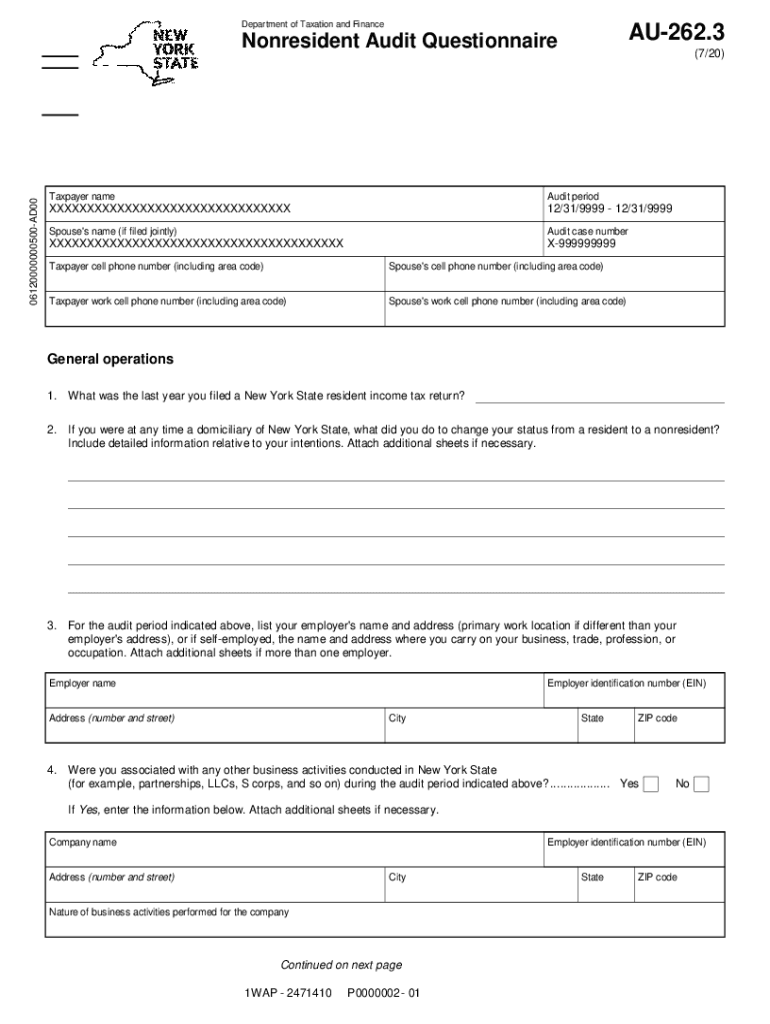

The AU 262 3, Nonresident Audit Questionnaire 720 is a specialized form used primarily for tax compliance and audit purposes for nonresident individuals or entities in the United States. This form serves to collect essential information regarding the financial activities of nonresidents, ensuring that they meet their tax obligations according to U.S. law. It is crucial for the Internal Revenue Service (IRS) to ascertain the tax liabilities of nonresidents, especially in cases where income is generated from U.S. sources.

How to use the AU 262 3, Nonresident Audit Questionnaire 720

This form is utilized by nonresident taxpayers who have been selected for an audit by the IRS. It aids in gathering pertinent information that the IRS requires to evaluate the taxpayer's compliance with U.S. tax laws. Users should carefully complete each section, providing accurate and comprehensive details about their income, expenses, and any relevant financial transactions. Proper use of the form facilitates a smoother audit process and helps in resolving any discrepancies promptly.

Steps to complete the AU 262 3, Nonresident Audit Questionnaire 720

Completing the AU 262 3 involves several key steps:

- Begin by reading the instructions carefully to understand the requirements.

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the completed form for accuracy and completeness before submission.

- Submit the form to the designated IRS office by the specified deadline.

Legal use of the AU 262 3, Nonresident Audit Questionnaire 720

The AU 262 3 is legally mandated for nonresidents undergoing an audit. It is important for users to understand that providing false information or failing to submit the form can lead to penalties and legal repercussions. Compliance with the form's requirements is essential for maintaining good standing with the IRS and avoiding potential audits in the future.

Key elements of the AU 262 3, Nonresident Audit Questionnaire 720

Key elements of the AU 262 3 include:

- Identification information of the taxpayer, including name and address.

- Details of income earned from U.S. sources.

- Information regarding deductions and credits claimed.

- Disclosure of any foreign financial accounts.

- Signature and date to certify the accuracy of the information provided.

Required Documents

When completing the AU 262 3, nonresidents should have several documents on hand to support the information provided. These may include:

- W-2 forms or 1099s for income earned.

- Bank statements showing U.S. transactions.

- Receipts for any claimed expenses.

- Prior year tax returns for reference.

Quick guide on how to complete au 262 3 nonresident audit questionnaire 720

Effortlessly prepare AU 262 3, Nonresident Audit Questionnaire 720 on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a seamless eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage AU 262 3, Nonresident Audit Questionnaire 720 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign AU 262 3, Nonresident Audit Questionnaire 720 with ease

- Locate AU 262 3, Nonresident Audit Questionnaire 720 and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the worry of lost or misfiled documents, tedious form retrieval, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign AU 262 3, Nonresident Audit Questionnaire 720 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the au 262 3 nonresident audit questionnaire 720

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AU 262 3, Nonresident Audit Questionnaire 720?

The AU 262 3, Nonresident Audit Questionnaire 720 is a crucial document used by businesses to gather information from nonresident clients for audit purposes. This questionnaire helps ensure compliance with tax regulations and provides necessary data for accurate reporting. Utilizing airSlate SignNow, you can easily send and eSign this document, streamlining your audit process.

-

How can airSlate SignNow help with the AU 262 3, Nonresident Audit Questionnaire 720?

airSlate SignNow simplifies the process of managing the AU 262 3, Nonresident Audit Questionnaire 720 by allowing users to send, sign, and store documents securely. The platform's user-friendly interface ensures that both senders and recipients can navigate the signing process with ease. This efficiency can signNowly reduce the time spent on audits.

-

What are the pricing options for using airSlate SignNow for the AU 262 3, Nonresident Audit Questionnaire 720?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing access to features necessary for managing the AU 262 3, Nonresident Audit Questionnaire 720. Visit our pricing page for detailed information.

-

What features does airSlate SignNow provide for the AU 262 3, Nonresident Audit Questionnaire 720?

With airSlate SignNow, you gain access to features such as customizable templates, real-time tracking, and secure cloud storage for the AU 262 3, Nonresident Audit Questionnaire 720. These features enhance the efficiency of document management and ensure that all parties can easily access and sign the necessary forms. Additionally, the platform supports multiple file formats for added convenience.

-

Are there any integrations available for airSlate SignNow when handling the AU 262 3, Nonresident Audit Questionnaire 720?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with the AU 262 3, Nonresident Audit Questionnaire 720. You can connect with popular tools like CRM systems, cloud storage services, and productivity apps to streamline your document management process. This integration capability allows for a more cohesive operational experience.

-

What are the benefits of using airSlate SignNow for the AU 262 3, Nonresident Audit Questionnaire 720?

Using airSlate SignNow for the AU 262 3, Nonresident Audit Questionnaire 720 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform ensures that your documents are signed and returned promptly, minimizing delays in your audit process. Additionally, the secure environment protects sensitive information, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations for the AU 262 3, Nonresident Audit Questionnaire 720?

Absolutely, airSlate SignNow is designed to comply with industry regulations, ensuring that your use of the AU 262 3, Nonresident Audit Questionnaire 720 meets legal standards. The platform employs advanced security measures, including encryption and authentication, to protect your documents. This compliance helps safeguard your business against potential legal issues.

Get more for AU 262 3, Nonresident Audit Questionnaire 720

- Postnuptial agreements package vermont form

- Letters of recommendation package vermont form

- Vermont mechanics lien form

- Vt corporation 497429110 form

- Storage business package vermont form

- Child care services package vermont form

- Special or limited power of attorney for real estate sales transaction by seller vermont form

- Special or limited power of attorney for real estate purchase transaction by purchaser vermont form

Find out other AU 262 3, Nonresident Audit Questionnaire 720

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe